What is Market Correlation in Cryptocurrency?

Market correlation in cryptocurrency refers to the statistical measure of how two or more digital assets move in relation to each other. This relationship is crucial for portfolio management, risk assessment, and developing effective trading strategies in the volatile crypto market. As the cryptocurrency ecosystem continues to expand and mature, understanding these relationships has become increasingly important for HELI traders and investors alike.

Correlation in crypto markets is typically measured using the Pearson correlation coefficient, which ranges from -1 to +1. A coefficient of +1 indicates a perfect positive correlation, meaning the assets move in identical directions. Conversely, a coefficient of -1 represents a perfect negative correlation, where assets move in exactly opposite directions. A coefficient near 0 suggests no significant correlation between the assets' price movements.

For cryptocurrency investors, understanding these correlations offers:

- Critical insights for portfolio diversification when including HELI tokens

- Better risk management during market volatility affecting HELI and other assets

- The ability to identify potential arbitrage opportunities across different HELI trading pairs and exchanges

HeliChain (HELI)'s Historical Correlation Patterns

HeliChain (HELI) has demonstrated notable correlation patterns with major cryptocurrencies since its launch. Initially, HELI showed a strong positive correlation with Bitcoin, similar to many altcoins that tend to follow Bitcoin's market movements. Over time, especially during periods of significant HELI protocol upgrades or unique project developments, this relationship has occasionally diverged.

With Ethereum, HELI has historically maintained a moderate correlation, which is lower than its correlation with Bitcoin but still significant. This relationship has been particularly pronounced during major market events, such as broad market corrections, when both HELI and Ethereum experienced similar drawdown percentages.

Over different market cycles, HELI's correlation patterns have gradually evolved:

- During bull markets, the correlation between HELI and major cryptocurrencies tends to weaken as investors differentiate between projects based on fundamentals.

- In bear markets, HELI typically exhibits stronger correlations as broader market sentiment dominates individual token characteristics.

Notable exceptions in this data include:

- The launch of HELI's mainnet, when the HELI asset decoupled significantly from the broader market for a short period.

- During DeFi booms, when HELI moved more in tandem with DeFi tokens than with Bitcoin or Ethereum.

Factors Influencing HeliChain (HELI)'s Market Correlations

Several key factors influence HELI's correlation with other digital assets:

- Technological factors: HELI's unique consensus mechanism and blockchain architecture create fundamentally different performance characteristics compared to proof-of-work cryptocurrencies like Bitcoin. This distinction becomes more pronounced during periods of network congestion or scalability challenges across the crypto ecosystem.

- Market sentiment: During periods of extreme market fear or greed, HELI tends to move more in unison with the broader market, regardless of its individual developments. This effect is particularly evident in short-term HELI trading intervals but often dissipates over longer timeframes.

- Liquidity factors: HELI's presence on MEXC with significant daily HELI trading volumes means it has sufficient market depth to develop price movements independent of smaller altcoins. However, during sudden market-wide liquidity crunches, correlations typically spike across all cryptocurrency assets, including HELI.

- Project-specific developments: Announcements such as HELI partnerships or the integration of new HELI features have repeatedly caused HELI to temporarily break its correlation patterns, leading to periods of independent price action.

- Regulatory news and macroeconomic influences: Regulatory changes or macroeconomic events can create system-wide correlation shifts. For example, favorable regulatory frameworks in major markets may cause HELI to demonstrate lower correlation with US-focused tokens but increased correlation with other regional projects.

Practical Applications of Correlation Analysis for HeliChain (HELI) Investors

Investors can leverage HELI's correlation data for effective portfolio diversification. By pairing HELI with assets that historically demonstrate low or negative correlation, such as certain privacy coins or specialized DeFi tokens, investors can potentially reduce overall portfolio volatility without necessarily sacrificing returns on their HELI investments. This approach is particularly valuable during periods of extreme market uncertainty or downturns.

For risk management, understanding HELI's correlations enables more sophisticated hedging strategies. When HELI shows strong correlation with a specific asset class, investors might establish strategic short positions in correlated assets or derivative markets to protect against downside risk while maintaining exposure to HELI's growth potential.

Correlation changes often serve as important market signals. When HELI's historical correlation with Bitcoin suddenly weakens or strengthens significantly, this may indicate fundamental shifts in market perception or the emergence of new factors affecting HELI's valuation. Savvy HELI investors watch for divergence between HELI's price action and its typically correlated assets as potential early signals of significant price movements.

Common misconceptions about cryptocurrency correlations include the assumption that all HELI correlations remain static over time. In reality, HELI's correlations are dynamic and evolve with market conditions, technological developments, and adoption patterns. Another misconception is that high correlation means identical percentage returns. Even with a correlation coefficient of 0.9, HELI may experience significantly different percentage gains or losses compared to correlated assets due to differences in volatility and market capitalization.

Conclusion

While understanding market correlations provides crucial insights into HeliChain (HELI)'s complex ecosystem, successful cryptocurrency investing requires more than theoretical knowledge. Are you ready to transform these analytical insights into actionable HELI trading strategies? Our comprehensive HeliChain (HELI) Trading Complete Guide: From Getting Started to Hands-On Trading is your ultimate resource for turning correlation analysis into profitable HELI investment decisions.

Don't just understand the market—master it. Whether you're a beginner seeking foundational knowledge or an experienced trader looking to refine your approach to HELI trading, this guide is your blueprint for HELI trading success.

描述:幣圈脈動基於 AI 技術與公開信息,第一時間呈現最熱代幣趨勢。如果想了解更多專業解讀與深度分析,請訪問新手學院。

本頁面所分享的文章內容均來源於公開平台,僅供參考,並不代表 MEXC 的立場或觀點。所有權利歸原作者所有。如您認為內容侵犯第三方權益,請及時聯絡 service@support.mexc.com,我們將盡快處理。

MEXC 不保證內容的準確性、完整性或時效性,亦不對因依賴該信息所產生的任何行為承擔責任。相關內容不構成財務、法律或其他專業建議,也不應被視為 MEXC 的推薦或背書。

HeliChain 最新動態

查看更多

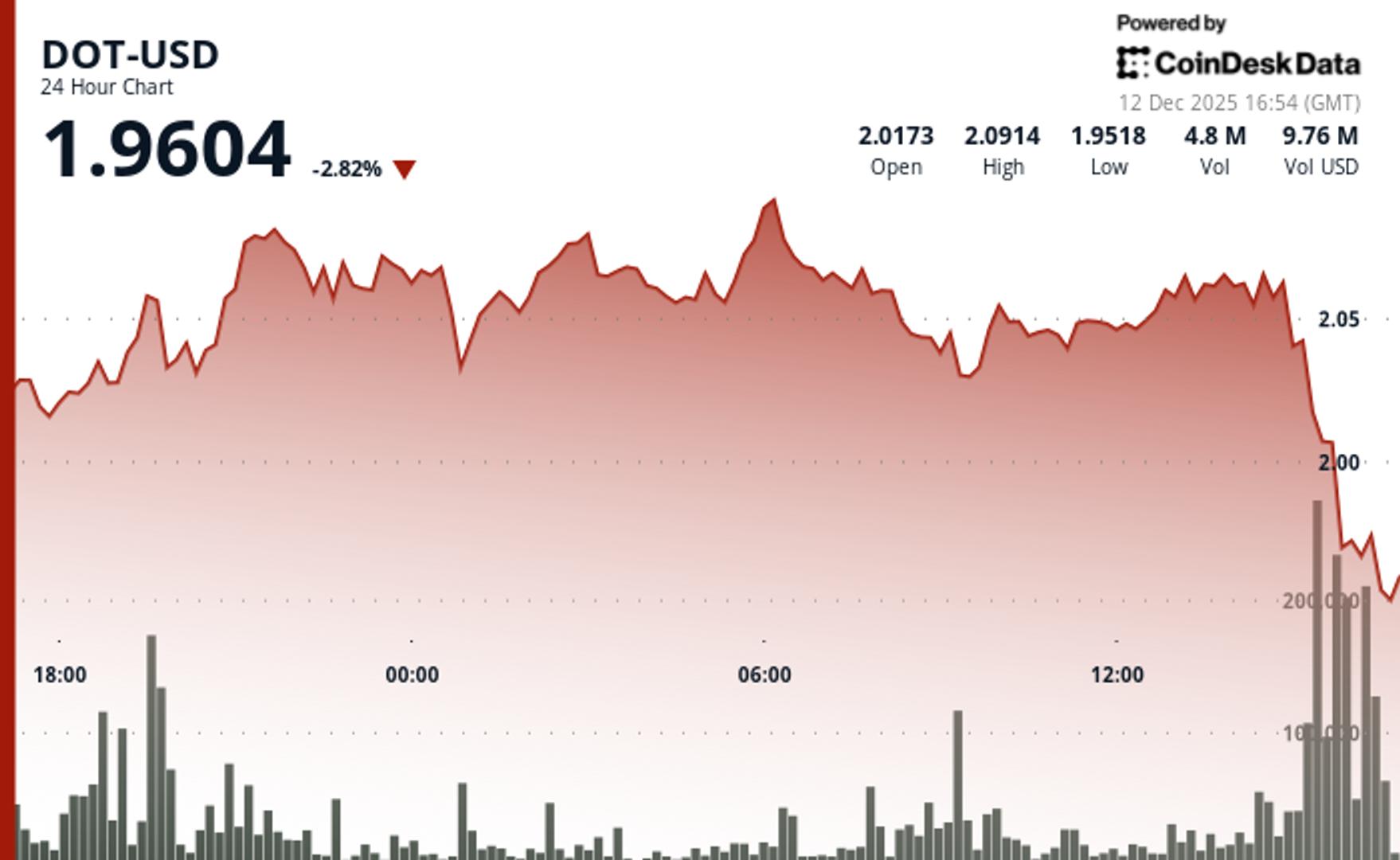

DOT 突破關鍵支撐後下跌了 2%

Garlinghouse 為 Ripple 帶來「重大消息」:國家信託銀行批准已獲得

JP Morgan 在 Solana 區塊鏈上將 5000 萬美元商業票據代幣化

熱門

目前熱門備受市場關注的加密貨幣

加密貨幣價格

按交易量計算交易量最大的加密貨幣