The Beginner's Guide to Copy Trading (Copy Trading User)

What is Futures Copy Trading?

MEXC Copy Trade is a system that provides both professional traders and followers with a series of simple and convenient trading features. Followers can easily follow a professional trader, and when the trader initiates a lead trade, the system will automatically place orders for followers based on the same strategy as the trader. As a result, traders can receive a portion of their followers' profits.

Note: The term "same strategy" refers to conducting futures trades with almost identical entry and closing prices as the trader. Due to factors such as volatile market conditions, the entry and closing prices may not be exactly the same. Please be aware of the risks. Copy trading is a specific form of futures trading and does not guarantee a 100% success rate.

Advantages of Copy Trading

Traders: Traders can make use of their professional trading experience and earn up to 15% of their followers' profits.

Followers: Followers can copy trades with just a few simple steps, as the system will automatically replicate the trader's trading strategy for followers. This way, followers will never miss out on trading opportunities even when they are busy.

How to Start Copy Trading

Ensure sufficient funds in your spot account

Go to yourSpot Assets page to view your USDT balance. The current minimum copy trade amount is 5 USDT, but it is recommended to ensure at least 50 USDT in your asset balance for a better copy trading experience.

2. EnterCopy Trade page and select your preferred trader.

3. Click on [Follow] (Copy trade parameter settings)

3-1. General Settings

In most cases, the general settings are sufficient. Fill in the copy trade amount and select the copy trade mode to start copying trades immediately.

By default, all trading pairs available for copy trading are selected in general settings.

Users can adjust the copy trade futures pairs and copy trade mode by themselves.

At least one trading pair must be selected.

1. Copy Trade Amount: Required Field

Copy trade amount refers to the funds allocated to the current copy trade sub-account, which are directly used as margin for opening a position when copying a trader's trade.

The minimum copy trade amount is 5 USDT, while the maximum amount depends on the USDT balance of the main spot account.

Transfer funds: If the available balance in the spot account is insufficient, you can also make use of the transfer funds feature.

2. Copy Trade Mode: Required Field

By default, Fixed Amount mode is selected. Users can click it to switch to another mode.

Users can switch it to Multiplier mode.

If Multiplier mode is selected, when entering a value lower than 0.3, the following message will be displayed: "The current multiplier is small. Thus, the actual order amount may be less than the minimum copy trade amount of 5 USDT for each order, resulting in the failure of the copy trade." However, this does not affect the copy trade.

Fixed Amount mode: Followers must enter the amount to be allocated for each copy trade

For example, if Fixed Amount mode is selected and you set the copy trade amount to be 100 USDT, this means that the system will place an order with a 100 USDT margin for you every time the trader opens a position.

Multiplier mode: Followers must enter the ratio they want to apply for each copy trade (i.e., the ratio of the copy trade position to the trader's position) For example, you are a follower of Trader A and you set the multiplier mode to be 10x. Later, when Trader A has a lead trade with a 10 USDT order margin (partially or fully executed), the copy trade amount you will allocate in this copy trade will be 10 * 10 = 100 USDT.

*Note:

1) Regardless of the copy trade mode, after following a trader successfully, followers must wait for the trader to initiate a lead trade before they can copy trade.

2) To ensure the timeliness of the copy trades, the system will attempt to place orders for followers as soon as the trader executes a trade. In Multiplier mode, the system will calculate the follower's margin based on the trader's order margin.

(In rare cases, if the trader cancels the remaining order after a partial execution, there might be instances where the trader's order margin does not meet the minimum opening amount, usually 5 USDT, for a single lead trade.)

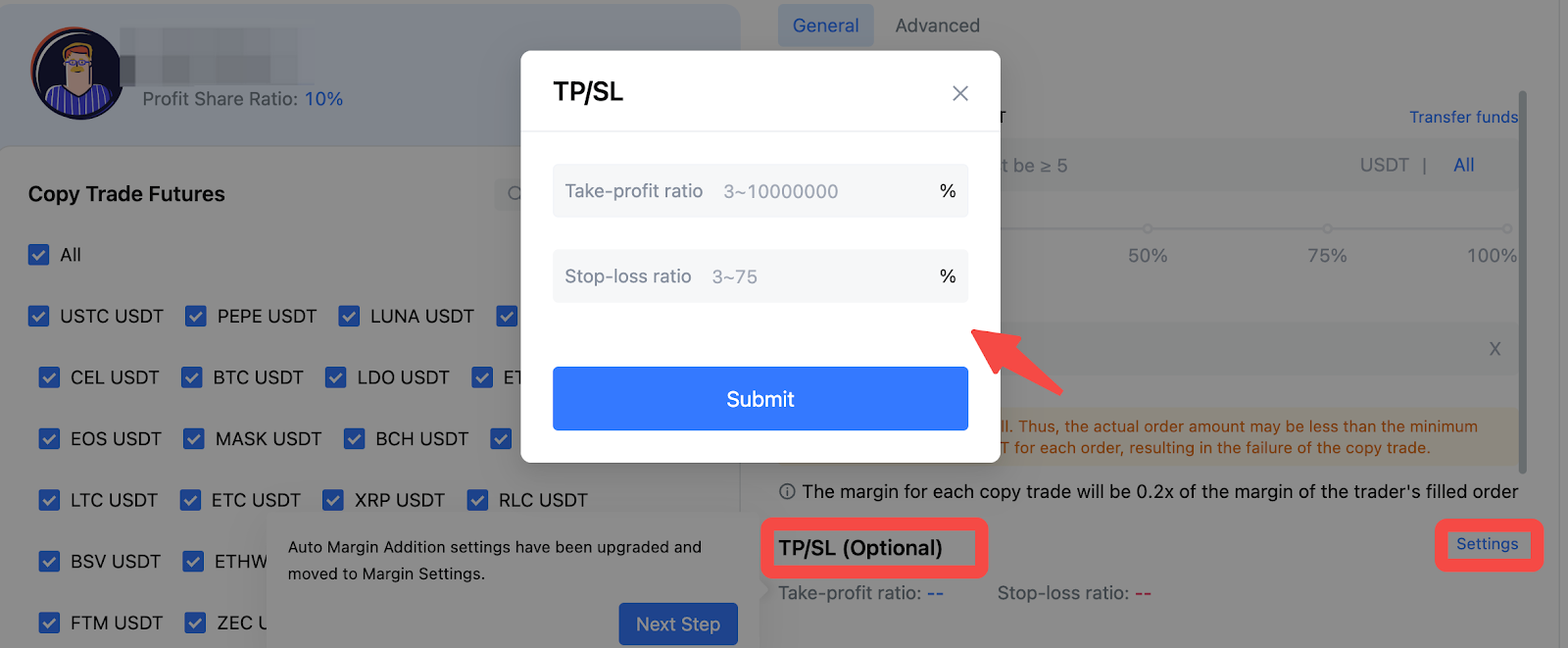

TP/SL: Optional Field

Due to factors such as market fluctuations, there is a certain probability of failure when triggering TP/SL orders.

To manage risk and increase the probability of successful triggering of TP/SL orders, the minimum value for take-profit and stop-loss is 3%, while the stop-loss ratio must not exceed 75%.

Once the take-profit and stop-loss ratios are set, they will be automatically applied to every subsequent copy trade.

After copying trades successfully, followers can also set TP/SL individually on their current copy trades.

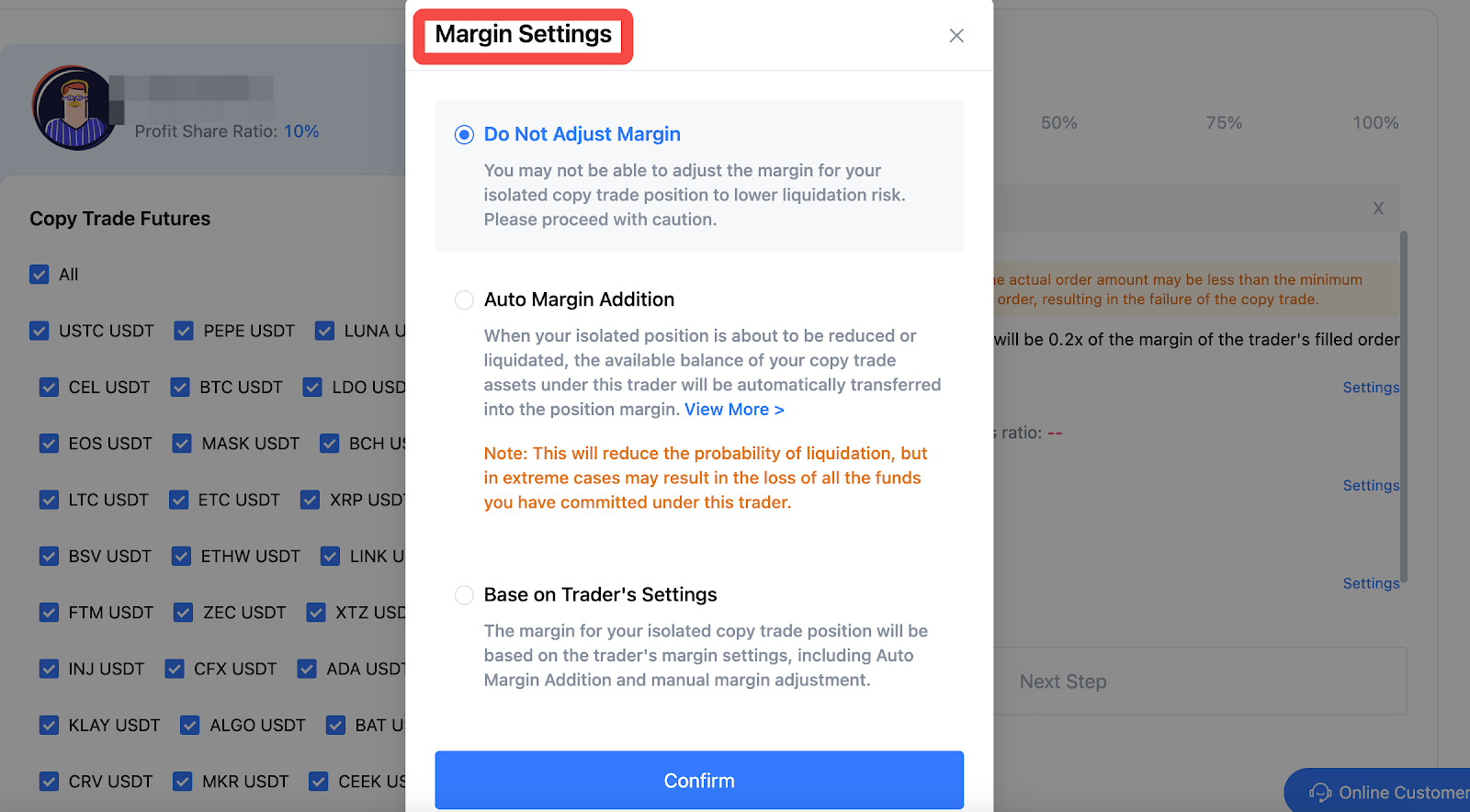

4. Margin Settings: Optional Field

The default settings option is "Do Not Adjust Margin," which means that the margin for the copy trade position in isolated margin mode will not be adjusted.

There are three settings options to choose from.

"Do Not Adjust Margin" and "Auto Margin Addition": These options correspond to whether Auto Margin Addition is disabled or enabled.

"Base on Trader's Settings": Selecting this option enables the margin for the copy trade position to be maintained or adjusted based on the trader's actions, such as enabling/disabling Auto Margin Addition and manually adding/reducing the position margin.

[Note] If you select the "Base on Trader's Settings" option, when the trader manually adjusts the margin, the follower's margin for the copy trade position may fail to be adjusted accordingly due to force majeure such as high concurrent underperformance, network abnormality, etc.

5. Trader's Liquidation Settings: Required Field

There is no default settings option. Followers are required to select an option manually.

"Follow to Close": When a trader's lead trade position undergoes liquidation, the corresponding copy trade position will be closed, regardless of whether the follower's copy trade position triggers liquidation.

"Do Not Follow": If this option is selected, when the trader experiences liquidation, the follower can continue to hold the copy trade position if it has not triggered liquidation.

Please note that at this point, followers will receive a notification message informing them to take over their copy trade position.

4. Information Submission Settings

Click to proceed to the next step to submit the settings information and wait for the trader to initiate a lead trade.

*Advanced Settings

Select Advanced Settings to set up customized leverage multipliers and slippage for specific trading pairs.

All the items in general settings can be adjusted.

Leverage: Optional Field

a. Use the same leverage multiplier as the trader: For each copy trade, the leverage multiplier will be the same as the trader's.

b. Customize leverage multiplier: For each copy trade, the leverage multiplier will be determined by the customized value, which can be set independently for long and short positions.

1. As the "Leverage" field is an optional field, you can choose not to set it. By not setting it, you will be using the same leverage multiplier as the trader.

As shown in the image: The leverage for long positions is set as 20x, while the leverage is not set for short positions (i.e., the leverage multiplier will be the same as the trader's).

3. Slippage: Optional Field

Description of slippage settings (hover over the information icon below the slippage settings to reveal):

To avoid huge deviation between your entry price and the trader's entry price, you may choose to set a slippage. The system will place an order when your entry price and the trader's entry price do not exceed the slippage. However, your order might not be filled completely. Kindly set up with caution. If no slippage is set, the system will place an order at the market price. However, under volatile market conditions, there might be a huge deviation between your entry price and the trader's entry price. Please be aware of the risks.

a. No customized slippage:

If selected, the system will apply the same logic as the general settings when placing market orders for the followers in each copy trade.

b. Customized slippage:

If selected, the system will combine the slippage settings and the trader's entry price when placing orders for the followers for each copy trade. The following are the examples for calculation of order prices for both long and short directions:

Example: The follower set the slippage for BTC USDT trading pair as 1%.

When the trader opens a long BTC USDT position at the entry price of 20,000 USDT, a limit order will be placed for the follower at the order price of: 20,000 * (1 + 1%) = 20,200 USDT, and the execution price will be 20,200 or lower.

When the trader opens a short BTC USDT position at the entry price of 20,000 USDT, a limit order will be placed for the follower at the order price of: 20,000 * (1 - 1%) = 19,800 USDT, and the execution price will be 19,800 or higher.

5. Viewing and managing copy trades

5.1 On the Copy Trade page, click on [My Copy Trades]

Term Definitions

Total Equity: The total equity of the copy trade account, including floating PNL.

Copy Trade Cost: The total initial cost allocated for following all current traders (you can check the copy trade amounts on My Traders page and add the multiple amounts to obtain the total copy trade cost).

Total PNL: The sum of total PNL of the copy trade account, which includes closing PNL, trading fees, and funding fees.

5.2 How to Close Positions Manually

In the Action column, click on [Close] and the system will immediately close all copy trade positions at market price.

5.3 How to Set TP/SL for Positions

In the TP/SL Ratio column, click on the edit icon to reveal the TP/SL ratios settings window.

Reasonable TP/SL ratios allow for worry-free copy trades, helping you reduce losses and preserve profits. However, unreasonable TP/SL ratios may be rejected by the system.

The minimum value for TP/SL is 3%.

The stop loss ratio is capped at 75%.

5.4 How to View Copy Trade History

Enter My Copy Trade page, click on [History] to view past copy trade information.

Click on [Details] to reveal more information including margin, order ID, trader and trading fees.

How to View Following Traders

Enter My Copy Trades page, click on [My Traders] to view the list of traders you follow.

How to View Traders in Watchlist

Enter My Copy Trades page, click on [Watchlist] to view the traders you are watching.

How to Edit Copy Trade Information

1. In the trader list, click on [Edit] in the Action column to reveal the page for editing copy trade information.

2. Click on [Edit] to reveal a pop-up window for editing the copy trade amount.

3. The copy trade amount can be increased or reduced by selecting the corresponding tabs.

4. After choosing to reduce the copy trade amount and submitting, check if the copy trade amount in the trader list has been reduced after the operation. The deducted copy trade funds will be returned to your spot account.

How to Unfollow

Enter My Copy Trades page, click on [My Traders]. Select the trader you are following and click on [Unfollow] in the Action column.

If you have active copy trades associated with the trader, you will not be able to unfollow the trader.

Note: Once unfollowed, the funds in the copy trade sub-account will be transferred to the main spot account. On the Assets page, you can click on [Quantitative Account] - [Asset Transfer Details] to view the capital flow records.

Other Questions

1. The copy trade sub-accounts will incur the same fee rates as the main account.

In other words, the fee rates are the same for the main account and the copy trade sub-account.

2. The follower's leverage before and after copying the trade can be different

Provided that the follower already has a copy trade position, if the trader continues to add to the position after adjusting the leverage, the follower can continue to copy trade normally.

3. If the trader partially closes the lead trade, the follower can follow to close their position based on a certain ratio

For example, the trader has a lead trade with 100 ETH and the follower has a copy trade with 10 ETH. When the trader partially closes by 60 ETH, the follower will close the copy trade by 10 * (60 / 100) = 6 ETH. The quantity field is displayed as: Closeable/Amount Opened.

Traders: Traders can make use of their professional trading experience and earn up to 15% of their followers' profits.

Followers: Followers can copy trades with just a few simple steps, as the system will automatically replicate the trader's trading strategy for followers. This way, followers will never miss out on trading opportunities even when they are busy.

Ensure sufficient funds in your spot account

By default, all trading pairs available for copy trading are selected in general settings.

Users can adjust the copy trade futures pairs and copy trade mode by themselves.

At least one trading pair must be selected.

Copy trade amount refers to the funds allocated to the current copy trade sub-account, which are directly used as margin for opening a position when copying a trader's trade.

The minimum copy trade amount is 5 USDT, while the maximum amount depends on the USDT balance of the main spot account.

Transfer funds: If the available balance in the spot account is insufficient, you can also make use of the transfer funds feature.

Fixed Amount mode: Followers must enter the amount to be allocated for each copy trade

Multiplier mode: Followers must enter the ratio they want to apply for each copy trade (i.e., the ratio of the copy trade position to the trader's position) For example, you are a follower of Trader A and you set the multiplier mode to be 10x. Later, when Trader A has a lead trade with a 10 USDT order margin (partially or fully executed), the copy trade amount you will allocate in this copy trade will be 10 * 10 = 100 USDT.

TP/SL: Optional Field

Due to factors such as market fluctuations, there is a certain probability of failure when triggering TP/SL orders.

To manage risk and increase the probability of successful triggering of TP/SL orders, the minimum value for take-profit and stop-loss is 3%, while the stop-loss ratio must not exceed 75%.

Once the take-profit and stop-loss ratios are set, they will be automatically applied to every subsequent copy trade.

After copying trades successfully, followers can also set TP/SL individually on their current copy trades.

The default settings option is "Do Not Adjust Margin," which means that the margin for the copy trade position in isolated margin mode will not be adjusted.

There are three settings options to choose from.

"Do Not Adjust Margin" and "Auto Margin Addition": These options correspond to whether Auto Margin Addition is disabled or enabled.

"Base on Trader's Settings": Selecting this option enables the margin for the copy trade position to be maintained or adjusted based on the trader's actions, such as enabling/disabling Auto Margin Addition and manually adding/reducing the position margin.

There is no default settings option. Followers are required to select an option manually.

"Follow to Close": When a trader's lead trade position undergoes liquidation, the corresponding copy trade position will be closed, regardless of whether the follower's copy trade position triggers liquidation.

"Do Not Follow": If this option is selected, when the trader experiences liquidation, the follower can continue to hold the copy trade position if it has not triggered liquidation.

4. Information Submission Settings

All the items in general settings can be adjusted.

Leverage: Optional Field

When the trader opens a long BTC USDT position at the entry price of 20,000 USDT, a limit order will be placed for the follower at the order price of: 20,000 * (1 + 1%) = 20,200 USDT, and the execution price will be 20,200 or lower.

When the trader opens a short BTC USDT position at the entry price of 20,000 USDT, a limit order will be placed for the follower at the order price of: 20,000 * (1 - 1%) = 19,800 USDT, and the execution price will be 19,800 or higher.

Total Equity: The total equity of the copy trade account, including floating PNL.

Copy Trade Cost: The total initial cost allocated for following all current traders (you can check the copy trade amounts on My Traders page and add the multiple amounts to obtain the total copy trade cost).

Total PNL: The sum of total PNL of the copy trade account, which includes closing PNL, trading fees, and funding fees.

The minimum value for TP/SL is 3%.

The stop loss ratio is capped at 75%.

Buy USDT Instantly Here:https://otc.mexc.com/

Create your own referral link today and start inviting friends to enjoy great rebates:

Enjoy trading on MEXC.

The MEXC Team

13 September 2022