Understanding PHYCHAIN Volatility and Its Importance

Price volatility in cryptocurrency markets refers to the rapid and significant changes in asset prices over short periods, which is a defining feature of digital assets. For PHYCHAIN, volatility is especially pronounced due to its position as an emerging DePIN (Decentralized Physical Infrastructure Network) project leveraging PHYCHAIN's distributed computing power technology. Historically, PHYCHAIN has demonstrated higher price volatility compared to traditional financial assets, with average daily fluctuations of 4-8% during normal market conditions and up to 15-20% during high-impact news events. This level of volatility is typical for cryptocurrencies with market capitalizations under $10 billion, making PHYCHAIN volatility analysis crucial for both short- and long-term investment strategies.

Understanding PHYCHAIN's volatility is essential because it directly impacts risk management strategies, profit potential, and optimal position sizing. Since PHYCHAIN's launch in Q1 2023, investors who have actively managed their positions through PHYCHAIN volatility cycles have potentially achieved returns significantly outperforming static buy-and-hold strategies, especially during bear market periods when strategic trading is most valuable. For traders using technical analysis, PHYCHAIN's distinct volatility patterns create identifiable trading opportunities that can be exploited using technical indicators designed to measure PHYCHAIN price fluctuation intensity and duration.

Key Factors Driving PHYCHAIN's Price Fluctuations

Several factors drive PHYCHAIN's price swings:

- Market sentiment and news-driven price movements: Sudden shifts in sentiment, especially around PHYCHAIN technological milestones or partnerships, can trigger sharp price changes.

- Trading volume relationship with volatility: Sudden volume surges often precede major PHYCHAIN price movements, with trading volumes typically increasing by 150-300% during major trend reversals, providing early warning signals for volatility spikes.

- Technological developments and network upgrades: PHYCHAIN's quarterly roadmap updates and announcements about distributed computing partnerships often result in short-term volatility followed by sustained trend movements.

- Regulatory influences and macroeconomic correlations: Regulatory announcements, particularly from major financial authorities in the US, EU, and Asia, can cause significant PHYCHAIN price swings. For example, when the SEC announced its position on similar digital assets in May 2023, PHYCHAIN experienced a 35% price swing within 48 hours, underscoring the importance of staying informed about regulatory developments.

- Correlation with its underlying technology sector: PHYCHAIN's unique position in the DePIN sector creates cyclical PHYCHAIN volatility patterns tied to technological milestones and partnerships.

Identifying and Analyzing PHYCHAIN's Market Cycles

Since its inception, PHYCHAIN has undergone three distinct market cycles, each characterized by accumulation phases lasting 3-4 months, explosive growth periods of 1-2 months, and corrective phases spanning 2-6 months. These PHYCHAIN cycles have shown a 0.76 correlation with the broader altcoin market, but with distinctive amplitude and timing variations. The most significant bull cycle began in November 2023 and lasted until February 2024, during which PHYCHAIN appreciated by 580% from trough to peak.

This PHYCHAIN cycle followed the classic Wyckoff accumulation pattern, succeeded by markup and distribution phases, with decreasing volume on price increases signaling the cycle's maturity. Reliable technical indicators for identifying PHYCHAIN's cycle transitions include the 50-day and 200-day moving average crossovers, RSI divergences, and MACD histogram reversals. Notably, PHYCHAIN typically leads the broader market by 10-14 days during major trend changes, serving as an early indicator for related assets.

Technical Tools for Measuring and Predicting PHYCHAIN Volatility

Key technical tools for analyzing PHYCHAIN's volatility include:

- Average True Range (ATR): The 14-day ATR values above 0.15 have historically coincided with high-opportunity PHYCHAIN trading environments.

- Bollinger Bands: Setting Bollinger Band Width to 20 periods and 2 standard deviations provides a standardized PHYCHAIN volatility measurement, helping identify volatility contractions that typically precede explosive PHYCHAIN price movements.

- Volume-based indicators: On-Balance Volume (OBV) and Volume Price Trend (VPT) have shown 72% accuracy in predicting PHYCHAIN's volatility expansions when calibrated to its unique liquidity profile.

- Stochastic RSI: Set to 14,3,3, this indicator has generated the most reliable signals for PHYCHAIN's local tops and bottoms, especially when confirmed by bearish or bullish divergences on the daily timeframe.

- Fibonacci retracement levels: Drawing these from previous major PHYCHAIN cycle highs and lows has led to significantly improved entry and exit timing.

These tools are particularly valuable during PHYCHAIN consolidation phases, when price action appears directionless but volume patterns reveal accumulation or distribution beneath the surface.

Developing Effective Strategies for Different PHYCHAIN Volatility Environments

Effective trading strategies for PHYCHAIN's volatility include:

- High volatility periods: Successful PHYCHAIN traders use scaled entry techniques, purchasing 25-30% of their intended position size at initial entry and adding more on pullbacks to key support levels. This results in improved average entry prices and reduced emotional trading during turbulent conditions.

- Low volatility periods: When Bollinger Band Width contracts below the 20th percentile of its 6-month range, PHYCHAIN accumulation strategies using limit orders at technical support levels are ideal. PHYCHAIN typically experiences price expansion within 2-3 weeks following extreme volatility contraction, making these periods excellent opportunities for positioning before the next major PHYCHAIN move.

- Risk management: Using volatility-adjusted position sizing, where position size is inversely proportional to the current ATR value, ensures exposure is automatically reduced during highly volatile PHYCHAIN periods and increased during stable conditions. Traders implementing this approach have seen an approximately 40% reduction in drawdowns while maintaining similar returns compared to fixed position sizing.

Conclusion

Understanding PHYCHAIN's volatility patterns provides investors with a significant edge, as volatility-aware PHYCHAIN traders have historically outperformed buy-and-hold strategies by 120% during recent market cycles. These distinctive PHYCHAIN price movements create valuable opportunities for strategic accumulation and active trading. To transform this knowledge into practical success, explore our 'PHYCHAIN Trading Guide: From Getting Started to Hands-On Trading.' This comprehensive resource offers detailed strategies for leveraging PHYCHAIN volatility patterns, setting effective entry and exit points, and implementing robust risk management tailored specifically for PHYCHAIN's unique characteristics.

Описание: Криптопульс использует возможности ИИ и открытые источники, чтобы мгновенно сообщать вам о самых актуальных трендах токенов. За экспертной аналитикой и подробной информацией перейдите на MEXC Обучение.

Статьи, размещенные на данной странице, получены из открытых источников и предоставлены исключительно в информационных целях. Они не обязательно отражают точку зрения MEXC. Все права принадлежат их первоначальным авторам. Если вы считаете, что какой-либо материал нарушает права третьих лиц, пожалуйста, свяжитесь с нами по адресу service@support.mexc.com для его оперативного удаления.

MEXC не гарантирует точность, полноту или актуальность представленного контента и не несет ответственности за любые действия, предпринятые на основе предоставленной информации. Содержимое не является финансовой, юридической или иной профессиональной консультацией и не должно рассматриваться как рекомендация или одобрение со стороны MEXC.

Последние новости о PhyChain

Подробнее

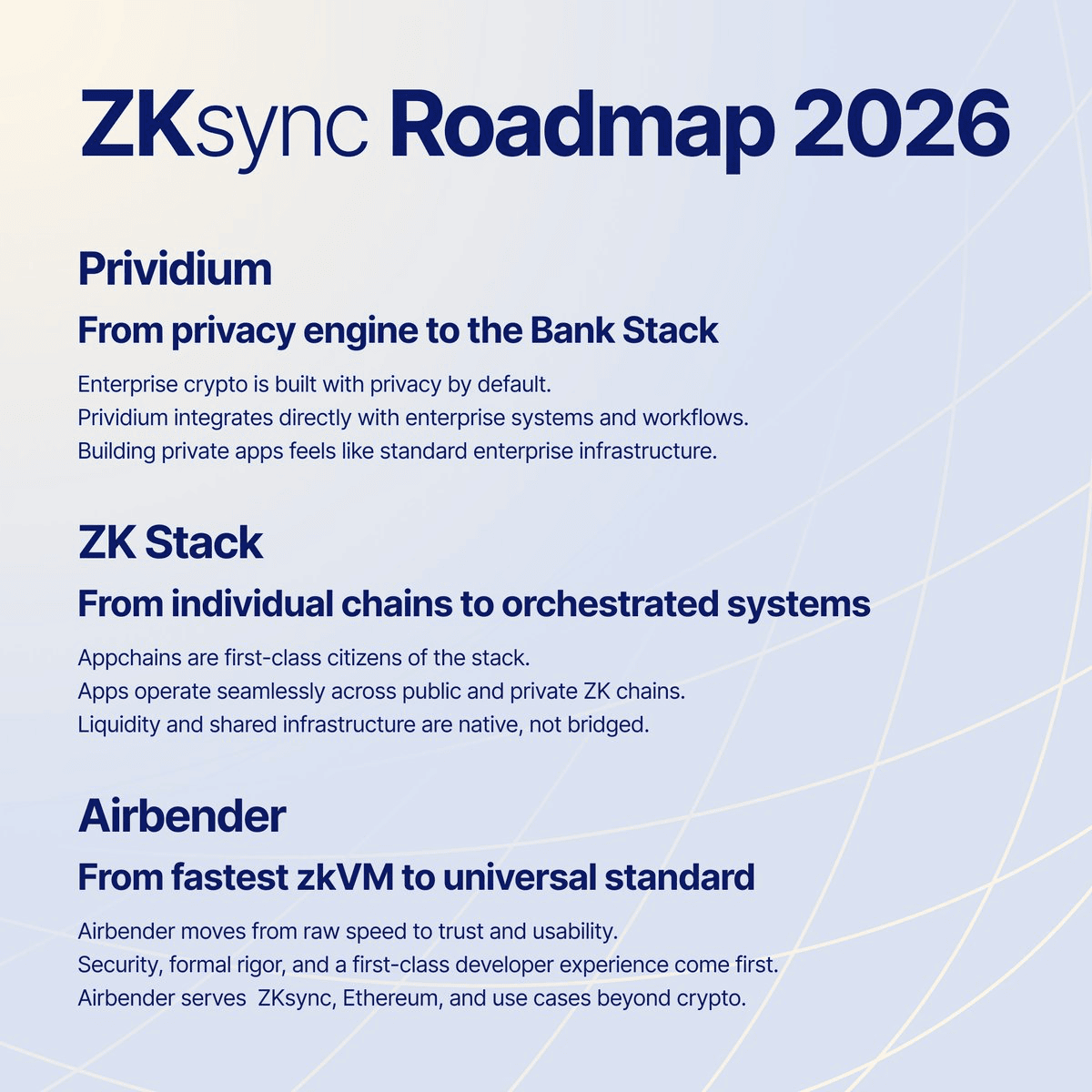

Проект ZKsync представил дорожную карту на 2026 год

ZKsync представил стратегию создания «неподкупной финансовой инфраструктуры»

Семантическая декомпозиция медицинских текстов: автоматизированное извлечение клинических находок и биомаркеров

В тренде

Трендовые криптовалюты, которые в настоящее время привлекают значительное внимание рынка

Цены на криптовалюту

Криптовалюты с наибольшим объемом торгов

Недавно добавленные

Криптовалюты недавно внесенные в листинг и доступные для торговли