Tether Gold (XAUT) bridges the gap between traditional gold investment and decentralized finance (DeFi), providing investors with opportunities to utilize gold-backed digital assets within blockchain ecosystems. As of 11 November 2025, understanding XAUT’s integration in DeFi protocols is crucial for leveraging liquidity, yield, and portfolio efficiency.

What Is DeFi Integration for XAUT?

DeFi integration allows XAUT tokens to be used in decentralized applications, lending platforms, and liquidity pools. This enables investors to earn returns, participate in automated trading strategies, or utilize gold-backed tokens as collateral without converting them to fiat currency.

Benefits of Using XAUT in DeFi

Enhanced Liquidity

Tokens can be deployed in smart contracts, increasing circulation and market activity.Yield Opportunities

Participating in DeFi protocols allows investors to earn interest or rewards on XAUT holdings.Portfolio Flexibility

XAUT can serve multiple roles, from collateral for loans to liquidity provision, diversifying use beyond simple storage of value.

Security Considerations

While DeFi integration expands utility, investors must be aware of potential risks:

Smart Contract Vulnerabilities

Protocols should be audited to prevent exploits or loss of tokens.Platform Reliability

Selecting reputable DeFi applications reduces operational and counterparty risk.Network Fees

Transactions within DeFi may incur blockchain network fees that impact net returns.

Trading and Liquidity Management

MEXC provides a secure environment for spot trading XAUT before deploying tokens to DeFi protocols. Real-time pricing allows investors to determine optimal entry points for DeFi participation:

https://www.mexc.com/price/XAUT

Spot trading on MEXC ensures liquidity and flexibility for adjusting positions:

https://www.mexc.com/exchange/XAUT_USDT

Strategic Use Cases

Collateral for Loans

XAUT can be used as a secure, gold-backed asset in lending protocols.Liquidity Provision

Investors can supply XAUT to liquidity pools to earn rewards.Yield Farming

Combining XAUT with other digital assets can generate compound returns while retaining gold exposure.

Tracking and Managing DeFi Positions

Monitoring positions is essential to manage risk and maximize returns. Investors should track interest rates, token valuation, and protocol security. Integrating XAUT with DeFi requires ongoing attention but provides significant opportunities for portfolio optimization.

Conclusion

Tether Gold’s integration in DeFi protocols extends its utility beyond traditional investment, allowing gold-backed digital assets to generate returns, serve as collateral, and participate in decentralized financial strategies. As of 11 November 2025, XAUT combines gold’s stability with blockchain efficiency, offering investors both security and dynamic opportunities within modern digital finance.

説明:暗号資産パルスは、AIと公開情報源を活用し、最新のトークントレンドを瞬時にお届けします。専門家の洞察と詳細な分析については、MEXC 学ぶ をご覧ください。

このページに掲載されている記事は、公開プラットフォームから引用したものであり、情報提供のみを目的としています。MEXCの見解を必ずしも反映するものではありません。すべての権利は原著者に帰属します。コンテンツが第三者の権利を侵害していると思われる場合は、service@support.mexc.com までご連絡ください。速やかに削除いたします。

MEXCは、いかなるコンテンツの正確性、完全性、または適時性についても保証するものではなく、提供された情報に基づいて行われたいかなる行動についても責任を負いません。本コンテンツは、財務、法律、またはその他の専門的なアドバイスを構成するものではなく、MEXCによる推奨または支持と解釈されるべきではありません。

DeFi についてもっと知る

もっと見る

ビットコインステーキングとは何か、そしてどのように機能するのか?

USDTステーキング:高APY率でテザーから利息を得る方法

DeFiステーキングとは何か、そしてどのように機能するのか?

DeFi の最新情報

もっと見る

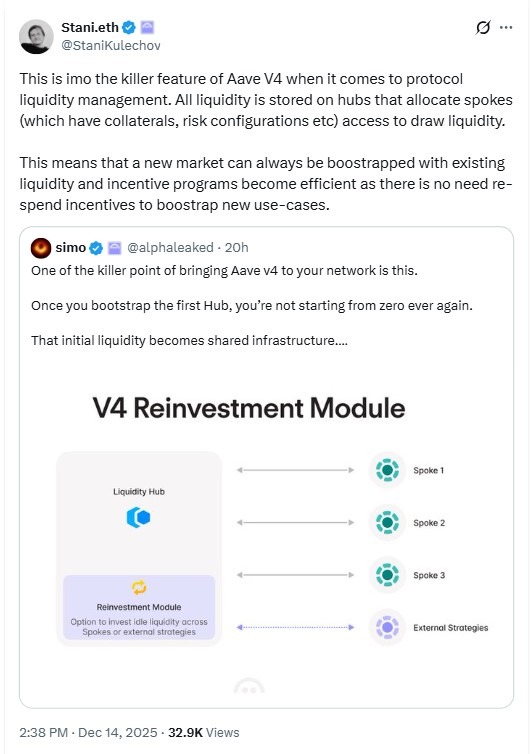

Aave V4、DeFi成長を促進するハブアンドスポーク型流動性モデルを発表、創設者がその影響を共有

Asterが2億トークンのステージ3エアドロップを開始

アナリストが2027年までにこの新しいDeFiトークンの10倍〜25倍のシナリオを概説、フェーズ6は98%以上完了

ホット

現在、市場で大きな注目を集めているトレンドの暗号資産

暗号資産価格

取引高が最も多い暗号資産