Introduction to GPUS Price Analysis

The current market position of GPUS reflects its status as a newly listed asset on MEXC, with trading commencing on April 14, 2025. As a decentralized network enabling individuals to share idle GPU resources for AI computation, GPUS is positioned at the intersection of artificial intelligence and blockchain technology. At present, GPUS is trading at approximately $0.0001579, with a 24-hour trading volume of $152.82 and a market capitalization that remains negligible due to its early stage in cryptocurrency price development.

Understanding both short-term and long-term GPUS price predictions is essential for investors seeking to capitalize on GPUS's unique value proposition. Key factors influencing GPUS price forecasting include:

- Development progress on the platform's core decentralized GPU-sharing protocol

- User adoption metrics as more contributors and consumers join the network

- Token unlock schedules and supply dynamics

- Broader market sentiment toward AI-crypto projects and decentralized compute solutions

The project's phased roadmap—Bootstrapping, Scaling, and Decentralization—signals a controlled and strategic approach to ecosystem growth, which will impact both circulating supply and market perception over time, ultimately affecting GPUS token price predictions.

Short-Term Price Prediction Methods and Strategies

Technical analysis tools are central to short-term GPUS price forecasting. Traders typically monitor indicators such as:

- Moving Average Convergence Divergence (MACD)

- Relative Strength Index (RSI)

- Bollinger Bands

These tools help identify potential entry and exit points, with particular attention to support levels and the formation of price patterns. For GPUS, the current price action around $0.0001579 suggests a period of price discovery, with volatility expected as liquidity builds and the user base expands, making short-term GPUS trading strategies crucial.

Market sentiment and social indicators are also critical, especially given GPUS's focus on decentralized AI compute. Social engagement metrics—such as increased mentions in crypto communities and positive sentiment around the project's airdrop and listing—can foreshadow short-term GPUS price movements.

Key short-term trading approaches include:

- Swing trading, capitalizing on 3–5 day price cycles as the token reacts to news and platform updates

- Day trading, focusing on volume spikes that often precede significant price movements, particularly after announcements of new features or partnerships

- News-based trading, leveraging volatility around roadmap milestones and ecosystem developments

The most effective short-term traders combine technical analysis with real-time monitoring of project news and community sentiment to identify high-probability opportunities in GPUS price prediction markets.

Long-Term Price Prediction Approaches

Fundamental analysis for GPUS centers on:

- User growth metrics (number of GPU providers and consumers)

- Platform adoption rate (expansion of the decentralized compute network)

- Revenue generation potential (fees from AI task execution and network participation)

Analysts evaluating GPUS's long-term potential focus on the expanding market for decentralized AI compute, which is projected to grow substantially as demand for affordable, distributed GPU power increases, potentially driving long-term GPUS price predictions upward. The project's business model—rewarding contributors and leveraging smart contracts for secure, equitable transactions—positions it to create sustainable economic value beyond speculative trading.

On-chain metrics such as increasing active addresses, transaction volumes, and staking participation will be key indicators of healthy ecosystem development. A positive trend would be a declining concentration of tokens among large holders, suggesting broader market participation and potentially reduced volatility over time.

The project's development roadmap includes:

- Expansion of the core protocol to support more complex AI workloads

- Integration with third-party tools and enterprise GPU providers

- Community-driven governance and protocol upgrades

As these milestones are achieved, analysts expect substantial growth in utility-driven token demand, which could drive GPUS cryptocurrency price appreciation independent of broader market trends.

Factors Affecting GPUS Value Across Time Horizons

Several factors will influence GPUS's value over both short and long-term horizons:

- Regulatory developments: As global economies and emerging markets develop frameworks for AI and crypto, GPUS's proactive compliance approach may provide a competitive edge. Upcoming clarity on decentralized compute networks from key regulatory bodies could significantly impact GPUS price discovery.

- Macroeconomic influences: Interest rate policies, inflation trends, and the performance of the broader technology sector will affect investor appetite for AI-crypto assets. During periods of economic uncertainty, GPUS's utility as a decentralized compute resource may enhance its appeal.

- Competitor analysis: GPUS faces competition from traditional cloud providers, centralized AI compute platforms, and other decentralized compute protocols. Its unique combination of blockchain-based incentives and decentralized governance creates significant barriers to entry for potential competitors.

- Network effects and ecosystem growth: Strategic partnerships and community engagement will be critical in establishing GPUS's position in the decentralized AI compute market. As the network grows, positive feedback loops may drive further adoption and GPUS token price value accrual.

Conclusion

When approaching GPUS investments, the most effective strategies combine short-term technical analysis with long-term fundamental evaluation for accurate GPUS price forecasting. Understanding both timeframes allows investors to make more informed decisions regardless of market conditions. For a complete walkthrough on how to apply these GPUS price prediction methods and develop your own successful trading strategy, check out our comprehensive 'GPUS Trading Complete Guide: From Getting Started to Hands-On Trading'—your essential resource for mastering GPUS learning in any market environment.

説明:暗号資産パルスは、AIと公開情報源を活用し、最新のトークントレンドを瞬時にお届けします。専門家の洞察と詳細な分析については、MEXC 学ぶ をご覧ください。

このページに掲載されている記事は、公開プラットフォームから引用したものであり、情報提供のみを目的としています。MEXCの見解を必ずしも反映するものではありません。すべての権利は原著者に帰属します。コンテンツが第三者の権利を侵害していると思われる場合は、service@support.mexc.com までご連絡ください。速やかに削除いたします。

MEXCは、いかなるコンテンツの正確性、完全性、または適時性についても保証するものではなく、提供された情報に基づいて行われたいかなる行動についても責任を負いません。本コンテンツは、財務、法律、またはその他の専門的なアドバイスを構成するものではなく、MEXCによる推奨または支持と解釈されるべきではありません。

Belong の最新情報

もっと見る

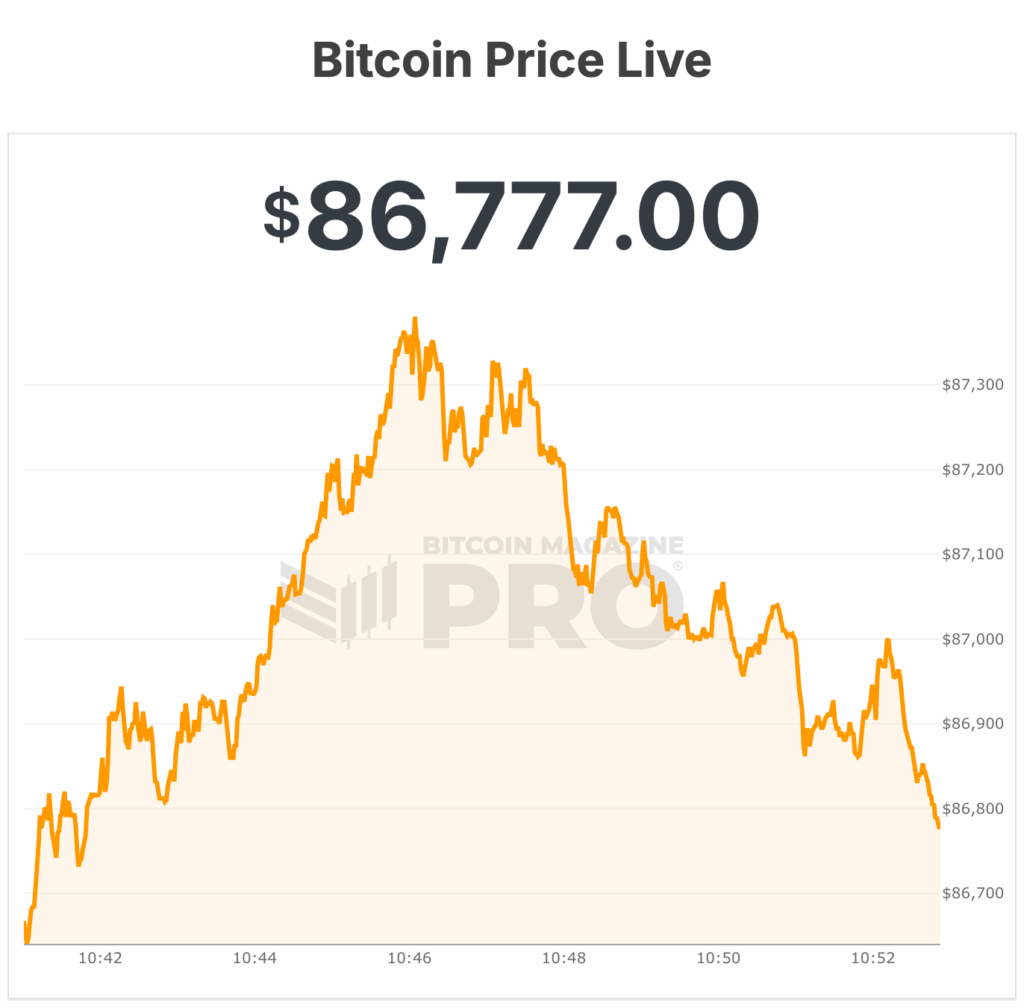

ビットコイン無期限先物取引:現在の市場で空売りがわずかに優位である理由

イランが大量消費者向け燃料価格を引き上げ

ビットコインが1時間で2億ドル相当の暗号資産のロングポジションが清算され、87,000ドルを下回る

ホット

現在、市場で大きな注目を集めているトレンドの暗号資産

暗号資産価格

取引高が最も多い暗号資産