What Are Candlestick Charts in Fasttoken (FTN) Trading?

Candlestick charts originated in Japan during the 18th century when rice traders first used them to track market prices. These visual tools have evolved into one of the most powerful methods for analyzing cryptocurrency price movements, especially for Fasttoken (FTN) traders seeking to identify potential entry and exit points in the FTN market. Unlike simple line charts that only show closing prices, candlestick charts provide four key data points—open, high, low, and close—within specific time periods, making them exceptionally valuable for FTN trading where volatility can be extreme and rapid. Each candlestick tells a complete story about the trading session, revealing not just FTN price movements but also the market sentiment behind those movements.

The anatomy of a candlestick consists of the real body (the rectangular section showing the difference between opening and closing prices) and the shadows or wicks (the thin lines extending above and below the body). In most FTN trading platforms, green/white candlesticks indicate bullish movement (closing price higher than opening price), while red/black candlesticks signal bearish movement (closing price lower than opening price). This intuitive color-coding allows FTN traders to instantly grasp market direction and sentiment across multiple timeframes.

Essential Candlestick Patterns for Fasttoken (FTN) Market Analysis

- Single Candlestick Patterns (Doji, Hammer, Shooting Star)

- Multi-Candlestick Patterns (Engulfing, Harami, Morning/Evening Star)

- How These Patterns Signal Potential Market Movements in FTN

Single candlestick patterns provide immediate insights into market sentiment shifts and potential price reversals for Fasttoken (FTN). The Doji pattern, characterized by almost identical opening and closing prices creating a cross-like appearance, indicates market indecision and often precedes significant FTN price movements. Similarly, the Hammer (with a small body and long lower shadow) appearing during a downtrend suggests a potential bullish reversal, while the Shooting Star (small body with long upper shadow) during an uptrend warns of a possible bearish reversal in FTN trading.

Multi-candlestick patterns offer more reliable signals by capturing market psychology over extended periods. The Bullish Engulfing pattern occurs when a larger green candle completely engulfs the previous red candle, suggesting strong buying pressure that could reverse an FTN downtrend. Conversely, the Harami pattern (a small body contained within the previous candle's body) indicates diminishing momentum and possible trend exhaustion. The Morning Star (a three-candle pattern starting with a large bearish candle, followed by a small body, and completed with a strong bullish candle) often marks the end of a downtrend and is particularly effective in FTN markets during major correction periods.

In the highly volatile FTN market, these patterns take on special significance due to the 24/7 trading environment and the influence of global events. FTN traders have observed that candlestick patterns tend to be more reliable during periods of high volume and when they appear at key support and resistance levels established through previous price action.

Strategic Time Frame Selection for Fasttoken (FTN) Trading

- Short-term vs. Long-term Analysis Using Candlesticks

- How to Identify Trends Across Multiple Time Frames

- Time Frame Considerations Unique to 24/7 FTN Markets

The selection of appropriate time frames is crucial for effective FTN candlestick analysis, with different intervals providing complementary perspectives on market movements. Day traders typically focus on shorter intervals (1-minute to 1-hour charts) to capture immediate volatility and micro-trends, while position traders prefer daily and weekly charts to identify major trend reversals and filter out short-term noise in the Fasttoken market.

A powerful approach to FTN analysis involves multi-timeframe analysis—examining patterns across at least three different time frames simultaneously. This methodology helps traders confirm signals when the same pattern appears across multiple timeframes, substantially increasing the reliability of trading decisions. For example, a bullish engulfing pattern on a daily chart carries more weight when supported by similar bullish patterns on 4-hour and weekly charts when trading FTN.

The FTN market presents unique time frame considerations due to its round-the-clock trading and absence of official market closes. Unlike traditional markets with clear opening and closing times, FTN candlesticks are formed at arbitrary time points (e.g., midnight UTC), which can affect their reliability during low-volume periods. Experienced Fasttoken (FTN) traders often pay special attention to weekly and monthly closings as these tend to be more psychologically significant to the broader market.

Enhancing Candlestick Analysis with Technical Indicators

- Combining Moving Averages with Candlestick Patterns

- Using Volume and Momentum Indicators for Confirmation

- Building an Integrated Technical Analysis Framework for FTN

While candlestick patterns provide valuable insights on their own, combining them with moving averages significantly enhances trading accuracy for FTN markets. The 50-day and 200-day moving averages serve as dynamic support and resistance levels, with candlestick patterns forming near these lines carrying greater significance. For instance, a bullish hammer forming just above the 200-day moving average during a pullback often presents a high-probability buying opportunity for Fasttoken (FTN).

Volume analysis serves as a critical confirmation mechanism for candlestick patterns in FTN trading. Patterns accompanied by above-average volume typically demonstrate greater reliability as they reflect stronger market participation. A bearish engulfing pattern with 2-3 times normal volume suggests genuine selling pressure rather than random price movement, particularly important in the sometimes thinly-traded altcoin markets like FTN.

Building an integrated technical analysis framework for FTN requires combining candlestick patterns with momentum indicators like the Relative Strength Index (RSI) and MACD. These indicators can identify overbought or oversold conditions that, when aligned with reversal candlestick patterns, create high-conviction trading signals. The most successful FTN traders look for confluence scenarios where multiple factors—candlestick patterns, key support/resistance levels, indicator readings, and volume—all align to suggest the same market direction.

Avoiding Common Pitfalls in Fasttoken (FTN) Candlestick Trading

The most prevalent mistake in FTN candlestick analysis is pattern isolation—focusing exclusively on a single pattern without considering the broader market context. Even the most reliable patterns can generate false signals when they occur against the prevailing trend or at insignificant price levels. Successful Fasttoken traders always evaluate patterns within the context of larger market structures, considering factors such as market cycle phase, trend strength, and nearby support/resistance zones.

Many FTN traders fall victim to confirmation bias, selectively identifying patterns that support their pre-existing market view while ignoring contradictory signals. This psychological trap often leads to holding losing positions too long or prematurely exiting winning trades. To combat this tendency, disciplined FTN traders maintain trading journals documenting all identified patterns and their outcomes, forcing themselves to objectively evaluate both successful and failed signals.

The FTN market's inherent volatility can create imperfect or non-textbook patterns that still carry trading significance. Inexperienced traders often miss opportunities by waiting for perfect textbook formations or force pattern recognition where none exists. Developing pattern recognition expertise requires extensive chart practice and studying historical FTN price action, gradually building an intuitive understanding of how candlestick patterns manifest in this unique market environment.

Conclusion

Candlestick analysis provides FTN traders with a powerful visual framework for interpreting market sentiment and potential price movements. While these patterns offer valuable insights, they're most effective when integrated with other technical tools and proper risk management. To develop a complete trading approach that combines candlestick analysis with fundamental research, position sizing, and market psychology, explore our comprehensive Fasttoken (FTN) Trading Complete Guide: From Getting Started to Hands-On Trading. This resource will help you transform technical knowledge into practical trading skills for long-term success in the FTN market.

説明:暗号資産パルスは、AIと公開情報源を活用し、最新のトークントレンドを瞬時にお届けします。専門家の洞察と詳細な分析については、MEXC 学ぶ をご覧ください。

このページに掲載されている記事は、公開プラットフォームから引用したものであり、情報提供のみを目的としています。MEXCの見解を必ずしも反映するものではありません。すべての権利は原著者に帰属します。コンテンツが第三者の権利を侵害していると思われる場合は、service@support.mexc.com までご連絡ください。速やかに削除いたします。

MEXCは、いかなるコンテンツの正確性、完全性、または適時性についても保証するものではなく、提供された情報に基づいて行われたいかなる行動についても責任を負いません。本コンテンツは、財務、法律、またはその他の専門的なアドバイスを構成するものではなく、MEXCによる推奨または支持と解釈されるべきではありません。

Fasttoken の最新情報

もっと見る

Sui、Aptos、およびArbitrumが来月45億ドルのトークンリリースを主導

Apple Watch急速充電対応! Belkin BoostCharge Pro Apple Watch充電器付き パワーバンク 10K が12月12日から販売開始

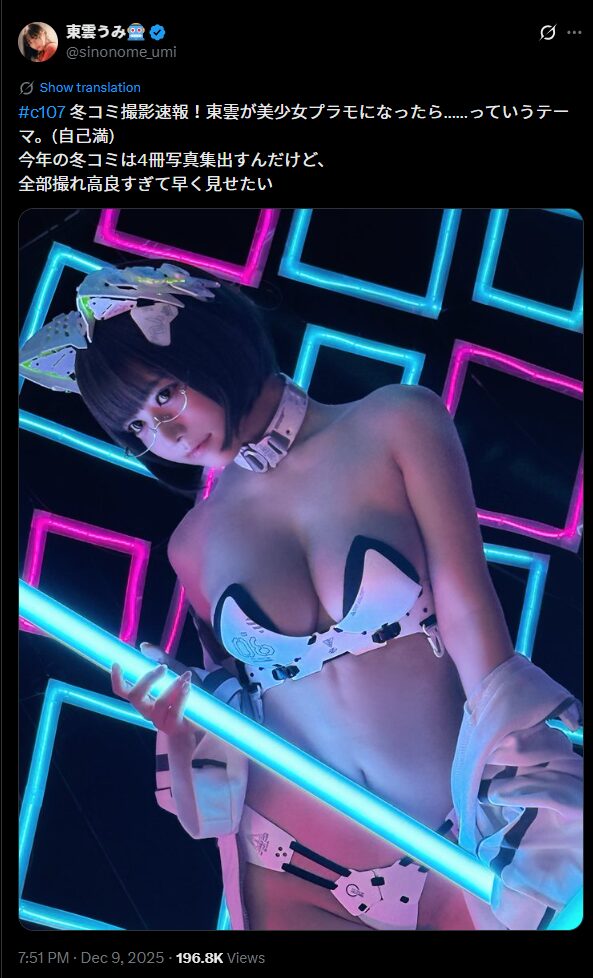

未来的なサイバー美少女! 東雲うみ、冬コミC107写真集4冊の制作裏話を大胆コスプレで公開

ホット

現在、市場で大きな注目を集めているトレンドの暗号資産

暗号資産価格

取引高が最も多い暗号資産