Introduction to Position Size Management in TMX Trading

- Understanding why position sizing is crucial for TMX investments

- How proper risk management can protect your capital in the volatile crypto market

- Overview of key position sizing strategies for different market conditions

When trading TMX, position sizing is the cornerstone of successful risk management. In the cryptocurrency market, where price swings of 5-20% in a single day are common, proper TMX position sizing can mean the difference between sustainable growth and devastating losses. A trader who invests 50% of their portfolio in a single TMX position risks catastrophic losses, while limiting each TMX trade to just 1-2% ensures that no single trade can significantly damage their overall portfolio.

The Importance of Risk-to-Reward Ratios

- Defining optimal risk-to-reward ratios for TMX trades

- How to calculate potential profits versus possible losses

- Adjusting position sizes based on conviction level and market volatility

Successful TMX investors maintain favorable risk-to-reward ratios, typically aiming for at least 1:3. This approach ensures that even with a 50% win rate, their TMX portfolio can still grow steadily. For example, if you're entering TMX at $10 with a stop-loss at $9 and a profit target at $13, your risk-to-reward ratio is 1:3. During heightened volatility, adjust your TMX position size downward to compensate for increased uncertainty.

Implementing the Percentage Risk Model

- Using the fixed percentage risk approach (1-2% rule) for TMX investments

- How to calculate position size based on your total portfolio value

- Examples of TMX position sizing calculations for different market scenarios

By limiting your risk on any TMX trade to 1-2% of your total capital, you create a safety buffer against multiple consecutive losses. With a $10,000 portfolio and 1% maximum risk per trade, you're only risking $100 on any TMX position. If buying TMX at $50 with a stop-loss at $45, your position size would be 20 units of TMX, protecting your portfolio from catastrophic drawdowns during unexpected market events.

Diversification and Correlation Management

- Balancing TMX with other assets in your crypto portfolio

- Understanding correlation between TMX and other cryptocurrencies

- How to adjust TMX position sizes across multiple correlated investments

During bull markets, many cryptocurrencies including TMX show correlation coefficients exceeding 0.7. If you've allocated 2% risk to TMX and another 2% to a highly correlated asset, your effective exposure might actually be closer to 3-4%. A more balanced approach includes reducing position sizes in correlated assets to TMX and ensuring your portfolio contains truly uncorrelated investments like stablecoins or certain DeFi tokens.

Advanced Risk Control Techniques

- Implementing tiered TMX position entry and exit strategies

- Using stop-loss and take-profit orders to automate TMX risk management

- Scaling in and out of TMX positions to reduce emotional decision-making

Consider dividing your intended TMX position into 3-4 smaller entries at different price levels rather than entering a full position at once. When trading TMX on MEXC, set stop-loss orders approximately 5-15% below your entry point and take-profit orders at levels maintaining your desired risk-reward ratio. With a $100 TMX entry, you might set a stop-loss at $85 and tiered take-profits at $130, $160, and $200, removing emotional decision-making while capturing TMX profits systematically.

Conclusion

Implementing effective position sizing and risk management is essential for successful TMX trading. By limiting each TMX position to 1-2% of your portfolio, maintaining favorable risk-to-reward ratios, diversifying across uncorrelated assets, and using advanced entry and exit strategies for TMX, you can significantly improve your long-term results. Ready to apply these techniques to your TMX trading? Visit MEXC's TMX Price page for real-time TMX market data, advanced charting tools, and seamless trading options that make implementing these strategies simple and effective.

説明:暗号資産パルスは、AIと公開情報源を活用し、最新のトークントレンドを瞬時にお届けします。専門家の洞察と詳細な分析については、MEXC 学ぶ をご覧ください。

このページに掲載されている記事は、公開プラットフォームから引用したものであり、情報提供のみを目的としています。MEXCの見解を必ずしも反映するものではありません。すべての権利は原著者に帰属します。コンテンツが第三者の権利を侵害していると思われる場合は、service@support.mexc.com までご連絡ください。速やかに削除いたします。

MEXCは、いかなるコンテンツの正確性、完全性、または適時性についても保証するものではなく、提供された情報に基づいて行われたいかなる行動についても責任を負いません。本コンテンツは、財務、法律、またはその他の専門的なアドバイスを構成するものではなく、MEXCによる推奨または支持と解釈されるべきではありません。

TMX の最新情報

もっと見る

Roblox Corporation (RBLX) 株価:安全性への懸念が投資家の焦点を揺るがす中、訴訟に直面

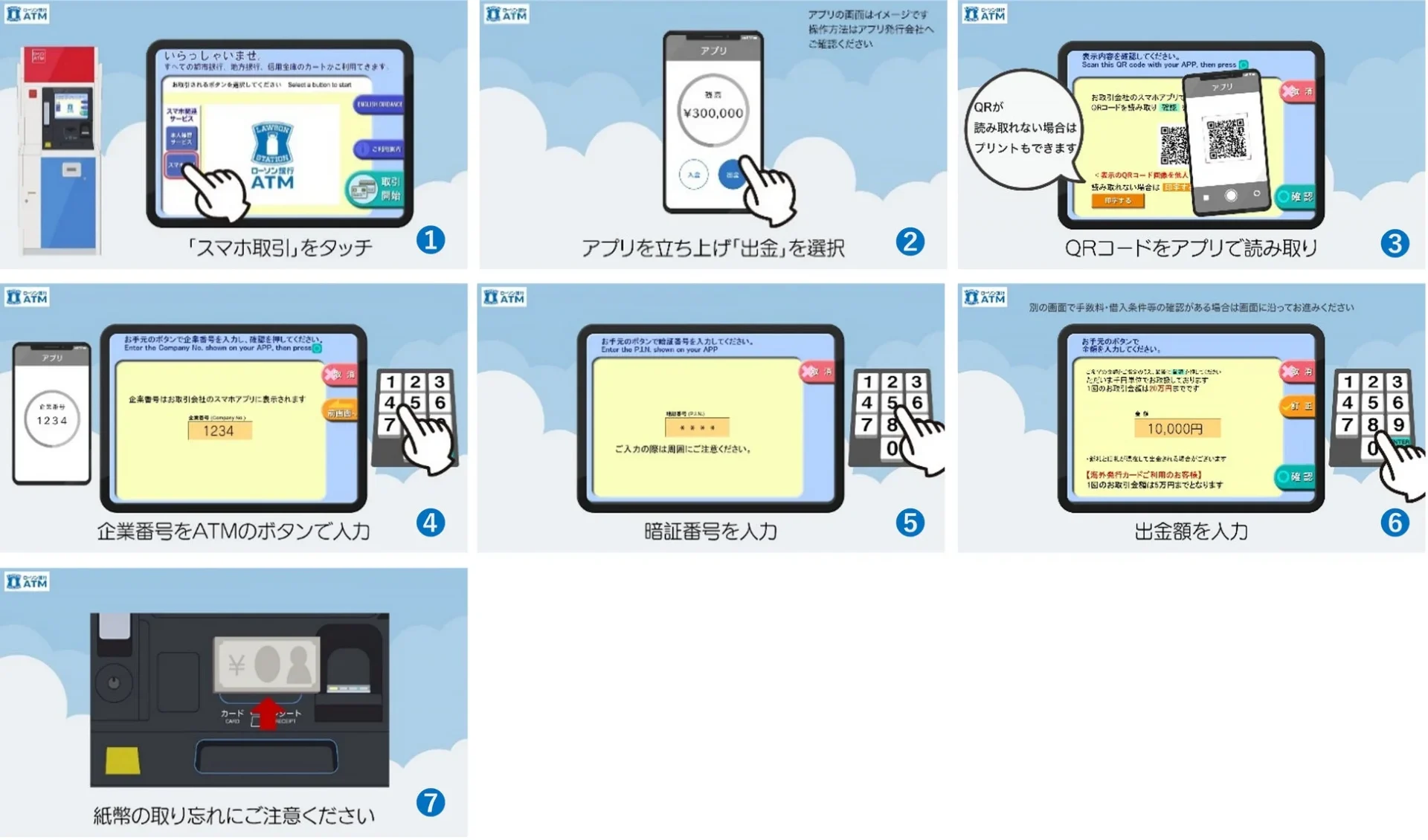

ローソン銀行ATMで楽天銀行の「スマホATM」サービス開始! キャッシュカード不要で入出金が可能に

Pontaパス会員限定! 映画がIMAX®も含めて1,200円で鑑賞できる「シアター割10周年キャンペーン」第2弾12月19日より開始

ホット

現在、市場で大きな注目を集めているトレンドの暗号資産

暗号資産価格

取引高が最も多い暗号資産