Understanding PTB Derivatives

PTB derivatives are financial contracts whose value is based on the underlying PTB (PortalToBitcoin) cryptocurrency, allowing traders to gain exposure to PTB price movements without directly owning the token. Unlike spot trading, where you buy or sell the actual asset, PortalToBitcoin derivatives enable speculation or hedging through instruments such as futures contracts (agreements to buy/sell PTB at a set date and price), perpetual contracts (futures without expiration), and options (the right, but not the obligation, to buy/sell at a specific price).

Trading PTB derivatives offers several advantages, including higher capital efficiency through leverage, the ability to profit in both rising and falling markets, and advanced hedging strategies. However, these PortalToBitcoin products also carry significant risks, such as amplified losses due to leverage, potential liquidation during volatile market swings, and complex contract mechanisms that can impact profitability.

Essential Concepts for PTB Derivatives Trading

Leverage allows traders to control PTB (PortalToBitcoin) positions much larger than their initial margin. For example, with 10x leverage, $1,000 can control $10,000 worth of PTB contracts. While this can multiply profits, it also magnifies losses. PTB derivatives platforms typically offer leverage ranging from 1x to 100x, but beginners should use high leverage with caution.

Understanding margin requirements is crucial: the initial margin is the minimum amount needed to open a position, while the maintenance margin is the threshold below which your PortalToBitcoin position may be liquidated. For perpetual contracts, funding rates are periodic payments exchanged between long and short positions to keep contract prices aligned with the PTB spot market. Contract specifications vary and include settlement methods, contract size, and expiration dates for traditional futures.

Basic PTB Derivatives Trading Strategies

- Hedging: If you hold $10,000 worth of PTB, you can open a short PortalToBitcoin derivatives position of equal size to protect against price declines.

- Speculation: Trade PTB price movements without owning the token, using leverage to amplify returns or to take short positions easily.

- Arbitrage: Exploit price differences between PTB spot and derivatives markets through strategies like spot-futures arbitrage or funding rate arbitrage.

- Dollar-Cost Averaging: Systematically open small PTB futures positions at regular intervals to reduce the impact of volatility while maintaining market exposure.

Risk Management for PTB Derivatives

Professional traders typically limit risk exposure to 1-5% of total trading capital per position. When using leverage, calculate position size based on the actual capital at risk, not the notional value. Use stop-loss orders to automatically close PortalToBitcoin positions at predetermined loss levels and take-profit orders to secure gains. To avoid liquidation, maintain a substantial buffer above maintenance margin requirements—ideally at least 50% extra. Diversify across different PTB derivative products to spread risk and capture various market opportunities.

Getting Started with PTB Derivatives on MEXC

- Create and verify your MEXC account via the website or mobile app, completing KYC verification for full access.

- Navigate to the 'Futures' section and select PTB (PortalToBitcoin) contracts (e.g., USDT-M contracts).

- Transfer assets from your spot wallet to your futures wallet to fund your trading.

- Place your first PTB derivatives order: choose the contract, set your desired leverage, and select an order type (market, limit, or advanced). Input your position size and review all details before confirming.

- Start with smaller positions and lower leverage (1-5x) until you are comfortable with PTB derivatives and their market behavior.

Conclusion

PTB derivatives offer powerful tools for traders, but require careful study and disciplined risk management. By understanding the core concepts covered in this guide, implementing proper risk controls, and starting with small positions, you can develop the skills needed to navigate this complex market. Ready to start trading PortalToBitcoin derivatives? Visit MEXC's PTB Price Page for real-time market data, chart analysis, and competitive trading fees. Start your derivatives trading journey with MEXC today—where security meets opportunity in the world of PTB trading.

説明:暗号資産パルスは、AIと公開情報源を活用し、最新のトークントレンドを瞬時にお届けします。専門家の洞察と詳細な分析については、MEXC 学ぶ をご覧ください。

このページに掲載されている記事は、公開プラットフォームから引用したものであり、情報提供のみを目的としています。MEXCの見解を必ずしも反映するものではありません。すべての権利は原著者に帰属します。コンテンツが第三者の権利を侵害していると思われる場合は、service@support.mexc.com までご連絡ください。速やかに削除いたします。

MEXCは、いかなるコンテンツの正確性、完全性、または適時性についても保証するものではなく、提供された情報に基づいて行われたいかなる行動についても責任を負いません。本コンテンツは、財務、法律、またはその他の専門的なアドバイスを構成するものではなく、MEXCによる推奨または支持と解釈されるべきではありません。

Portal To Bitcoin の最新情報

もっと見る

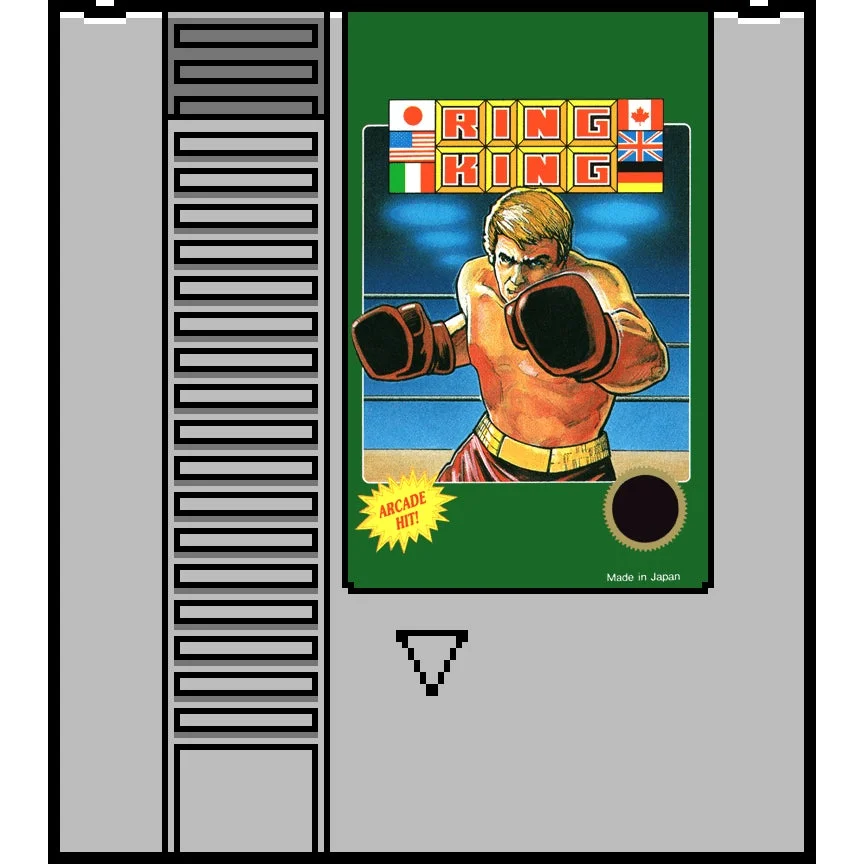

レトロボクシングゲーム「リングキング」がPicoPicoに追加! 12月10日より無料配信開始

Oracleは79億8000万ドルへの34%のクラウド成長と40億8000万ドルへの68%のインフラ成長を発表

NVIDIAの秘密兵器:追跡ソフトウェアが中国へのAIチップ密輸を標的に

ホット

現在、市場で大きな注目を集めているトレンドの暗号資産

暗号資産価格

取引高が最も多い暗号資産