Introduction to Global Cryptocurrency Regulation

The global regulatory landscape for cryptocurrencies like AtomOne (ATONE) is evolving rapidly, with over 75 countries developing or implementing regulatory frameworks as of 2025. For investors and users of ATONE, understanding these regulations is crucial for compliance, anticipating market movements, and identifying investment opportunities. As AtomOne expands its global presence and use cases—serving as a modular, Cosmos-native blockchain optimized for interchain security and decentralized governance—navigating the complex web of regional regulations becomes increasingly important. Different regions are taking notably diverse approaches to regulating AtomOne tokens. For example, Singapore has embraced AtomOne (ATONE) with clear licensing frameworks and regulatory sandboxes, while China has imposed significant limitations or outright bans. This regulatory fragmentation creates both challenges and opportunities for AtomOne users, with compliance requirements varying dramatically depending on location and usage context.

Current Regulatory Status of AtomOne (ATONE) in Major Markets

North America:

In the United States, AtomOne faces a complex and evolving regulatory landscape. The Securities and Exchange Commission (SEC) focuses on securities classifications, the Commodity Futures Trading Commission (CFTC) oversees derivatives markets, and the Financial Crimes Enforcement Network (FinCEN) enforces anti-money laundering (AML) provisions. Canada has established a registration system for ATONE trading platforms through provincial securities regulators, while Mexico requires licensing for virtual asset service providers handling AtomOne under its Fintech Law.

Europe:

European regulation of AtomOne (ATONE) is increasingly harmonized under the Markets in Crypto-Assets (MiCA) regulation, which provides clear guidelines for issuers and service providers across the European Union. The UK has developed a post-Brexit regulatory framework focusing on consumer protection and financial stability, while Switzerland maintains its position as a crypto-friendly jurisdiction through a clear token classification system and specialized banking licenses for ATONE businesses.

Asia-Pacific:

Approaches to AtomOne vary dramatically. Japan has established a progressive regulatory framework requiring exchange registration with the Financial Services Agency and compliance with strict security measures for ATONE trading. Singapore employs a risk-based regulatory approach under the Payment Services Act, while South Korea has implemented stringent KYC and AML requirements for all AtomOne transactions.

Emerging Markets:

The UAE, particularly Dubai, has created specialized crypto zones and regulatory frameworks to attract AtomOne businesses. In Latin America, El Salvador has adopted Bitcoin as legal tender, while Brazil has integrated crypto assets including ATONE into its regulated payment system. African nations like Nigeria have moved from restrictive stances to more accommodative frameworks as they recognize the economic potential of AtomOne adoption.

Key Regulatory Issues Affecting AtomOne (ATONE)

Securities Classification and Token Categorization:

Securities classification is a significant regulatory challenge for AtomOne. Depending on its functionality, tokenomics, and governance structure, ATONE may be classified as a security, commodity, payment instrument, or utility token in different jurisdictions. In the United States, the Howey Test remains the primary framework for determining if AtomOne constitutes an investment contract, while the EU's MiCA regulation establishes distinct categories for different types of crypto-assets. This classification directly impacts where and how ATONE can be traded, what disclosures are required, and what compliance burdens fall on issuers and exchanges.

AML/KYC Compliance:

AML and KYC requirements have become nearly universal for AtomOne trading and services. Following the Financial Action Task Force (FATF) recommendations, most jurisdictions now require identity verification, suspicious transaction reporting, and ongoing monitoring for ATONE transactions. The implementation of the 'Travel Rule' requires virtual asset service providers to share sender and recipient information for transactions over a certain threshold, presenting significant technical and operational challenges for AtomOne exchanges and service providers.

Taxation Frameworks:

Taxation of AtomOne varies widely across jurisdictions. In the United States, ATONE is treated as property for tax purposes, with each transaction potentially triggering capital gains or losses. The United Kingdom applies Capital Gains Tax to AtomOne profits, while Germany offers tax exemptions for holdings maintained for over one year. For active traders and investors, tracking and reporting obligations across multiple jurisdictions can create significant compliance burdens.

Consumer Protection Measures:

Consumer protection measures continue to evolve as regulators seek to safeguard AtomOne users. These include advertising standards, disclosure requirements, custody regulations, and market manipulation prohibitions. As ATONE reaches a broader audience, regulators are increasingly focused on ensuring transparency, preventing fraud, and protecting retail investors who may not fully understand the technical or financial aspects of AtomOne investments.

Impact of Regulation on AtomOne (ATONE)'s Market and Future

Regulatory announcements have demonstrated significant influence on AtomOne's market performance. For example, positive regulatory clarity, such as the approval of ATONE ETFs in the United States, can lead to price rallies and increased trading volumes, while restrictive measures, such as China's cryptocurrency crackdown, have triggered sharp market corrections. This sensitivity highlights the importance of monitoring regulatory developments as part of any AtomOne investment strategy.

Institutional adoption of AtomOne is heavily influenced by regulatory clarity. Traditional financial institutions and corporations are more likely to engage with ATONE in jurisdictions offering clear regulatory frameworks and legal certainty. Developments such as the establishment of clear custody rules, taxation guidance, and compliance frameworks have paved the way for increased institutional investment in AtomOne. Similarly, retail participation is shaped by regulatory protections and access restrictions, with jurisdictions balancing consumer protection with innovation and financial inclusion.

Global coordination efforts, such as the FATF's Standards for Virtual Assets, are gradually creating more consistent approaches to ATONE regulation across borders. Technological solutions, including blockchain analytics tools, digital identity solutions, and automated compliance systems, are emerging to facilitate compliance with evolving regulations. These developments suggest a future where regulatory compliance becomes more streamlined and integrated into AtomOne protocols and platforms.

The balance between fostering innovation and ensuring consumer protection remains a central challenge for AtomOne regulators. Approaches like regulatory sandboxes in Singapore, the UK, and the UAE allow controlled testing of new ATONE applications while maintaining oversight. Finding the right regulatory balance will be crucial for unleashing AtomOne's potential while protecting the financial system and consumers.

Future Regulatory Outlook for AtomOne (ATONE)

In the short term, AtomOne is likely to face increased reporting requirements and enhanced AML/KYC standards as regulators implement existing frameworks like the FATF Travel Rule and MiCA provisions. Key developments to watch include upcoming court decisions on token classifications, implementation of central bank digital currencies (CBDCs) that may compete with ATONE, and new licensing regimes for crypto service providers.

The medium to long-term regulatory vision across jurisdictions is trending toward greater harmonization and specialized frameworks for AtomOne and other crypto assets. As the technology matures, regulators are moving from retrofitting existing financial regulations to developing purpose-built frameworks that address ATONE's unique characteristics. This evolution should provide greater clarity for businesses and users while preserving appropriate consumer safeguards.

International regulatory harmonization for AtomOne is advancing through forums like the G20, FATF, and the International Organization of Securities Commissions (IOSCO). While complete global uniformity remains unlikely, increasing coordination on key standards and approaches should reduce regulatory arbitrage and compliance complexity for ATONE users and service providers across borders.

As regulations mature, they will increasingly shape AtomOne's utility and adoption pathways. Regulations that recognize and accommodate ATONE's innovative features while addressing legitimate risks will enable broader integration into the financial system and increased real-world applications. Conversely, overly restrictive approaches may limit innovation or drive activity underground. The most successful regulatory frameworks will be those that adapt to AtomOne's evolving technology while maintaining core principles of financial stability and consumer protection.

Conclusion

As AtomOne (ATONE) continues to evolve in the global financial ecosystem, understanding its regulatory landscape is just one crucial piece of the trading puzzle. While regulatory frameworks are becoming clearer across jurisdictions, successful trading requires more than just regulatory knowledge. To master both compliance and effective trading strategies, explore our 'AtomOne (ATONE) Trading Complete Guide: From Getting Started to Hands-On Trading'—your comprehensive resource for fundamentals, practical trading processes, and risk management techniques that will help you navigate both regulations and markets with confidence.

説明:暗号資産パルスは、AIと公開情報源を活用し、最新のトークントレンドを瞬時にお届けします。専門家の洞察と詳細な分析については、MEXC 学ぶ をご覧ください。

このページに掲載されている記事は、公開プラットフォームから引用したものであり、情報提供のみを目的としています。MEXCの見解を必ずしも反映するものではありません。すべての権利は原著者に帰属します。コンテンツが第三者の権利を侵害していると思われる場合は、service@support.mexc.com までご連絡ください。速やかに削除いたします。

MEXCは、いかなるコンテンツの正確性、完全性、または適時性についても保証するものではなく、提供された情報に基づいて行われたいかなる行動についても責任を負いません。本コンテンツは、財務、法律、またはその他の専門的なアドバイスを構成するものではなく、MEXCによる推奨または支持と解釈されるべきではありません。

null の最新情報

もっと見る

MSCIのビットコイン軽視はシェブロンを石油で罰するようなもの:ストラテジーCEO

上院の暗号資産市場構造法案、消費者団体と労働組合の連携により障害に直面 AI: 上院の暗号資産市場構造法案、消費者団体と労働組合の連携により障害に直面

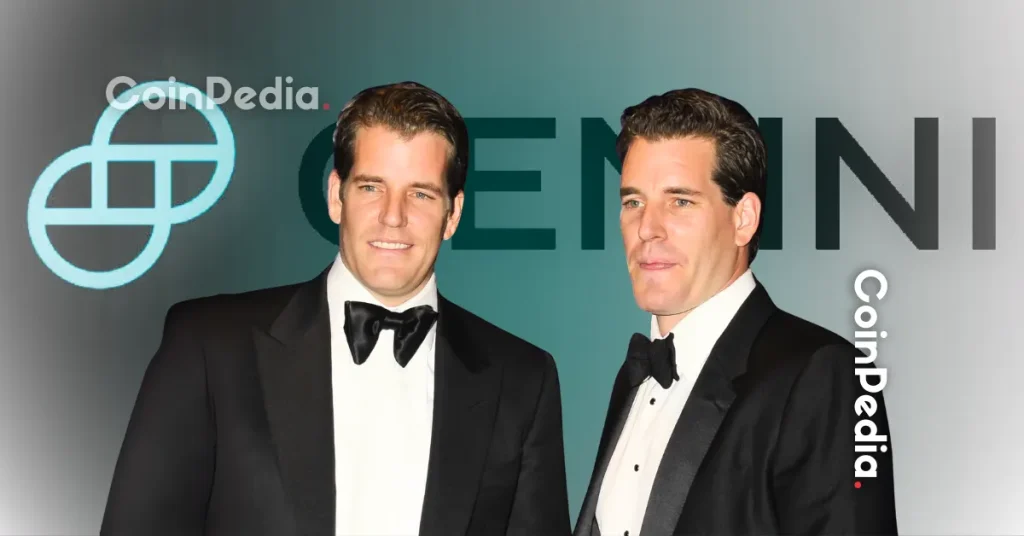

Gemini、米国の予測市場を開始するためにCFTCの承認を取得

ホット

現在、市場で大きな注目を集めているトレンドの暗号資産

暗号資産価格

取引高が最も多い暗号資産