Placing Different Types of Futures Orders

1. Limit Order

1.1 Definition

1.2 Advantages and Disadvantages

- No Slippage: Your execution price will never be worse than the limit you set, helping you control entry costs with precision.

- Maker Role: If your order does not immediately match with existing ones but stays in the order book, you often benefit from lower maker fees.

- Execution is not guaranteed, as it depends on market conditions.

- Orders may remain pending for some time before being filled.

1.3 Use Cases

1.4 Time-in-Force Options

- GTC (Good Till Canceled): The order remains active until it is either fully executed or manually canceled.

- IOC (Immediate or Cancel): The order will attempt to execute immediately. Any portion that cannot be filled at the specified price will be canceled.

- FOK (Fill or Kill): The order must be filled in full immediately at the specified price. If not, it will be canceled entirely.

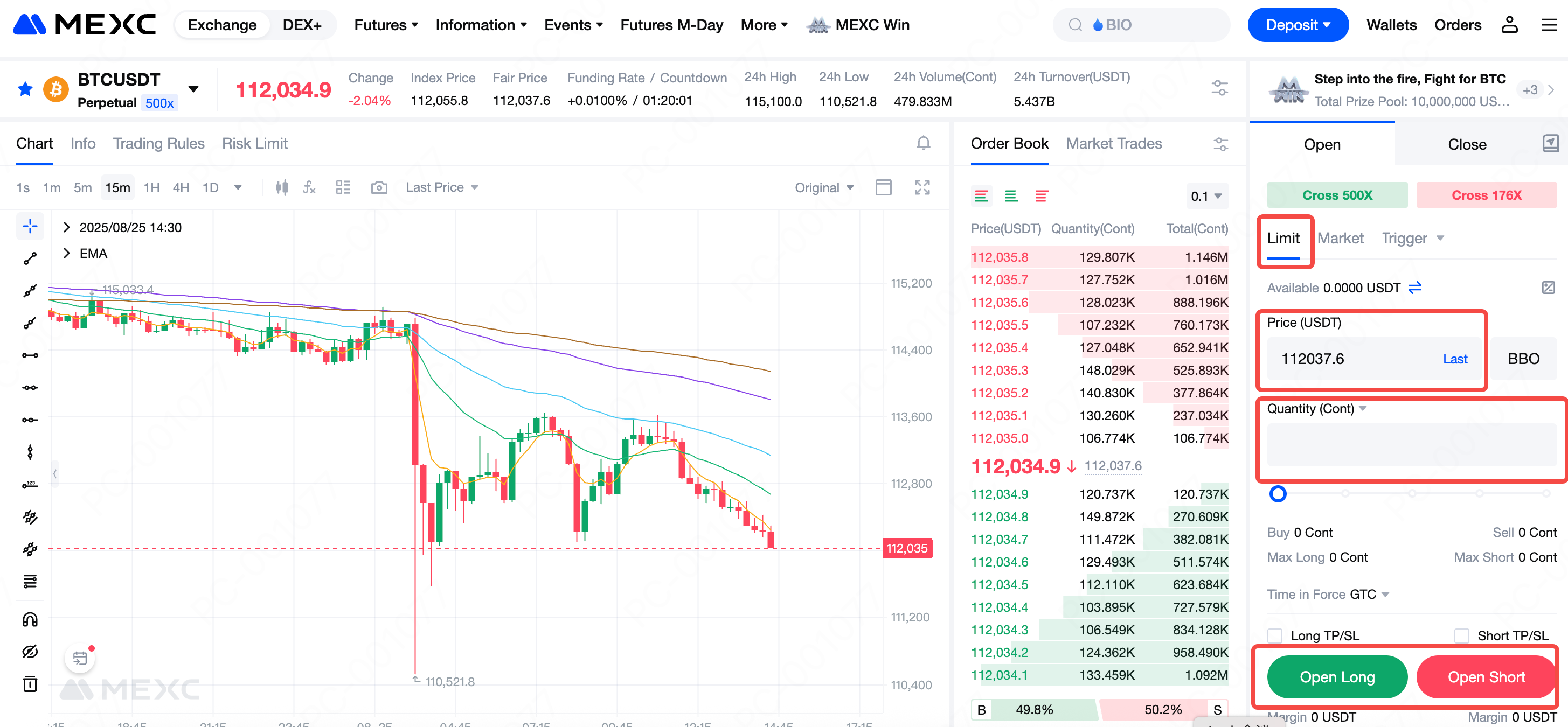

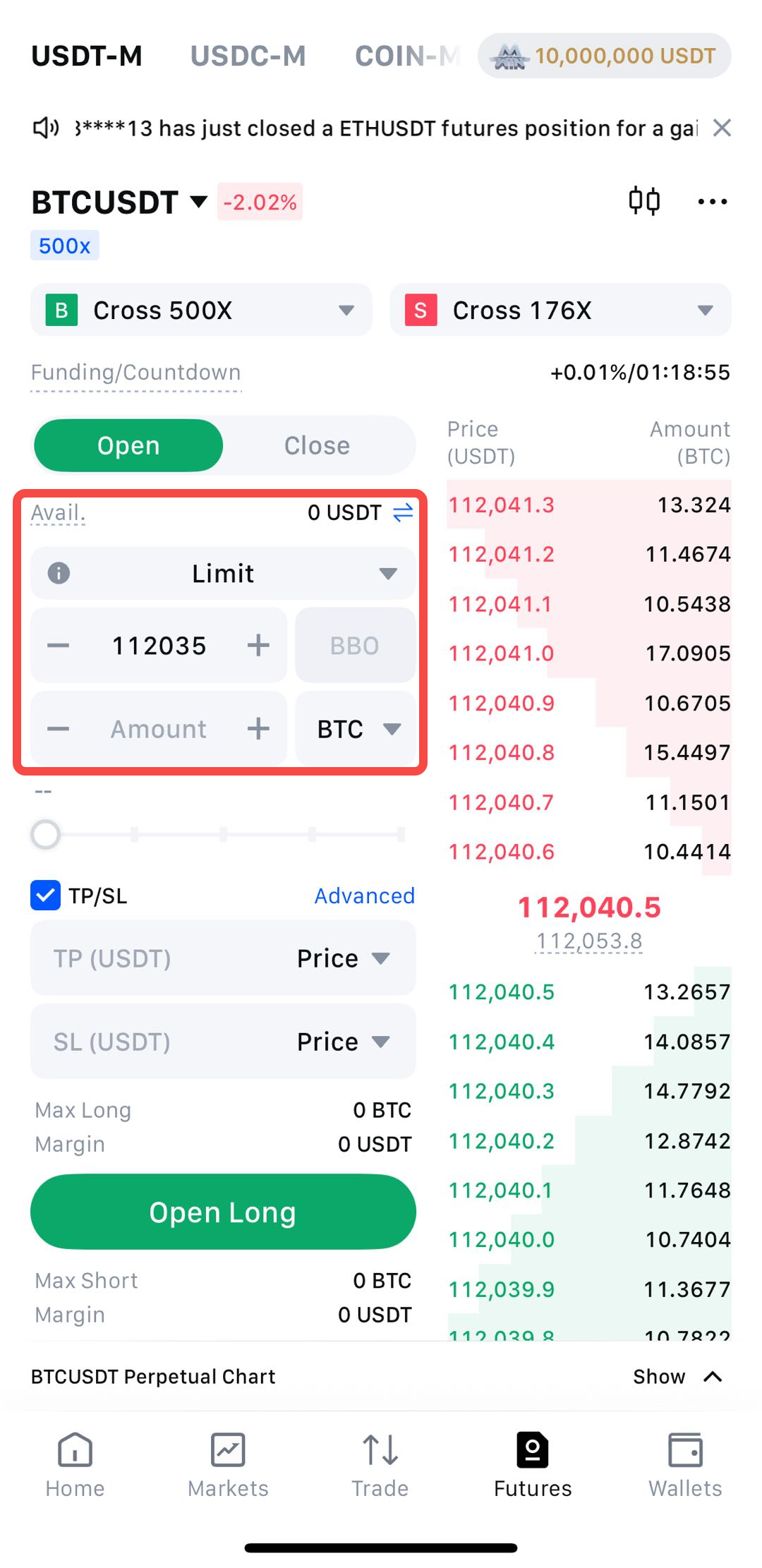

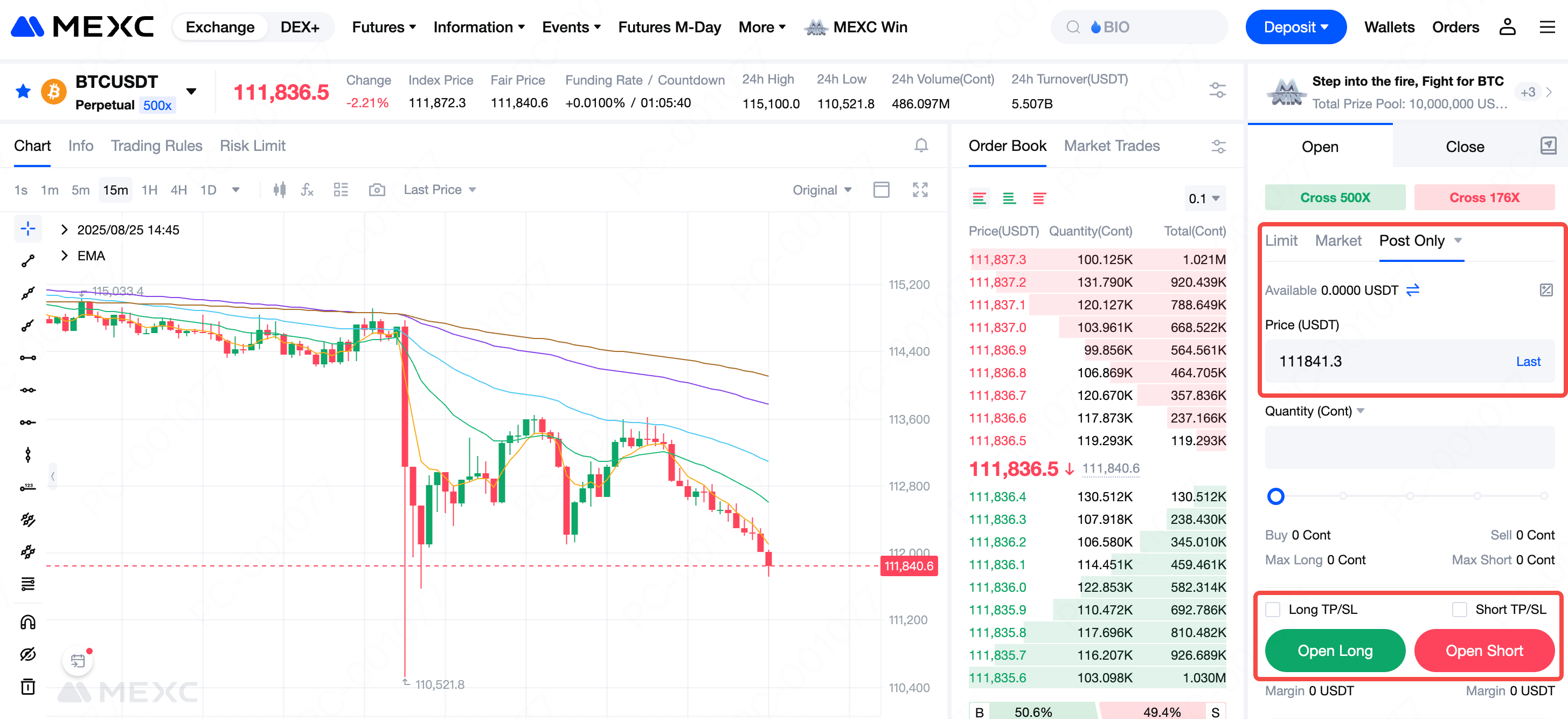

1.5 How to Place a Limit Order

2. Market Order

2.1 Definition

2.2 Advantages and Disadvantages

- Advantages: A market order does not require the user to set a price, allowing the order to be executed quickly.

- Disadvantages: While market orders ensure rapid execution, they cannot guarantee the execution price. Market prices may fluctuate rapidly, resulting in slippage compared to the expected price. To mitigate this risk, you can enable the Price Protection feature on MEXC, which helps prevent abnormal stop-loss or take-profit triggers during periods of extreme volatility.

2.3 Use Cases

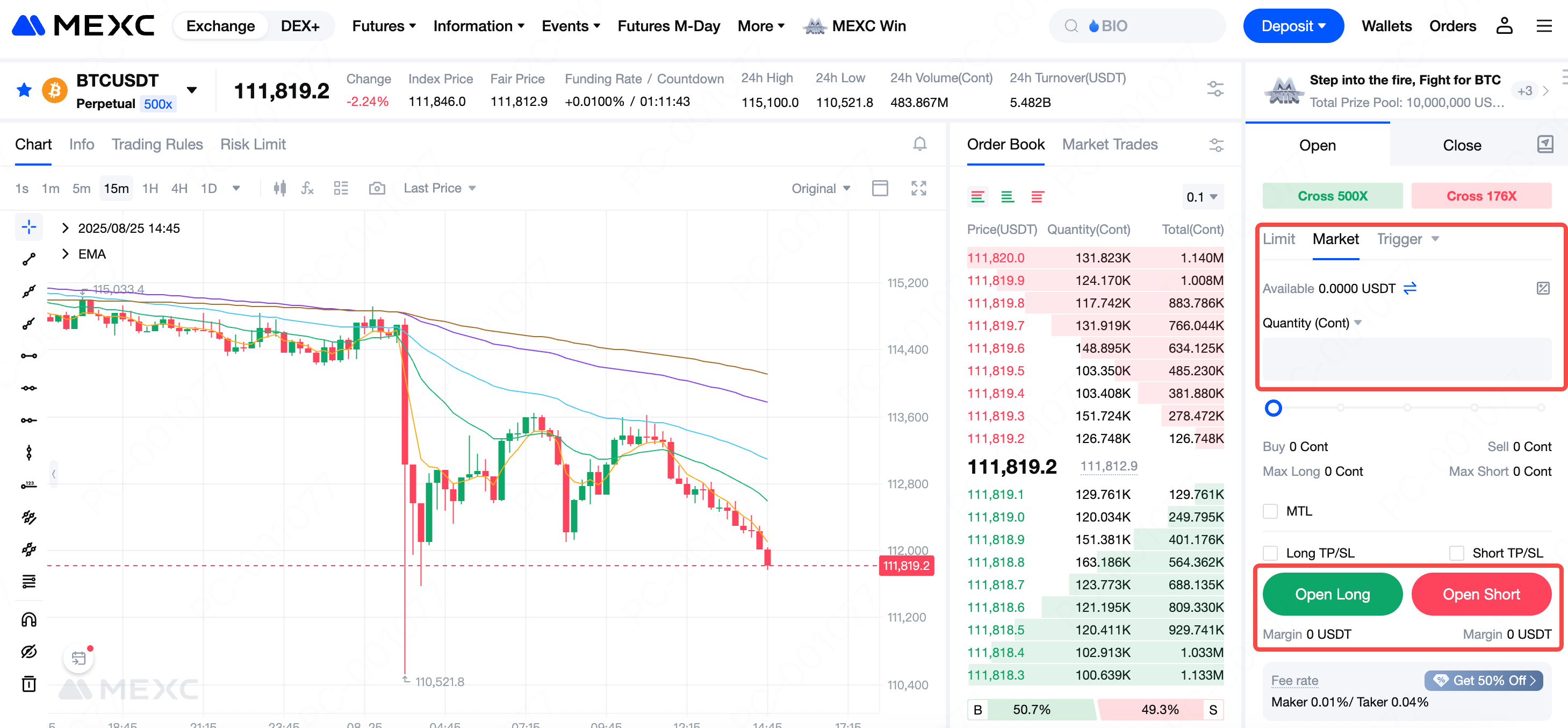

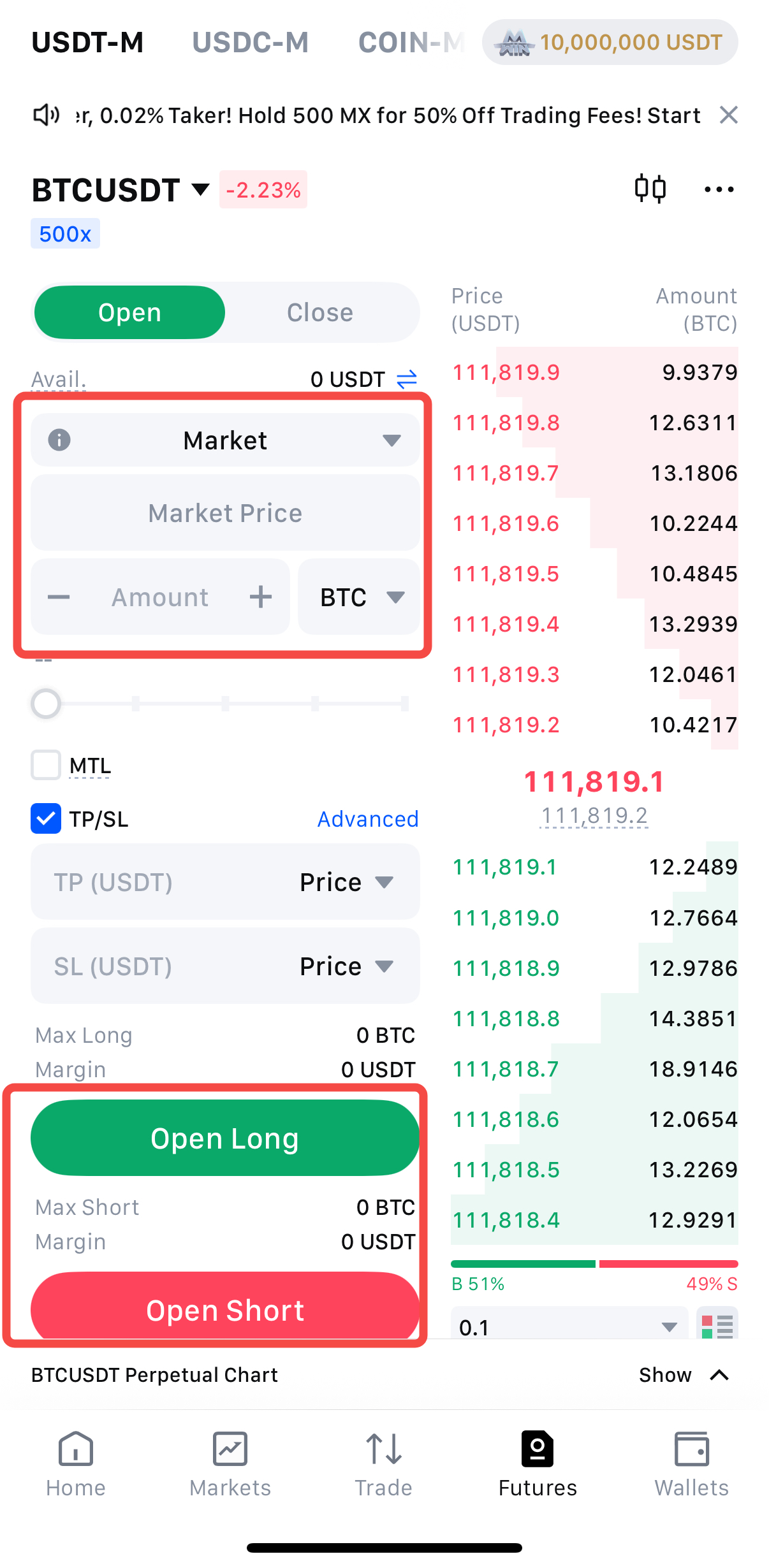

2.4 How to Place a Market Order

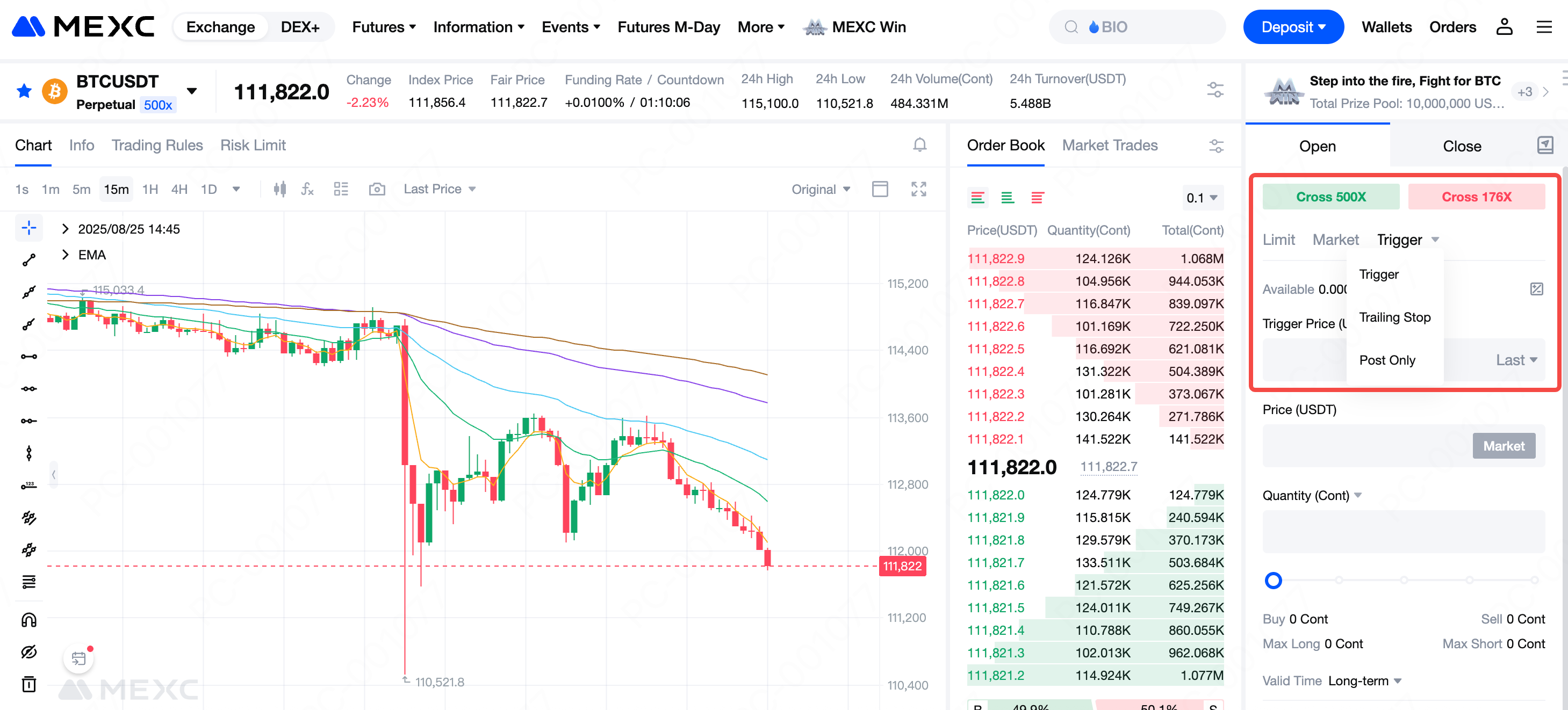

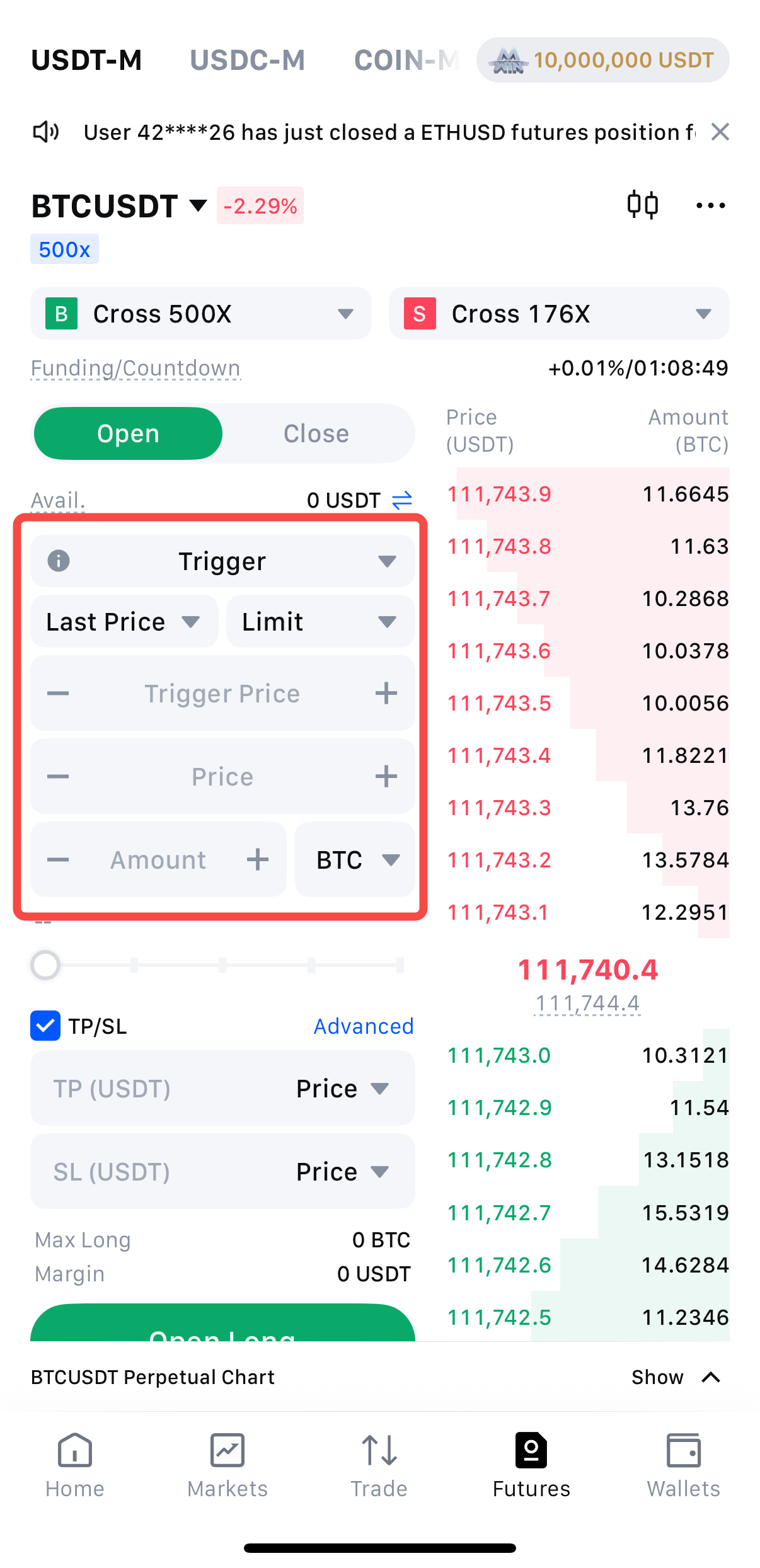

3. Trigger Order

3.1 Definition

3.2 Advantages and Disadvantages

- Advantages: Trigger orders reduce the need for constant monitoring, allowing users to plan entry and exit points in advance. They help secure profits or limit losses during trading.

- Disadvantages: A Trigger order may not always be successfully triggered due to position limits, insufficient margin, or market conditions.

3.3 Use Cases

3.4 Three Price Types

- Last Price: The most recent transaction price in the MEXC Futures order book.

- Fair Price: A protective mechanism introduced to prevent losses caused by abnormal price fluctuations on a single platform. It is calculated using weighted price data from major exchanges and reflects the market price more fairly.

- Index Price: Calculated by MEXC based on spot prices from multiple leading exchanges, with different weightings applied.

3.5 How to Place a Trigger Order

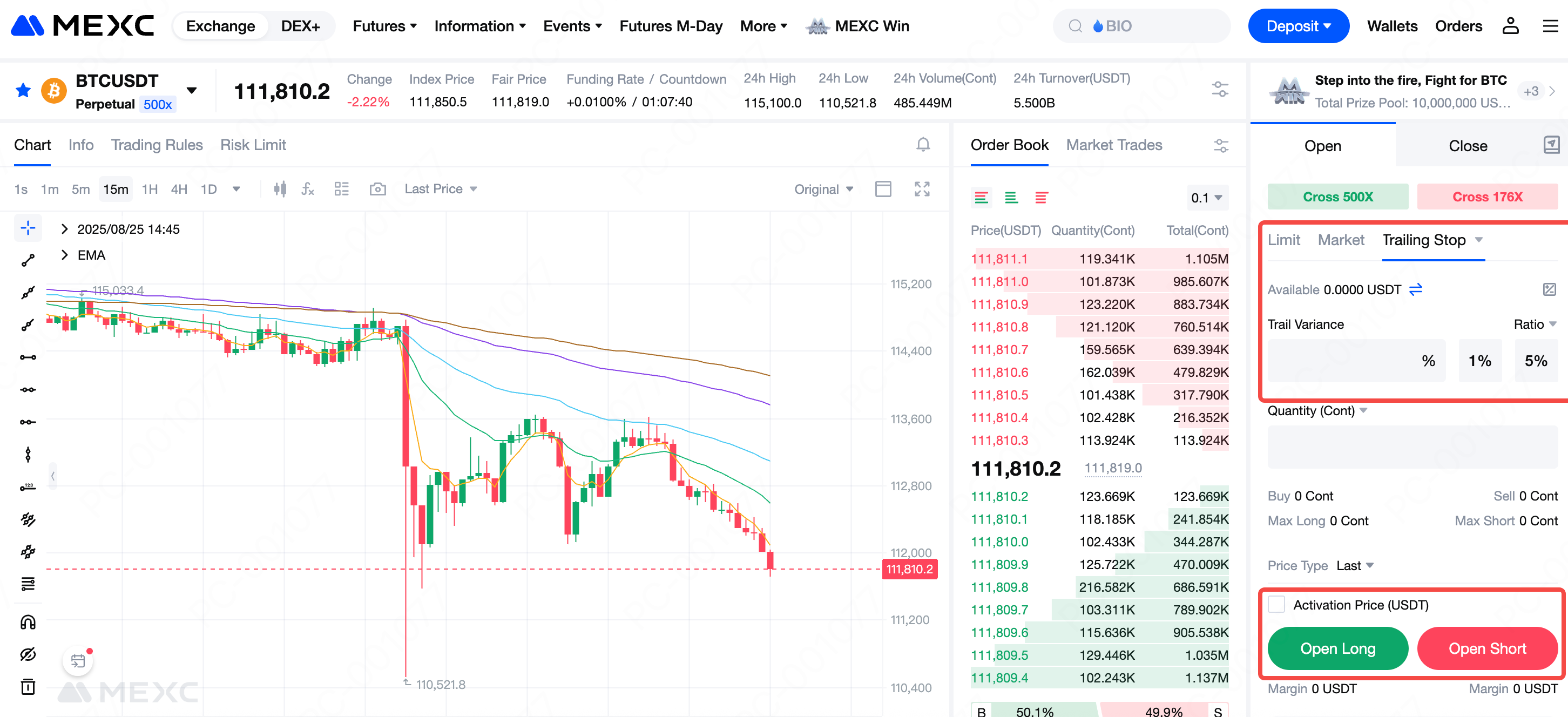

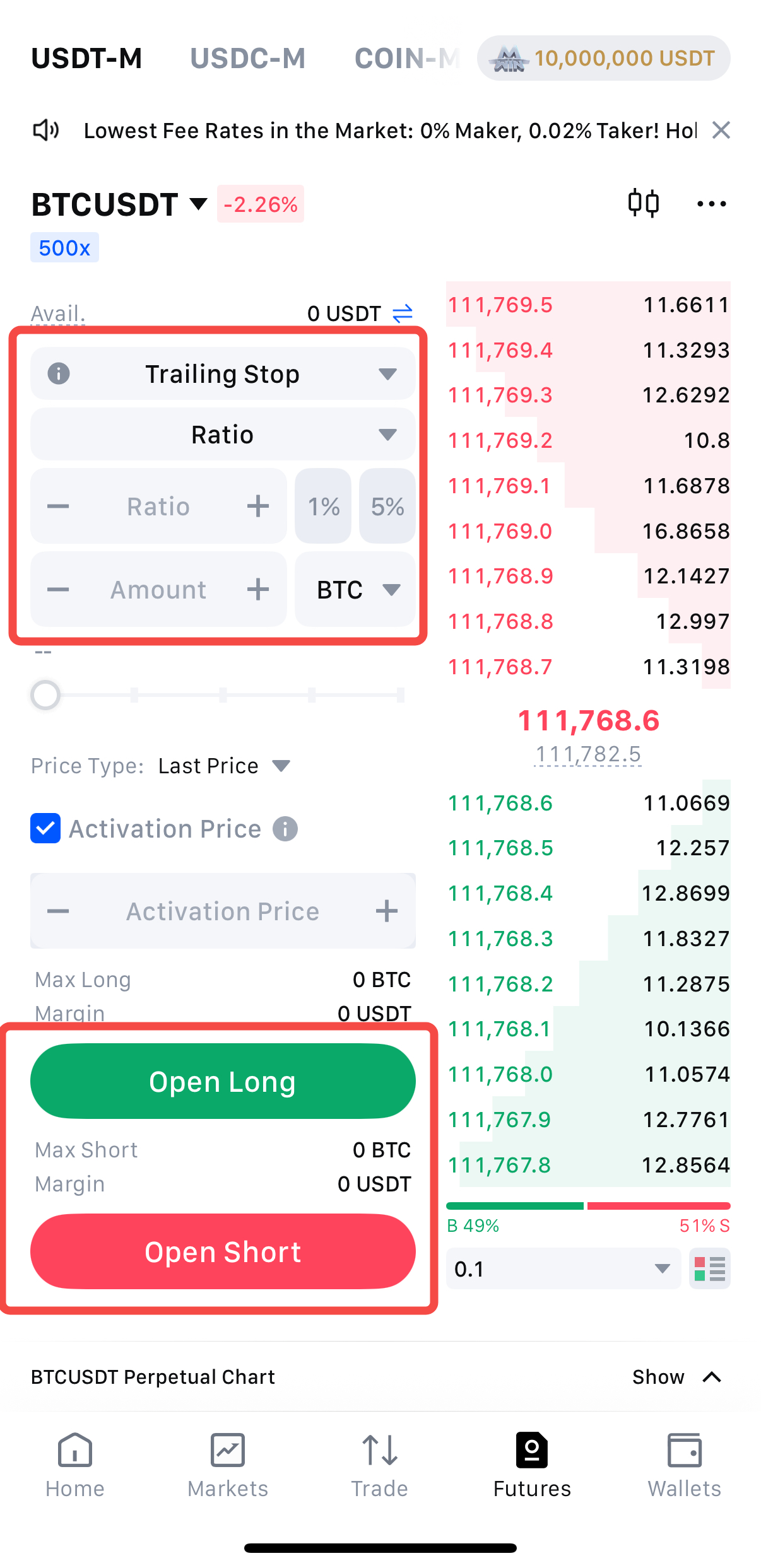

4. Trailing Stop Order

4.1 Definition

- Trigger Price = Highest Price Reached – Trail Variance (Price Distance)

- Trigger Price = Highest Price Reached × (1 – Trail Variance % (Ratio)

- Trigger Price = Lowest Price Reached + Trail Variance (Price Distance)

- Trigger Price = Lowest Price Reached × (1 + Trail Variance % (Ratio)

4.2 Advantages and Disadvantages

- Advantages: Provides better control over profits and allows traders to replicate trading strategies more systematically.

- Disadvantages: The cryptocurrency market is highly volatile, making it challenging to set an appropriate callback (trail) ratio.

4.3 Use Cases

4.4 How to Place a Trailing Stop Order

5. Post Only

5.1 Definition

5.2 Advantages and Disadvantages

- Advantages: In MEXC Futures trading, Maker orders have a much lower fee rate compared to Taker orders. Using Post Only guarantees that you always pay 0% fees.

- Disadvantages: Since Post Only places pending orders rather than taking existing ones, there is no guarantee of immediate execution.

5.3 Use Cases

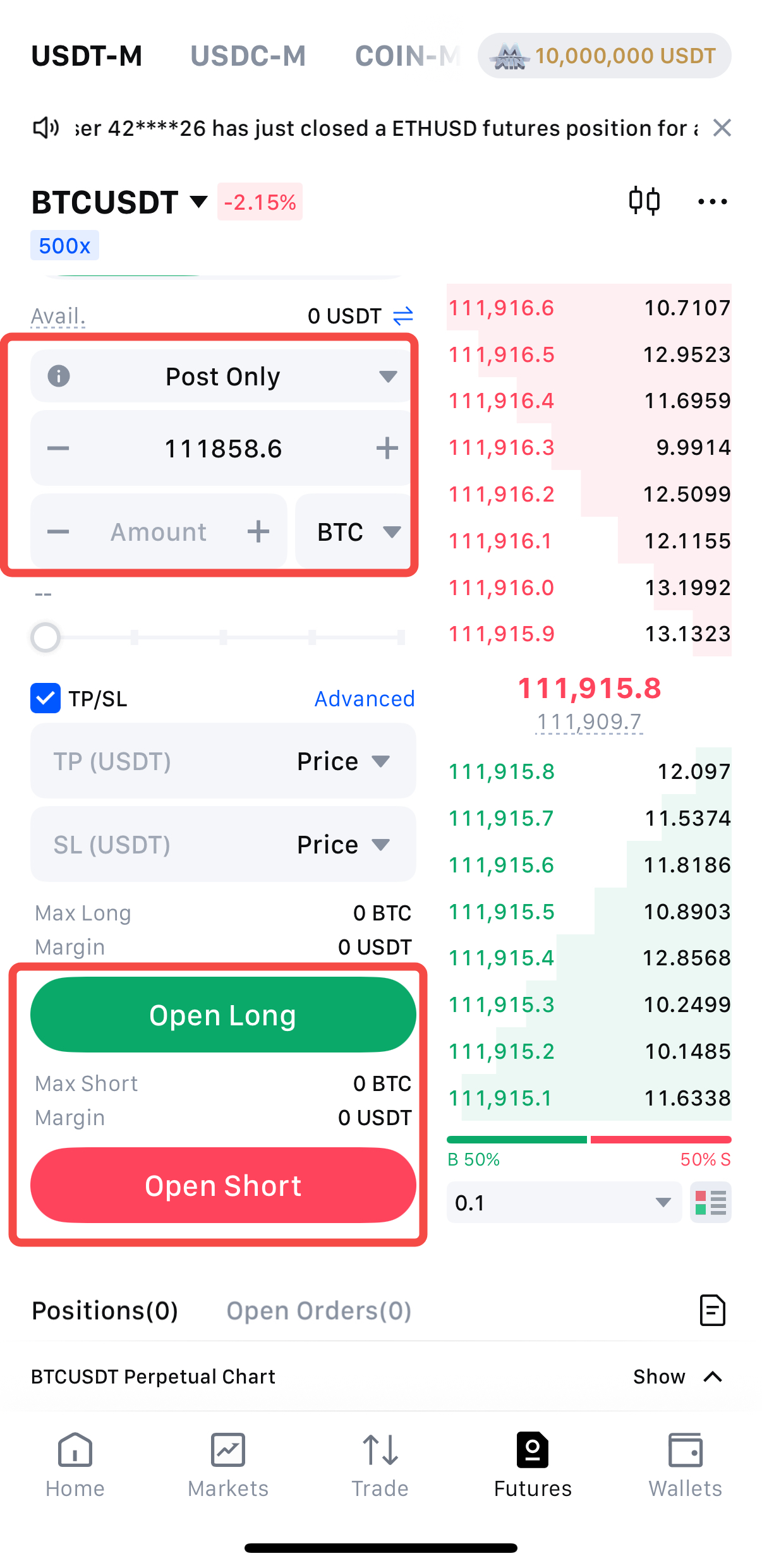

5.4 How to Place a Post Only Order

6.1 Definition

6.2 Advantages and Disadvantages

- Faster Execution: A Chase Limit Order allows execution at the real-time market price within a set protection limit, maximizing the chances of a quick fill.

- Capture Market Opportunities: Enables traders to react swiftly to market volatility and seize favourable price movements.

- Price Uncertainty: The executed price may differ from expectations. Buy orders could fill at higher prices or sell orders at lower prices than intended.

- Slippage Risk: During sharp price movements, the actual execution price may deviate significantly from the initial expected price, resulting in slippage.

6.3 Use Cases

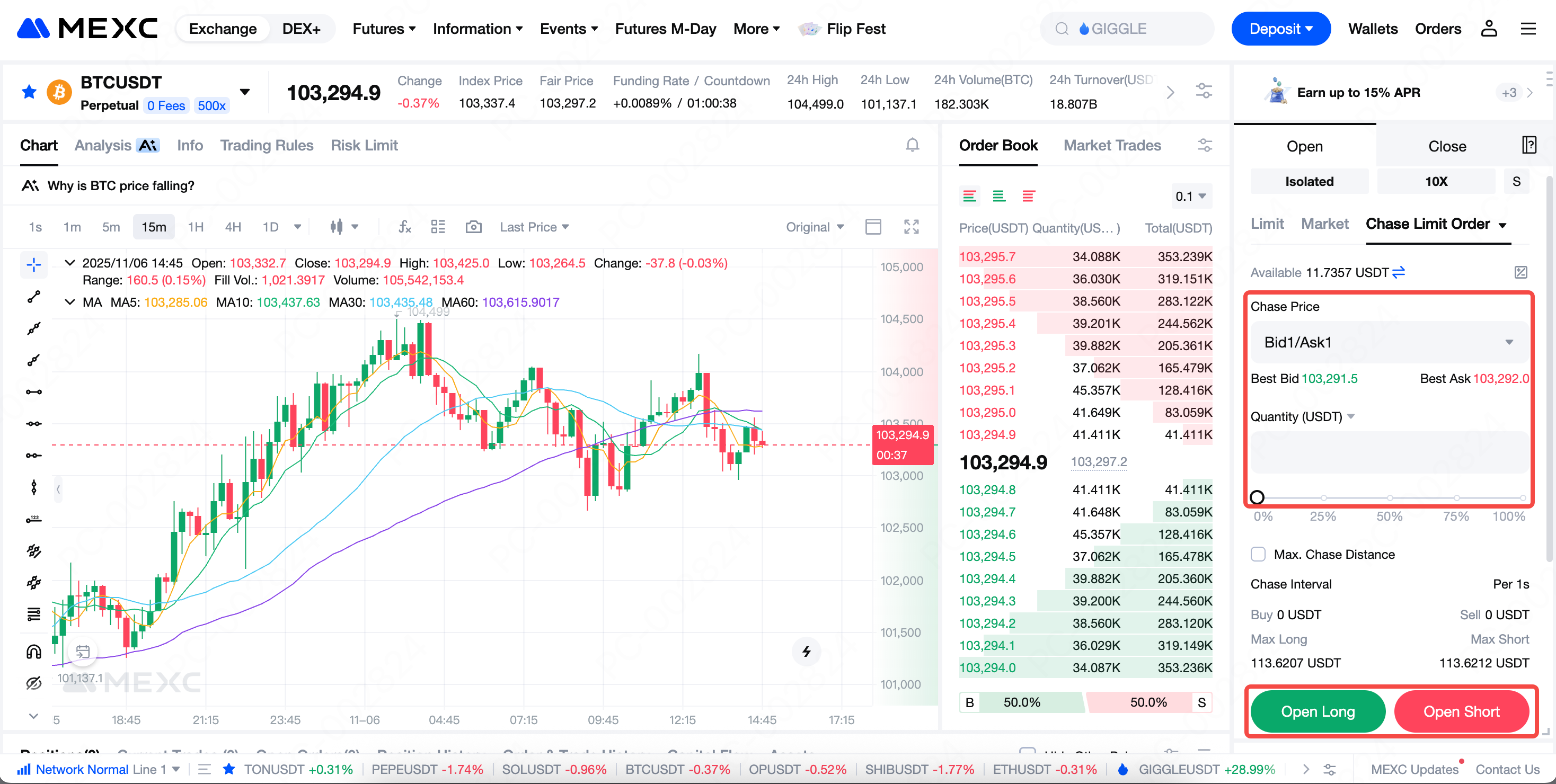

6.4 How to Place a Chase Limit Order

Recommended Reading:

- Why Choose MEXC Futures? Gain deeper insight into the advantages and unique features of MEXC Futures to help you stay ahead in the market.

- MEXC Futures Trading Tutorial (App) Understand the full process of trading Futures on the app and get started with ease.

Popular Articles

How to Buy USDT on MEXC? The Most Comprehensive Guide and Practical Tips

USDT (Tether), as a stablecoin, is widely used in cryptocurrency trading with stability and wide liquidity. This article will provide you with a complete guide to purchasing USDT on the MEXC platform,

What is the Main Purpose of Staking in Arichain? Everything You Need to Know

Blockchain technology can feel overwhelming for newcomers, but ARI Wallet is changing that narrative.This guide explains the main purpose of staking in Arichain, a blockchain platform that launched in

Celebrating 7 Years of MEXC: Building the Future of Crypto Infrastructure with "More" at the Core

As MEXC celebrates its seventh anniversary, it continues to embrace “more” as its core strategy—forging a path of innovation across the expanding universe of digital finance. Over the past seven years

How to Stake Polygon? Complete Guide to POL Staking Rewards

Polygon staking offers crypto holders a way to earn passive income while supporting network security.This guide explains everything beginners need to know about staking POL tokens, from choosing the r

Hot Crypto Updates

Dogecoin (DOGE) Price Analysis: December 2025 Breakdown Below Key Support – What Should Investors Do?

Key Takeaways Dogecoin (DOGE) price broke below the critical $0.145 support level in December 2025, initiating a new downtrendCurrent DOGE price trading below $0.140, beneath the 100-hour simple movin

EthXY (SEXY) Price Prediction 2026-2030: Expert Analysis & Investment Outlook

Key Takeaways EthXY (SEXY) currently trades around $0.03-0.04, significantly down from all-time high of $3.142026-2030 price predictions based on technical analysis, project development, and GameFi ma

Ethereum's Future: Institutional Investment and Price Potential

1. Financial Expert's Crypto Market PerspectiveTom Lee, co-founder of Fundstrat and chairman of BitMine Immersive Technologies, stands out as a leading voice in blending traditional macroeconomic anal

The Psychology of FOLO in Cryptocurrency Trading: Understanding and Overcoming Fear

1. Defining FOLO in the Cryptocurrency ContextFOLO, or Fear of Losing Out, represents a powerful psychological force in cryptocurrency trading, distinct from the more commonly discussed FOMO. Unlike F

Trending News

Golden surge in practical shooting propels PH past Malaysia in SEA Games medal tally

Rolly Nathaniel Tecson, Edcel John Gino, Genesis Pible, and Erin Mattea Micor hit the mark as the Philippines rakes in four gold medals in practical shooting to

Here are Two Major Milestones for Saylor as Strategy Acquires 10K+ Bitcoin in Latest Scoop

CryptoQuant analyst JA Maartunn highlights two impressive milestones by Saylor's Strategy after its latest Bitcoin purchase. Maartunn called attention to these

Japan trade show yields $1.72M in sales for PHL coconut exhibitors

COCONUT businesses from the Philippines generated $1.72 million in sales at Japan’s Food and Beverage Expo (FABEX) Kansai 2025 trade show,the Department of Trade

EUR steady in mid-1.17s ahead of ECB Thursday – Scotiabank

The post EUR steady in mid-1.17s ahead of ECB Thursday – Scotiabank appeared on BitcoinEthereumNews.com. The Euro (EUR) is steady, trading in a tight range in the

Related Articles

What Are Prediction Futures?

Cryptocurrency futures trading attracts countless investors with its high leverage and the ability to profit in both rising and falling markets. However, its complex mechanisms such as margin, leverag

Calculation of Futures Yield and Trading Fees

When trading futures on MEXC or other major exchanges, your trading PNL is based on three components:Trading Fees: The cost incurred during the transaction.Funding Fees: Periodic settlements based on

MEXC Fees Explained: Complete Trading, Futures & Withdrawal Fees Guide

Whether you are an experienced cryptocurrency trader or just getting started, understanding trading fees is essential to navigating the market and improving your trading experience. MEXC, a leading gl

MEXC Futures Funding Rates: How to Check, Calculate & Optimize Costs

Have you ever experienced this? You predicted the market direction correctly in a futures trade, yet your profits kept shrinking, or your balance mysteriously dropped? The culprit might be something m