Introduction to BDTC Transactions

BDTC transactions represent the fundamental way value is transferred within the decentralized network of this digital asset. Unlike traditional financial transactions that rely on intermediaries and centralized authorities, BDTC transactions operate on a peer-to-peer basis secured by cryptographic verification. Each transaction is recorded on the BDTC distributed ledger, making it transparent and immutable.

For investors, traders, and everyday users of BDTC, understanding how transactions work is crucial for ensuring funds are transferred securely, optimizing for lower fees, and troubleshooting any issues that might arise. Whether you're sending BDTC tokens to another wallet, trading on an exchange, or interacting with decentralized applications, transaction knowledge serves as your foundation for effective BDTC management.

BDTC transactions offer several distinctive advantages, including settlement times as quick as a few minutes without intermediaries, the ability to send value globally without permission from financial institutions, and programmable transfer logic through its smart contract layer. However, they also require users to understand the irreversible nature of blockchain transactions and take responsibility for proper address verification before sending.

How BDTC Transactions Work: Technical Fundamentals

At its core, BDTC operates on a proof-of-work blockchain where BDTC transactions are bundled into blocks and cryptographically linked to form an unbroken chain of records. When you initiate a BDTC transaction, it gets verified by network miners who confirm that you actually own the tokens you're attempting to send by checking your digital signature against your public key.

The mining process ensures that all network participants agree on the valid state of transactions, preventing issues like double-spending where someone might attempt to send the same BDTC tokens to different recipients. In BDTC's network, this consensus is achieved through computational puzzles, requiring significant computing power to secure the network.

Your BDTC wallet manages a pair of cryptographic keys: a private key that must be kept secure at all times, and a public key from which your wallet address is derived. When sending BDTC, your wallet creates a digital signature using your private key, proving ownership without revealing the key itself—similar to signing a check without revealing your signature pattern.

Transaction fees for BDTC are determined by network congestion, transaction size/complexity, and the priority level requested by the sender. These fees serve to compensate miners for their work, prevent spam attacks on the network, and prioritize transactions during high demand periods. The BDTC transaction process fee structure works by specifying the satoshis per byte, depending on the network design.

Step-by-Step BDTC Transaction Process

The BDTC transaction process can be broken down into these essential steps:

Step 1: Prepare Transaction Details

- Specify the recipient's address, an alphanumeric string of 34 characters starting with a specific prefix (e.g., "1" or "3" for Bitcoin-based forks).

- Determine the exact amount of BDTC to send.

- Set an appropriate transaction fee based on current network conditions.

- Most BDTC wallets provide fee estimation tools to balance cost and confirmation speed.

Step 2: Sign the Transaction

- Your wallet constructs a digital message containing sender address, recipient address, amount, and fee information.

- This message is cryptographically signed using your private key.

- The signing process creates a unique signature that proves you authorized the transaction.

- This entire process happens locally on your device, keeping your private keys secure.

Step 3: Broadcast to Network

- Your wallet broadcasts the signed BDTC transaction to multiple nodes in the BDTC network.

- These nodes verify the transaction's format and signature.

- Verified transactions are relayed to other connected nodes.

- Within seconds, your transaction propagates across the entire network.

- Your transaction now sits in the memory pool (mempool) awaiting inclusion in a block.

Step 4: Confirmation Process

- BDTC miners select transactions from the mempool, prioritizing those with higher fees.

- Once included in a block and added to the blockchain, your transaction receives its first confirmation.

- Each subsequent block represents an additional confirmation.

- Most services consider a BDTC transaction fully settled after 6 confirmations.

Step 5: Verification and Tracking

- Track your BDTC transaction status using blockchain explorers by searching for your transaction hash (TXID).

- These explorers display confirmation count, block inclusion details, fee paid, and exact timestamp.

- For BDTC, popular explorers include those integrated into the BDTC ecosystem and MEXC's transaction history tools.

- Once fully confirmed, the recipient can safely access and use the transferred funds.

Transaction Speed and Fees Optimization

BDTC transaction speeds are influenced by network congestion, the fee amount you're willing to pay, and the blockchain's inherent processing capacity of approximately 7 transactions per second (as a Bitcoin fork). During periods of high network activity, such as major market movements, completion times can increase from the usual 10 minutes to longer periods unless higher fees are paid.

The fee structure for BDTC is based on satoshis per byte. Each BDTC transaction requires computational resources to process, and fees are essentially bids for inclusion in the next block. The minimum viable fee changes constantly based on network demand, with wallets typically offering fee tiers such as economy, standard, and priority to match your urgency needs.

To optimize BDTC transaction costs while maintaining reasonable confirmation times, consider transacting during off-peak hours when network activity naturally decreases, typically weekends or between 02:00–06:00 UTC. You can also batch multiple operations into a single transaction when the protocol allows, utilize layer-2 solutions like the Lightning Network for frequent small transfers, or subscribe to fee alert services that notify you when network fees drop below your specified threshold.

Network congestion impacts BDTC transaction times and costs significantly, with BDTC's block time of 10 minutes serving as the minimum possible confirmation time. During major market volatility events, the mempool can become backlogged with thousands of pending transactions, creating a competitive fee market where only transactions with premium fees get processed quickly. Planning non-urgent transactions for historical low-activity periods can result in fee savings of 30% or more compared to peak times.

Common Transaction Issues and Solutions

Stuck or pending BDTC transactions typically occur when the fee set is too low relative to current network demand, there are nonce sequence issues with the sending wallet, or network congestion is extraordinarily high. If your BDTC transaction has been unconfirmed for more than 24 hours, you can attempt a fee bump (replace-by-fee if the protocol supports it), use a transaction accelerator service, or simply wait until network congestion decreases, as most transactions eventually confirm or get dropped from the mempool after a specific period.

Failed BDTC transactions can result from insufficient funds to cover both the sending amount and transaction fee, attempting to interact with smart contracts incorrectly, or reaching network timeout limits. The most common error messages include "insufficient balance," "invalid address," and "transaction size too large," each requiring different remediation steps. Always ensure your wallet contains a buffer amount beyond your intended transaction to cover unexpected fee increases during processing.

BDTC's blockchain prevents double-spending through its proof-of-work consensus protocol, but you should still take precautions like waiting for the recommended number of confirmations before considering large transfers complete, especially for high-value transactions. The protocol's design makes BDTC transaction reversal impossible once confirmed, highlighting the importance of verification before sending.

Address verification is critical before sending any BDTC transaction. Always double-check the entire recipient address, not just the first and last few characters. Consider sending a small test amount before large transfers, using the QR code scanning feature when available to prevent manual entry errors, and confirming addresses through a secondary communication channel when sending to new recipients. Remember that blockchain transactions are generally irreversible, and funds sent to an incorrect address are typically unrecoverable.

Security best practices include using hardware wallets for significant BDTC holdings, enabling multi-factor authentication on exchange accounts, verifying all transaction details on your wallet's secure display, and being extremely cautious of any unexpected requests to send BDTC. Be aware of common scams like phishing attempts claiming to verify your wallet, fake support staff offering transaction help in direct messages, and requests to send tokens to receive a larger amount back.

Conclusion

Understanding the BDTC transaction process empowers you to confidently navigate the ecosystem, troubleshoot potential issues before they become problems, and optimize your usage for both security and efficiency. From the initial creation of a BDTC transaction request to final confirmation on the blockchain, each step follows logical, cryptographically-secured protocols designed to ensure trustless, permissionless value transfer. As BDTC continues to evolve, transaction processes will likely see greater scalability through layer-2 solutions, reduced fees via protocol upgrades, and enhanced privacy features. Staying informed about these developments through official documentation, community forums, and reputable news sources will help you adapt your BDTC transaction strategies accordingly and make the most of this innovative digital asset.

説明:暗号資産パルスは、AIと公開情報源を活用し、最新のトークントレンドを瞬時にお届けします。専門家の洞察と詳細な分析については、MEXC 学ぶ をご覧ください。

このページに掲載されている記事は、公開プラットフォームから引用したものであり、情報提供のみを目的としています。MEXCの見解を必ずしも反映するものではありません。すべての権利は原著者に帰属します。コンテンツが第三者の権利を侵害していると思われる場合は、service@support.mexc.com までご連絡ください。速やかに削除いたします。

MEXCは、いかなるコンテンツの正確性、完全性、または適時性についても保証するものではなく、提供された情報に基づいて行われたいかなる行動についても責任を負いません。本コンテンツは、財務、法律、またはその他の専門的なアドバイスを構成するものではなく、MEXCによる推奨または支持と解釈されるべきではありません。

Ambire Wallet についてもっと知る

もっと見る

ビットコインの送金方法は?完全なステップバイステップガイド

SUIのステーキング方法は?受動的報酬を得るための完全ステーキングガイド

Arichainにおけるステーキングの主な目的とは?知っておくべきすべてのこと

Ambire Wallet の最新情報

もっと見る

クジラが3,800万ドルをマルチシグエクスプロイトで損失

トークン化された米国株がTelegramのブロックチェーンエコシステムに登場

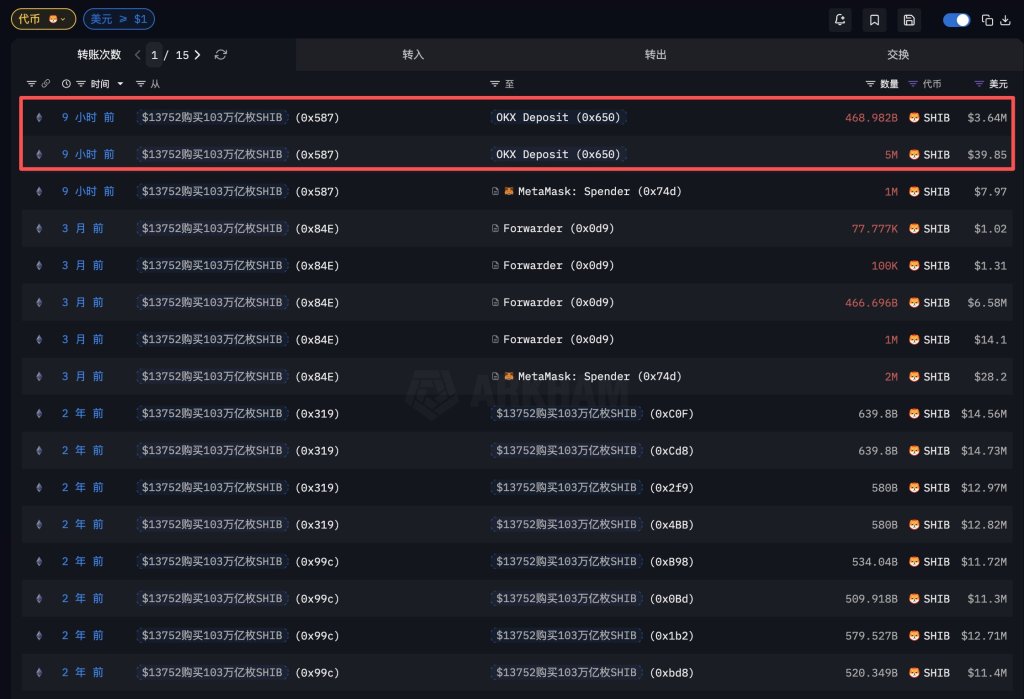

総供給量の16.4%を保有する柴犬クジラが数年ぶりに沈黙を破る

ホット

現在、市場で大きな注目を集めているトレンドの暗号資産

暗号資産価格

取引高が最も多い暗号資産