Hyperliquid Stablecoin: PayPal and Paxos Launch a Game-Changing Bid for USDH Issuance

BitcoinWorld

Hyperliquid Stablecoin: PayPal and Paxos Launch a Game-Changing Bid for USDH Issuance

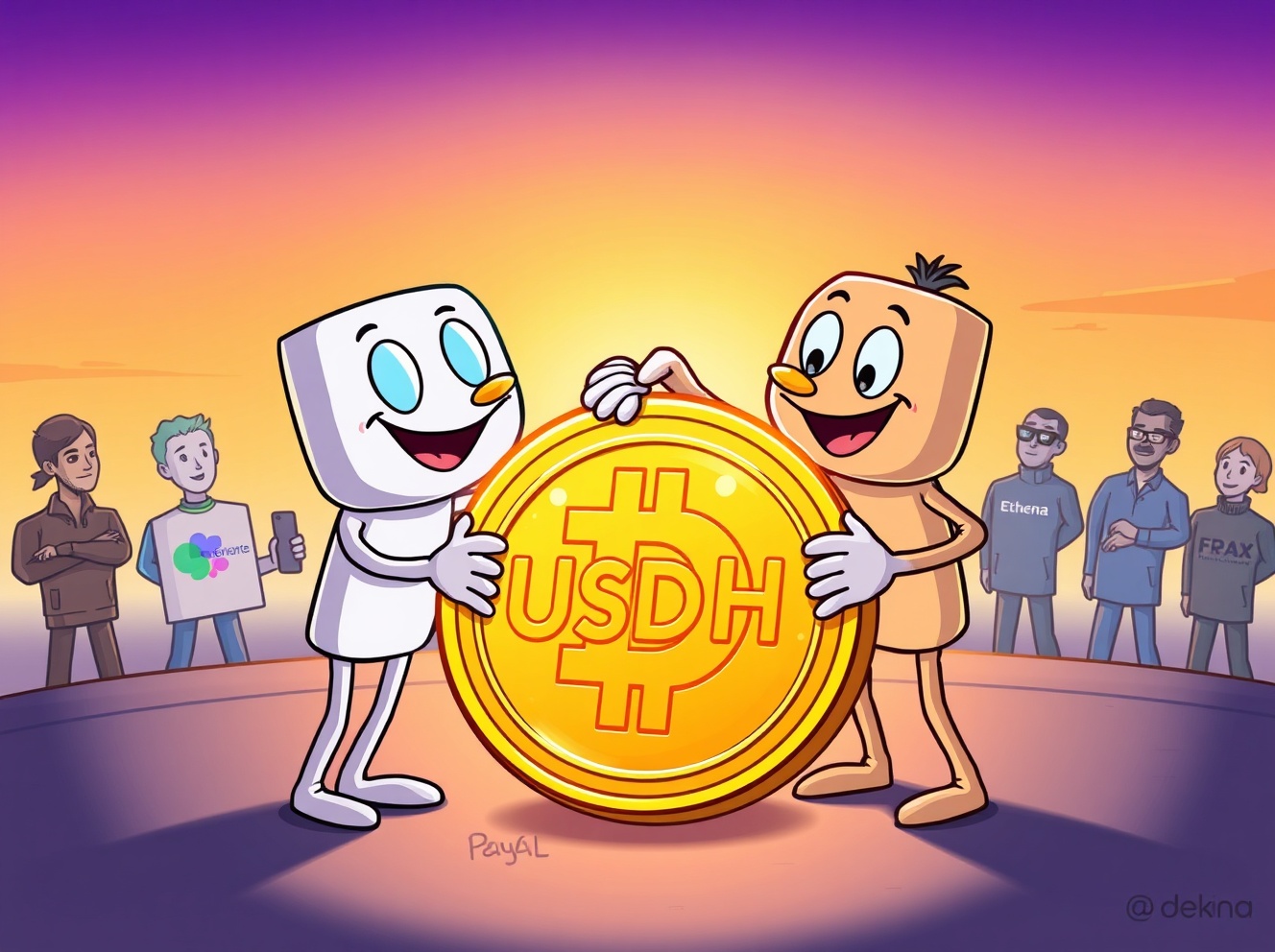

Are you ready for a major shake-up in the stablecoin world? The competition for Hyperliquid stablecoin issuance rights is heating up, with industry giants PayPal and Paxos throwing their hats into the ring. This isn’t just another partnership; it’s a strategic move that could redefine how stablecoins integrate into mainstream finance.

What’s Driving the Hyperliquid Stablecoin Issuance Race?

Hyperliquid, a decentralized exchange, announced plans to grant a partner the authority to issue its native stablecoin, USDH. This move has sparked intense interest from several prominent firms. Why is this so significant?

Issuing a stablecoin offers considerable influence and potential revenue within the growing decentralized finance (DeFi) ecosystem. For Hyperliquid, securing a reputable and well-resourced partner is crucial for the long-term stability and adoption of USDH.

PayPal, a global leader in online payments, has teamed up with Paxos, a regulated blockchain infrastructure platform and stablecoin issuer. Together, they are making a compelling bid for the rights to issue USDH. This collaboration brings together PayPal’s massive user base and regulatory compliance experience with Paxos’s proven expertise in stablecoin technology and regulatory adherence.

The Block initially reported on this high-stakes competition, highlighting the strategic implications for the broader crypto market. The decision for the Hyperliquid stablecoin partner will be closely watched.

PayPal and Paxos: A Powerful Alliance for USDH

The joint proposal from PayPal and Paxos isn’t just about issuing the Hyperliquid stablecoin; it’s about ecosystem integration and growth. Their plan outlines several key initiatives designed to boost USDH adoption and support the Hyperliquid platform:

- Venmo Listing: PayPal has proposed listing HYPE, Hyperliquid’s native token, on its popular subsidiary payment platform, Venmo. This could expose HYPE to millions of users, significantly increasing its accessibility and liquidity.

- Ecosystem Incentives: A substantial $20 million in incentives is earmarked for the Hyperliquid ecosystem. These funds are intended to foster development, encourage user participation, and drive innovation within the Hyperliquid network.

- Revenue-Sharing Model: The proposal includes a reward system where revenue generated from USDH activities would be channeled into a dedicated support fund for Hyperliquid. This creates a sustainable model for the stablecoin and ensures ongoing support for the underlying platform.

This comprehensive approach demonstrates a clear understanding of what it takes to launch and sustain a successful stablecoin in a competitive market. The integration with Venmo, in particular, could be a game-changer for mainstream adoption of the Hyperliquid stablecoin.

Who Else is Vying for Hyperliquid Stablecoin Rights?

The competition for USDH issuance is fierce, with several other notable players presenting their own bids. This diverse field underscores the perceived value and potential of the Hyperliquid stablecoin. Key contenders include:

- Frax Finance: Known for its algorithmic stablecoin, Frax brings innovative stablecoin mechanisms to the table.

- Agora: Another strong contender, likely offering its own unique approach to stablecoin issuance and management.

- Sky: Details on Sky’s proposal are less public, but their involvement indicates significant interest.

- Ethena: A project gaining traction for its synthetic dollar protocol, Ethena could offer a distinct model for USDH.

Each of these firms brings different strengths and strategies, making the selection process a critical decision for Hyperliquid. The chosen partner will not only issue USDH but also play a pivotal role in its market positioning and growth trajectory.

What Does This Mean for the Stablecoin Landscape?

The outcome of this bid for Hyperliquid stablecoin issuance rights could have far-reaching implications. If PayPal and Paxos succeed, it could:

- Legitimize DeFi: Further bridge the gap between traditional finance and decentralized finance by bringing a regulated, mainstream entity like PayPal directly into stablecoin issuance.

- Boost Adoption: The Venmo integration alone could introduce millions to stablecoins, potentially accelerating their mainstream acceptance and use for everyday transactions.

- Set New Standards: The rigorous proposals and competition could lead to higher standards for stablecoin transparency, stability, and regulatory compliance across the industry.

This strategic maneuver highlights the increasing interest of established financial players in the crypto space, particularly in areas like stablecoins that offer a blend of stability and digital innovation. The future of the Hyperliquid stablecoin looks incredibly promising, regardless of who ultimately wins the bid.

Concluding Thoughts: A New Era for Stablecoins?

The race for Hyperliquid’s USDH issuance rights represents a pivotal moment in the stablecoin market. The partnership between PayPal and Paxos, with its ambitious incentives and integration plans, sets a high bar for the competition.

This development not only underscores the growing importance of stablecoins in the broader financial ecosystem but also signals a potential shift towards greater institutional involvement and regulatory clarity. As Hyperliquid evaluates these proposals, the crypto community watches eagerly. The chosen partner will undoubtedly shape the future trajectory of USDH and, by extension, influence the evolution of stablecoins as a whole. This is a testament to the dynamic and rapidly maturing world of digital assets.

Frequently Asked Questions (FAQs)

Q1: What is USDH?

A1: USDH is the native stablecoin for Hyperliquid, a decentralized exchange. It is designed to maintain a stable value, typically pegged to the US dollar, to facilitate trading and transactions within the Hyperliquid ecosystem.

Q2: Why is Hyperliquid seeking a partner for USDH issuance?

A2: Hyperliquid aims to partner with an established entity to ensure the stability, regulatory compliance, and broad adoption of USDH. A strong partner can provide the necessary infrastructure, liquidity, and trust to make USDH a successful and widely used stablecoin.

Q3: What are the key elements of the PayPal and Paxos proposal?

A3: Their proposal includes listing Hyperliquid’s token (HYPE) on Venmo, providing $20 million in incentives to the Hyperliquid ecosystem, and establishing a reward system that channels USDH revenue into a support fund for Hyperliquid.

Q4: Who are the other main competitors for USDH issuance rights?

A4: Besides PayPal and Paxos, other notable firms competing for the issuance rights include Frax Finance, Agora, Sky, and Ethena.

Q5: How could this partnership impact the broader stablecoin market?

A5: A successful partnership, especially with a mainstream player like PayPal, could further legitimize stablecoins, boost their mainstream adoption through platforms like Venmo, and potentially set new standards for regulatory compliance and transparency in the industry.

Found this article insightful? Share it with your network and join the conversation about the future of stablecoins! Your thoughts and discussions help us all understand the evolving landscape of digital finance.

To learn more about the latest crypto market trends, explore our article on key developments shaping stablecoin institutional adoption.

This post Hyperliquid Stablecoin: PayPal and Paxos Launch a Game-Changing Bid for USDH Issuance first appeared on BitcoinWorld and is written by Editorial Team

You May Also Like

Nambatac, TNT duel with Beermen for the league crown jewel

Unleashing A New Era Of Seller Empowerment