Decoding the Crypto Fear & Greed Index: Why 50 is Crucial for Investors

BitcoinWorld

Decoding the Crypto Fear & Greed Index: Why 50 is Crucial for Investors

In the dynamic world of digital assets, understanding market sentiment is as vital as analyzing price charts. The Crypto Fear & Greed Index serves as a powerful barometer, offering a snapshot of investor psychology. Currently holding steady at 50, this key indicator signals a fascinating neutral stance in the market. But what exactly does this equilibrium mean for your crypto strategy?

What Exactly is the Crypto Fear & Greed Index?

The Crypto Fear & Greed Index is an essential tool designed to measure the prevailing emotional state of the cryptocurrency market. It ranges from 0 (extreme fear) to 100 (extreme greed). When investors are overly fearful, it can present a buying opportunity. Conversely, excessive greed might indicate a market correction is on the horizon. A score of 50, as we see today, suggests a balanced, neutral outlook among participants.

This index provides a valuable perspective beyond just price movements. It helps you gauge whether the market is reacting emotionally or rationally. For instance, a sudden dip might cause widespread panic (fear), while a rapid surge could ignite FOMO (greed). The current neutral position of the Crypto Fear & Greed Index suggests neither extreme emotion is dominating.

How is the Crypto Fear & Greed Index Calculated?

Ever wondered what factors contribute to this insightful indicator? The Crypto Fear & Greed Index is not based on a single metric but a sophisticated combination of several market data points, each weighted differently to provide a comprehensive view. This multi-faceted approach ensures a more accurate reflection of sentiment.

Here are the primary components that determine the index’s value:

- Volatility (25%): This measures the current volatility and maximum drawdowns of Bitcoin compared to its average values over the last 30 and 90 days. Higher volatility often indicates a fearful market.

- Market Momentum/Volume (25%): The current trading volume and market momentum are compared with average values. High buying volumes in a positive market often signal greed.

- Social Media (15%): This factor analyzes the number of posts and interactions related to cryptocurrencies on various social media platforms, especially Twitter. A surge in positive sentiment can push the index towards greed.

- Surveys (15%): While currently paused, surveys historically involved weekly polls to gather direct investor sentiment. This direct feedback offered unique insights.

- Bitcoin Dominance (10%): An increase in Bitcoin’s market cap dominance often suggests a shift from altcoins to Bitcoin, which can be a sign of fear or uncertainty in the broader altcoin market.

- Google Trends (10%): This component examines search query data for crypto-related terms. For example, a spike in searches for “Bitcoin price manipulation” might indicate fear.

Decoding the Neutral Crypto Fear & Greed Index Reading

A score of 50 on the Crypto Fear & Greed Index signifies a perfectly neutral market. This means neither extreme fear nor extreme greed is prevalent. Investors are not panicking, nor are they exhibiting irrational exuberance. Instead, the market is in a state of balance, weighing both positive and negative developments carefully.

For many, a neutral reading can be a moment of introspection rather than immediate action. It suggests a period where the market might be consolidating or waiting for a clearer catalyst. This balanced sentiment could indicate a pause before a significant move in either direction, making it a crucial time for careful observation. Understanding this neutral Crypto Fear & Greed Index helps inform a measured approach.

Actionable Insights: Navigating a Neutral Market with the Crypto Fear & Greed Index

When the Crypto Fear & Greed Index sits at 50, what should investors consider? This neutral zone offers unique opportunities and challenges. It encourages a strategic, rather than emotional, approach to crypto investing.

Benefits of a Neutral Market:

- Reduced Volatility: Often, a neutral index correlates with less drastic price swings, providing a calmer environment for analysis.

- Opportunity for Accumulation: Smart investors might use this period to gradually build positions in projects they believe in, without the pressure of extreme market emotions.

- Time for Research: It’s an excellent time to conduct thorough due diligence on various cryptocurrencies and emerging technologies.

Challenges and Considerations:

- Lack of Clear Direction: A neutral market can sometimes feel stagnant, lacking obvious trends for short-term traders.

- Waiting Game: Patience becomes key, as significant price movements may not occur immediately.

- Vulnerability to News: The market can be more susceptible to sudden shifts based on major news events or regulatory announcements.

In this neutral environment, focusing on long-term fundamentals and risk management becomes paramount. The Crypto Fear & Greed Index at 50 provides a chance to refine your strategy.

Conclusion: The Enduring Value of the Crypto Fear & Greed Index

The Crypto Fear & Greed Index, currently holding a neutral score of 50, remains an indispensable tool for anyone navigating the cryptocurrency markets. It distills complex market dynamics into a simple, understandable metric of investor sentiment. While it should not be the sole basis for investment decisions, it offers a powerful complementary perspective, helping you to identify potential overreactions or complacency.

By understanding its components and what a neutral reading implies, you empower yourself to make more informed, less emotional choices. Keep an eye on the Crypto Fear & Greed Index; it’s a window into the collective psyche of the crypto world, guiding you through its unpredictable currents.

Frequently Asked Questions (FAQs)

What is the Crypto Fear & Greed Index?

The Crypto Fear & Greed Index is a tool that measures the current emotional state of the cryptocurrency market, ranging from 0 (extreme fear) to 100 (extreme greed). It helps investors gauge whether the market is behaving rationally or emotionally.

How is a “neutral” reading defined by the index?

A neutral reading on the Crypto Fear & Greed Index, specifically a score of 50, indicates that neither extreme fear nor extreme greed is dominating the market. It suggests a balanced sentiment where investors are neither panicking nor exhibiting irrational exuberance.

What factors influence the Crypto Fear & Greed Index?

The index is calculated based on several factors, including market volatility, trading volume, social media sentiment, surveys (historically), Bitcoin’s market cap dominance, and Google search trends related to cryptocurrencies.

Should investors make decisions solely based on the Crypto Fear & Greed Index?

No, the Crypto Fear & Greed Index should be used as a complementary tool. While it provides valuable insight into market sentiment, it is crucial to combine it with fundamental analysis, technical analysis, and your own risk assessment before making any investment decisions.

Where can I find the current Crypto Fear & Greed Index value?

You can typically find the current value of the Crypto Fear & Greed Index on various cryptocurrency data websites and platforms, such as Alternative.me, which is a common source for this metric.

Did you find this analysis of the Crypto Fear & Greed Index insightful? Share this article with your network on social media to help others understand market sentiment and make more informed decisions in the crypto space!

To learn more about the latest crypto market trends, explore our article on key developments shaping Bitcoin price action.

This post Decoding the Crypto Fear & Greed Index: Why 50 is Crucial for Investors first appeared on BitcoinWorld and is written by Editorial Team

You May Also Like

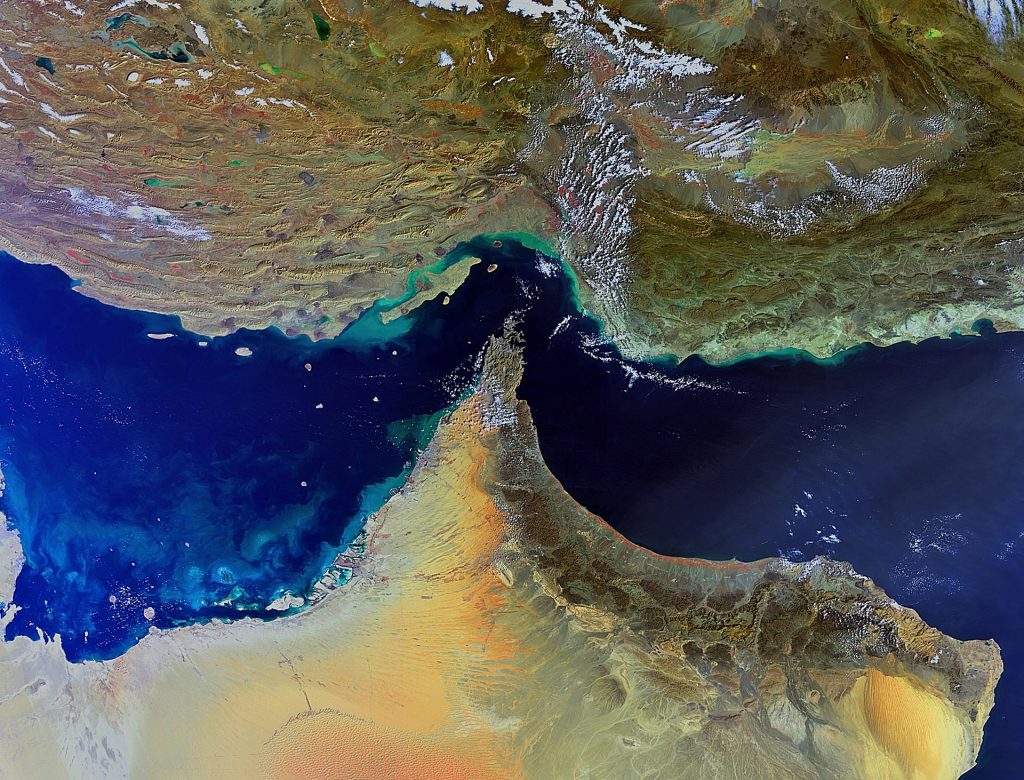

İran Hürmüz Boğazı’nı Kapatırsa Ne Olur? Verilerin Gösterdiği Tek Bir Şey Var!

TON Station Daily Combo 01 March 2026: Maximize Your $TONS Rewards Today