XRP Surges Over 13% After Ripple and SEC Drop Final Appeals in Landmark Case

Ripple Labs and the US SEC have officially ended their nearly four-year legal fight, marking one of the most closely watched cases in crypto history. The move sent XRP up more than 13% following the announcement.

On Thursday, both parties filed a joint notice with the US Court of Appeals for the Second Circuit, stating they would voluntarily withdraw their respective appeals.

The SEC dropped its challenge to a 2023 ruling that found Ripple’s XRP token was not a security when sold on public exchanges. Ripple, in turn, withdrew its cross-appeal. Each side agreed to cover its own legal costs.

Ripple Lawsuit Sparked Major Test of How US Courts View Digital Tokens

The case began in 2020, when the SEC sued Ripple under then-Chair Jay Clayton, accusing the firm of raising funds through an unregistered securities offering by selling XRP. The lawsuit, filed in the Southern District of New York, quickly became a test case for how US law should treat digital tokens.

In July 2023, US District Judge Analisa Torres issued a split ruling. She found that Ripple had indeed violated securities laws when it sold XRP directly to institutional investors.

However, she said that sales to retail investors through public exchanges did not meet the definition of a securities offering, a conclusion widely seen as a partial win for the broader crypto sector.

The SEC appealed the retail sales portion of the ruling last year, while Ripple filed a cross-appeal seeking to defend its position in full.

Ripple Secures Closure as SEC Scales Back Aggressive Crypto Legal Strategy

But after Donald Trump returned to the White House and installed new leadership at the SEC, the agency began stepping back from several enforcement actions. More than a dozen crypto-related cases and probes have since been dropped.

Ripple and the SEC agreed in June last year to resolve the remaining penalties tied to the case. Judge Torres imposed a $125m fine and a permanent injunction barring Ripple from violating securities laws in future institutional sales of XRP. That penalty, now in escrow, will be transferred to the US Treasury following the conclusion of the appeals.

Negotiations earlier this year to lower the penalty amount failed, with Judge Torres rejecting multiple proposals over procedural issues. The dismissal of the appeals finalizes the settlement terms, bringing the long-running dispute to a close.

Now, with the 2023 ruling intact, legal observers say the case may become a key reference for how courts evaluate whether crypto assets qualify as securities. For Ripple, it clears the way to expand operations, particularly in jurisdictions that have already adopted clearer regulatory guidelines.

You May Also Like

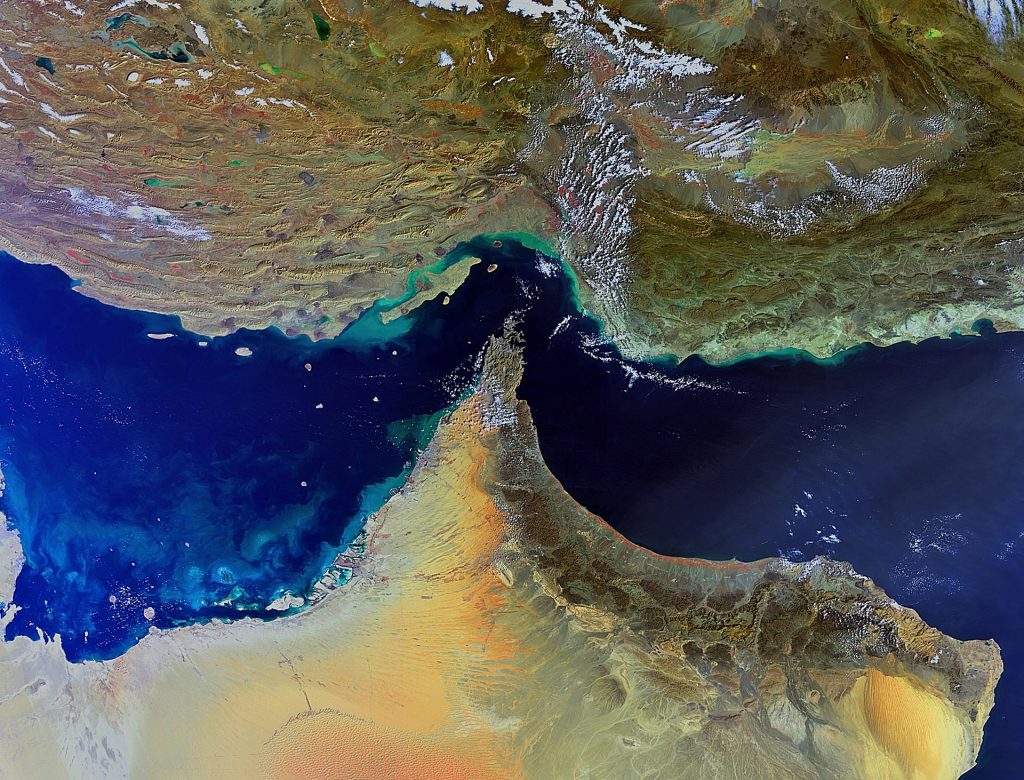

İran Hürmüz Boğazı’nı Kapatırsa Ne Olur? Verilerin Gösterdiği Tek Bir Şey Var!

TON Station Daily Combo 01 March 2026: Maximize Your $TONS Rewards Today