XRP Retail Turns Fearful Again—A Classic Contrarian Setup?

Data shows negative sentiment around XRP has seen a rise on social media, a sign that could actually be bullish if history is to go by.

XRP Positive/Negative Sentiment Has Gone Down

In a new post on X, analytics firm Santiment has discussed about the latest trend in the Positive/Negative Sentiment for XRP. This indicator measures the ratio between the positive and negative comments related to the asset that are appearing on the major social media platforms.

The metric works by going through social media posts/comments/threads to separate for those making mentions of the cryptocurrency and putting them through a machine-learning model. This model classifies each post as “positive” or “negative.” The indicator counts up the number of comments in each category and finds the ratio between them.

When the value of the Positive/Negative Sentiment is greater than 1, it means posts pertaining to a bullish sentiment are dominant on social media. On the other hand, the metric being under the threshold implies a bearish mentality is shared by the majority of users on these platforms.

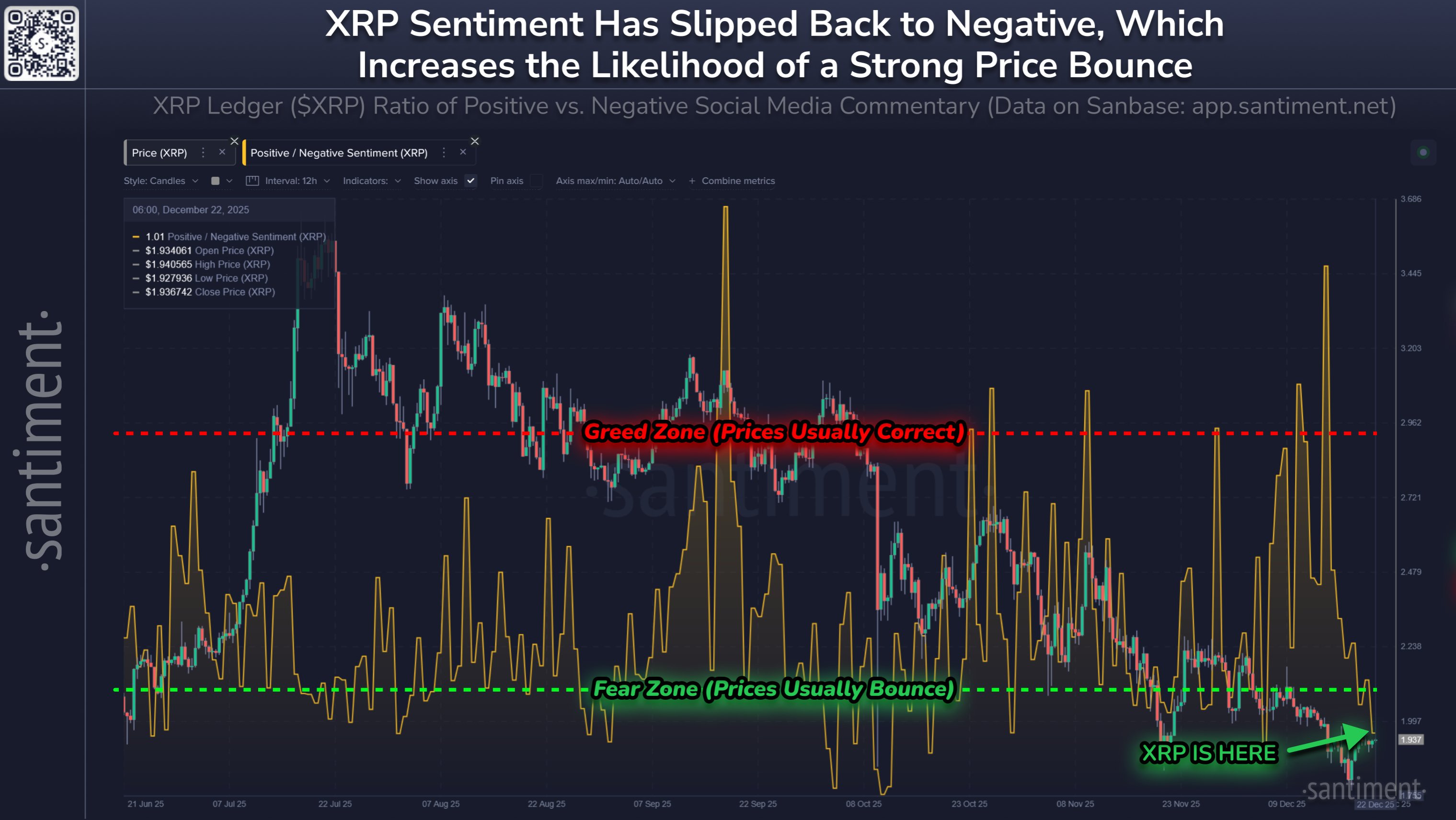

Now, here is the chart shared by Santiment that shows the trend in the XRP Positive/Negative Sentiment over the last few months:

As displayed in the above graph, the XRP Positive/Negative Sentiment saw a huge spike earlier in the month, implying positive comments related to the coin shot up on social media platforms.

What followed this burst of optimism among retail traders, however, was a drop in the cryptocurrency’s price. This pattern of the asset going against the crowd expectations is something that has been witnessed in digital asset markets throughout history.

Based on the historical trend, the analytics firm has defined regions where the likelihood of a reversal move becomes notable. The positive sentiment spike witnessed earlier in the year broke into the “greed zone,” corresponding to the area where price corrections tend to happen.

Since the plunge in the XRP price, sentiment among retail social media users has deteriorated fast, with the Positive/Negative Sentiment plummeting all the way to a value of 1.01.

At this value, bearish comments aren’t dominant yet, but the fact that negative posts are balancing out the positive ones is still something to take note of. In fact, this value is firmly inside Santiment’s “fear zone,” implying that the current degree of bearish sentiment is already significant.

“Historically, this setup leads to price rises,” explained the analytics firm. “When retail has doubts about a coin’s ability to rise, the rise becomes significantly more likely.” It now remains to be seen where XRP will go next and whether retail sentiment will play any role.

XRP Price

At the time of writing, XRP is floating around $1.90, down 1.3% over the last 24 hours.

You May Also Like

Solana Attempts Recovery as Analysts Expect Higher Move if $130 Support Holds

Solana Price Shows Rebound Potential After Hitting Key Resistance