Crypto token buybacks 2025: Hyperliquid’s $645M lead reshapes scarcity

In 2025, crypto token buybacks surged as Hyperliquid and peers repurchased tokens to tighten supply and signal financial strength.

What are token buyback strategies and monthly buyback spending trends?

Published reporting documents a cumulative $1.4 billion in repurchases in 2025, led by concentrated programs and a July spike that recorded an 85% month-over-month increase. Monthly spending averaged $145.9 million, up from a first-half average of $99.3 million.

Market analysts say large, sliced orders and OTC execution are common token buyback strategies to limit slippage during large repurchases. These patterns point to more formalised repurchase policies rather than purely tactical interventions.

Tip: Track on-chain flows and treasury disclosures to confirm whether reported repurchases represent burns, locks or treasury retention.

In brief: Repurchases accelerated through mid-2025, lifting monthly averages and signalling a shift toward structured buyback strategies.

Hyperliquid leads token buyback strategies, LayerZero and Pump.fun follow the trend

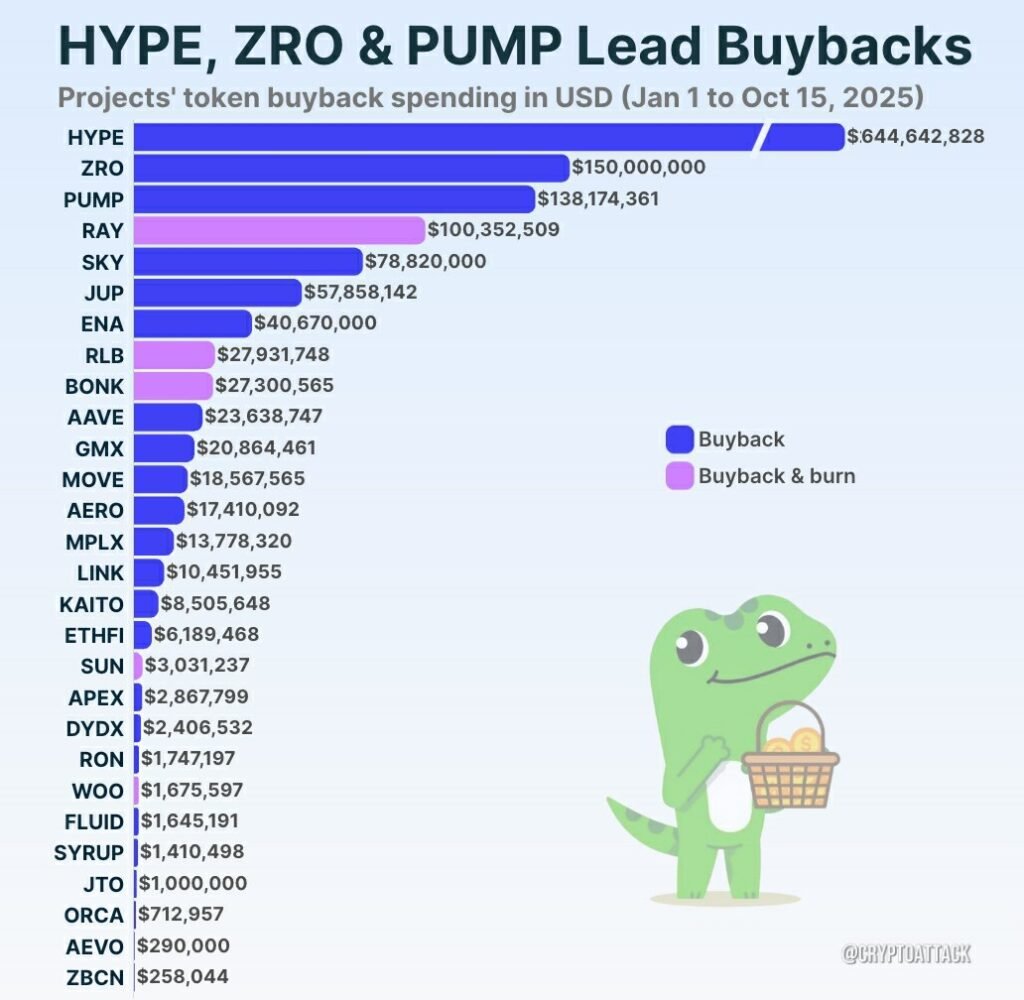

According to the report by Kelvin Munene published on Oct 17, 2025, the largest contributors were Hyperliquid with approximately $645 million, LayerZero with $150 million, and Pump.fun with $138 million, together forming the bulk of the $1.4B total.

Concentration in repurchases means a few projects can materially compress circulating supply. Whether that translates to lasting price effects depends on execution: permanent burns, vesting adjustments or treasury holdings each have different implications for scarcity.

Tip: Review governance notices and transaction proofs associated with each repurchase to assess permanence.

In brief: A small set of projects account for most repurchase volume, amplifying their influence on token supply.

HYPE, ZRO and PUMP lead protocol buybacks. Source: X

HYPE, ZRO and PUMP lead protocol buybacks. Source: X

How do tokenomics scarcity models react to concentrated crypto project buybacks?

Buybacks can tighten supply but outcomes depend on mechanics: burns remove tokens permanently, while treasury-held repurchases may be redeployed. Tax treatment and governance decisions further shape the investor impact.

CoinGecko research analyst Yuqian Lim noted:

highlighting how single events can skew monthly figures.

Note: Treat buybacks as one input in tokenomics; utility, adoption and liquidity fundamentals remain central to long-term value.

In brief: Repurchases can enhance scarcity but require transparent, verifiable mechanics to convert supply reductions into durable value for holders.

You May Also Like

The Channel Factories We’ve Been Waiting For

Zwitserse bankgigant UBS wil crypto beleggen mogelijk maken