Introduction to Technical Analysis for PinLink (PIN) Trading

Technical analysis is a methodology for evaluating investments by analyzing statistical trends from trading activity, such as price movements and volume. For PinLink (PIN) traders, this approach provides a framework for decision-making in a market known for high volatility. Unlike fundamental analysis, which examines project fundamentals and utility, technical analysis focuses on price patterns and trading signals to identify potential opportunities. This approach is especially relevant for PIN trading because cryptocurrency markets often respond strongly to technical levels and display recurring patterns that can be identified by skilled traders. With PIN's 24/7 trading availability, technical analysis offers systematic methods to identify potential entry and exit points across different timeframes. Essential tools covered in this article include chart patterns, technical indicators, advanced PIN trading strategies, and practical application on the MEXC platform.

Chart Patterns and Price Action Analysis for PinLink (PIN)

Key chart patterns for PIN trading include support and resistance levels, which mark price points where PIN has historically reversed direction. Trend lines connect successive highs or lows to visualize the market direction. Traders should watch for common reversal patterns like head and shoulders, double tops/bottoms, which signal potential trend changes, and continuation patterns such as flags, pennants, and triangles that suggest temporary pauses before trend resumption. Price action analysis examines raw PIN price movements through candlestick formations without heavy reliance on indicators. Important signals include engulfing patterns, pin bars, and inside bars, which can indicate potential reversals when analyzed within the broader PIN market context. Successful PIN traders often combine multiple pattern recognition approaches for more reliable trading signals.

Essential Technical Indicators for PinLink (PIN) Trading

Moving averages (Simple, Exponential, VWAP) smooth out PIN price data to reveal trends. The Simple Moving Average (SMA) calculates the average price over a specified period, while the Exponential Moving Average (EMA) gives greater weight to recent prices. Traders watch for moving average crossovers like the golden cross (bullish) or death cross (bearish) when trading PIN.

Momentum indicators help identify overbought or oversold conditions in PIN markets. The Relative Strength Index (RSI) measures price change velocity on a scale from 0-100, with readings above 70 suggesting overbought conditions and below 30 indicating oversold conditions. The MACD tracks relationships between moving averages, generating signals when lines cross.

Volume-based indicators confirm PIN price movements, while volatility tools like Bollinger Bands help identify potential breakout points.

For effective PIN analysis, combine complementary indicators that provide different perspectives rather than multiple tools that generate similar signals.

Advanced Technical Analysis Strategies for PinLink (PIN)

Multiple timeframe analysis involves examining PIN charts across different time periods to gain comprehensive market insight. Start with higher timeframes to identify the main PIN trend, then use shorter timeframes for precise entry timing. This approach helps align trades with dominant market forces while reducing false signals.

Divergence trading identifies situations where PIN price movement doesn't match indicator direction. Bullish divergence occurs when PIN price makes lower lows while an indicator makes higher lows, suggesting potential upward reversal. These non-confirmations often precede significant PIN price movements.

Fibonacci retracement tools identify potential support/resistance levels for PIN at key percentages (23.6%, 38.2%, 50%, 61.8%, 78.6%), with the 61.8% level considered particularly significant.

The Ichimoku Cloud provides multiple analytical insights through a single complex indicator, helping traders identify PIN trends and potential reversals.

Integration of on-chain metrics with technical analysis can further enhance PIN trading by providing additional context on network activity and token flows.

Implementing Technical Analysis on MEXC for PinLink (PIN) Trading

MEXC offers comprehensive charting tools for PIN technical analysis. Access these by navigating to the PIN trading page and selecting 'Chart.' The platform supports multiple chart types and timeframes from 1-minute to 1-month. Customize your PIN analysis by adding indicators through the indicator menu and adjusting parameters to match your strategy. Use MEXC's drawing tools to mark support/resistance levels and chart patterns directly on PIN charts. Set up alerts to receive notifications when PIN reaches specific prices or indicators generate signals, allowing you to capture opportunities without constant monitoring. When executing trades based on your analysis, utilize MEXC's various order types including limit, market, stop-limit, and OCO orders to implement your PIN trading strategy with precision and proper risk management.

Conclusion

Technical analysis equips PIN traders with structured methods to interpret market movements and make data-driven decisions. MEXC provides all the essential tools you need to apply these techniques effectively for PIN trading, from basic chart patterns to advanced indicators. While no strategy guarantees profits, combining technical analysis with proper risk management significantly improves your PIN trading outcomes. Ready to put these technical analysis tools into practice? Visit MEXC's PinLink (PIN) Price page to access real-time PIN charts, apply the indicators discussed, and start trading with confidence. The comprehensive trading interface offers everything you need to analyze PIN price movements and execute informed trades, all on one secure platform.

Description:Crypto Pulse is powered by AI and public sources to bring you the hottest token trends instantly. For expert insights and in-depth analysis, visit MEXC Learn.

The articles shared on this page are sourced from public platforms and are provided for informational purposes only. They do not necessarily represent the views of MEXC. All rights remain with the original authors. If you believe any content infringes upon third-party rights, please contact service@support.mexc.com for prompt removal.

MEXC does not guarantee the accuracy, completeness, or timeliness of any content and is not responsible for any actions taken based on the information provided. The content does not constitute financial, legal, or other professional advice, nor should it be interpreted as a recommendation or endorsement by MEXC.

Latest Updates on PinLink

View More

Davide Crapis: ERC 8004 enables trustless AI interactions, establishes vital reputation registries, and shapes the future of decentralized commerce

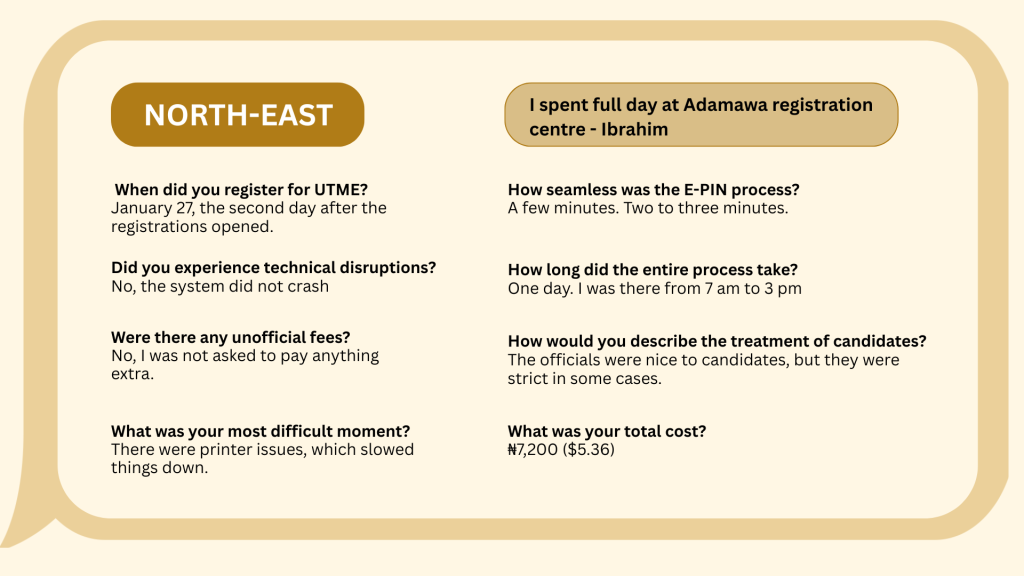

From E-PIN delays to extra charges: How Nigerians are experiencing 2026 UTME registration

Samsung’s Galaxy S26 Billed as First ‘Agentic AI Phone’—Here’s What That Means

HOT

Currently trending cryptocurrencies that are gaining significant market attention

Crypto Prices

The cryptocurrencies with the highest trading volume

Newly Added

Recently listed cryptocurrencies that are available for trading