Bio Protocol launches Aubrai, the first-ever decentralized AI agent for longevity science

Bio Protocol has kicked off the Ignition Sale for Aubrai, the world’s first decentralized BioAgent designed to accelerate longevity research.

- Co-developed with VitaDAO and informed by Dr. Aubrey de Grey’s longevity research, Aubrai leverages decentralized mechanisms to overcome traditional funding gaps and accelerate translational science.

- Aubrai can generate and validate research hypotheses, design wet-lab experiments, and securely encrypt data.

- Participants can subscribe to the Ignition Sale for AUBRAI by pledging BioXP and committing BIO tokens. All pledges and commitments must be completed before August 26, 11:00 UTC to qualify.

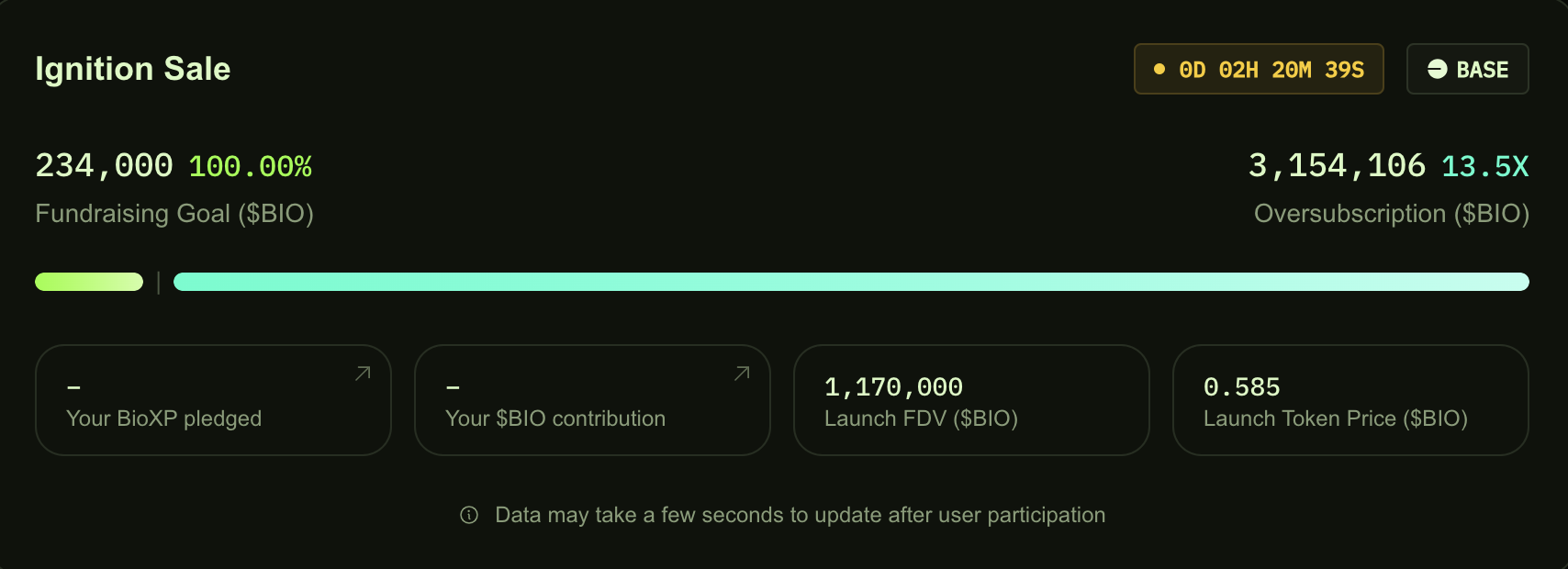

Bio Protocol (BIO) has launched the Ignition Sale for Aubrai, the world’s first decentralized AI agent designed to advance longevity research. Community members can participate by pledging BioXP (community points within the Bio Protocol ecosystem) or committing BIO tokens to the Ignition Sale, with a maximum contribution of 5,850 BIO per participant.

The launch price is set at 0.585 BIO per AUBRAI, and all pledges and commitments must be completed by August 26 11:00 UTC to qualify for an allocation.

The ongoing sale, conducted on the BASE blockchain, set a fundraising target of 234,000 BIO and has already been oversubscribed 13.5x.

About Bioprotocol’s Aubrai

Co-developed by Bio Protocol and VitaDAO, Aubrai is the world’s first decentralized BioAgent, drawing knowledge from thousands of private lab notes, internal chats, and unpublished insights from the lab of Dr. Aubrey de Grey. De Grey is best known for pioneering longevity research through his Strategies for Engineered Negligible Senescence (SENS) framework and advocating the idea that aging is a disease that can be treated.

“The consequences of traditional financing are a chronic funding gap, over-reliance on philanthropy, and a ‘valley of death’ between discovery and the clinic. That’s why we champion alternative mechanisms – DAOs, longevity-focused venture funds, and DeSci platforms – which can tolerate long horizons, align incentives around societal benefit, and crowd-source risk,” de Grey told CoinDesk in an interview.

Aubrai functions as an on-chain AI co-scientist. It can generate and validate hypotheses, design wet-lab experiments, and encrypt data to protect trade secrets while enriching research outputs. At the heart of Aubrai’s mission is the Robust Mouse Rejuvenation (RMR2) project — de Grey’s ambitious study aiming to double the remaining lifespan of middle-aged mice. Aubrai has already demonstrated its capabilities in the RMR2 study, suggesting methodological tweaks and flagging dosing caveats.

AUBRAI token holders gain governance rights over the agent’s research outputs. They also share in potential revenues from discoveries commercialized by the project.

You May Also Like

US Prosecutors Seek 12-Year Prison for Do Kwon Over Terra Collapse

Highlights: US prosecutors requested a 12-year prison sentence for Do Kwon after the Terra collapse. Terraform’s $40 billion downfall caused huge losses and sparked a long downturn in crypto markets. Do Kwon will face sentencing on December 11 and must give up $19 million in earnings. US prosecutors have asked a judge to give Do Kwon, Terraform Labs co-founder, a 12-year prison sentence for his role in the remarkable $40 billion collapse of the Terra and Luna tokens. The request also seeks to finalize taking away Kwon’s criminal earnings. The court filing came in New York’s Southern District on Thursday. This is about four months after Kwon admitted guilt on two charges: wire fraud and conspiracy to defraud. Prosecutors said Kwon caused more losses than Samuel Bankman-Fried, Alexander Mashinsky, and Karl Sebastian Greenwood combined. U.S. prosecutors have asked a New York federal judge to sentence Terraform Labs co-founder Do Kwon to 12 years in prison, calling his role in the 2022 TerraUSD collapse a “colossal” fraud that triggered broader crypto-market failures, including the downfall of FTX. Sentencing is… — Wu Blockchain (@WuBlockchain) December 5, 2025 Terraform Collapse Shakes Crypto Market Authorities explained that Terraform’s collapse affected the entire crypto market. They said it helped trigger what is now called the ‘Crypto Winter.’ The filing stressed that Kwon’s conduct harmed many investors and the broader crypto world. On Thursday, prosecutors said Kwon must give up just over $19 million. They added that they will not ask for any additional restitution. They said: “The cost and time associated with calculating each investor-victim’s loss, determining whether the victim has already been compensated through the pending bankruptcy, and then paying out a percentage of the victim’s losses, will delay payment and diminish the amount of money ultimately paid to victims.” Authorities will sentence Do Kwon on December 11. They charged him in March 2023 with multiple crimes, including securities fraud, market manipulation, money laundering, and wire fraud. All connections are tied to his role at Terraform. After Terra fell in 2022, authorities lost track of Kwon until they arrested him in Montenegro on unrelated charges and sent him to the U.S. Do Kwon’s Legal Case and Sentencing In April last year, a jury ruled that both Terraform and Kwon committed civil fraud. They found the company and its co-founder misled investors about how the business operated and its finances. Jay Clayton, U.S. Attorney for the Southern District of New York, submitted the sentencing request in November. TERRA STATEMENT: “We are very disappointed with the verdict, which we do not believe is supported by the evidence. We continue to maintain that the SEC does not have the legal authority to bring this case at all, and we are carefully weighing our options and next steps.” — Zack Guzmán (@zGuz) April 5, 2024 The news of Kwon’s sentencing caused Terraform’s token, LUNA, to jump over 40% in one day, from $0.07 to $0.10. Still, this rise remains small compared to its all-time high of more than $19, which the ecosystem reached before collapsing in May 2022. In a November court filing, Do Kwon’s lawyers asked for a maximum five-year sentence. They argued for a shorter term partly because he could face up to 40 years in prison in South Korea, where prosecutors are also pursuing a case against him. The legal team added that even if Kwon serves time in the U.S., he would not be released freely. He would be moved from prison to an immigration detention center and then sent to Seoul to face pretrial detention for his South Korea charges. eToro Platform Best Crypto Exchange Over 90 top cryptos to trade Regulated by top-tier entities User-friendly trading app 30+ million users 9.9 Visit eToro eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.

XRP Price Prediction: Double Bottom Near $1.80 Signals Potential Reversal Toward $2.70 Despite Market Weakness