XRP price hovers near decision levels. Analysts say Avalon X’s RWA appeal could attract institutional money

XRP sits near a make-or-break zone in 2025’s third quarter as traders weigh macro and ETF news. Meanwhile, another fresh token in the market, called Avalon X (AVLX) coin, is seemingly rising on a real-world asset pitch that could match institutional needs. This contrast frames 2025 choices for growth and stability. Here is a quick read.

Why Is XRP Price at Critical Decision Levels?

XRP is trading around $3.06 with modest gains during the day, as traders watch whether buyers can maintain support at the $3 level. Intraday ranges stay narrow as liquidity gathers ahead of key macro events and ETF headlines.

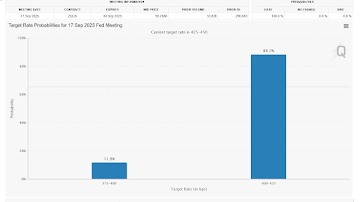

Recent XRP news links the pause to broader risk sentiment following the latest inflation report and rate cut prospects, which caused mixed feelings in the crypto market for the week. Markets slowed momentum as traders waited for the Federal Reserve decision, while XRP dipped slightly along with other major market-famed coins before stabilizing.

The ~$3 area serves as an important resistance level, and it will only be a valid trend if the price breaks above it. Media reports indicate this is a critical zone, and the $5 year-end target will be a room for aspiration until a genuine trigger is seen for a high move.

Chart patterns and weekly supply areas appear to be a short-term perspective, with yields mixed opinions on future price outlooks. Others just seemed to think, if it breaks and holds the breakout, they can measure the potential future price. Either way, traders balancing the best altcoins to invest in 2025 will weigh whether XRP can lead or whether capital rotates to the next big crypto 2025 as new themes emerge.

What Makes Avalon X Crypto the Top RWA Choice for 2025?

Avalon X is positioning AVLX coin as a real estate tokenization crypto that appeals to institutions and retail alike. The Avalon X token is a utility asset, not equity, and unlocks tier benefits, staking during presale, and discounts for partner properties, which fits investors seeking clear utility in a real estate-backed cryptocurrency. The team highlights independent audits and institutional-grade security, including a CertiK review of smart contracts.

The Avalon X presale lists a current token price of $0.005 in Stage 1 with a time-limited 10% bonus, as shown live on the site. Tiered commitments can add extra rewards, with Gold, Diamond, and Platinum paths granting higher presale bonuses and real-world travel perks that align with utility. That structure places Avalon X among RWA crypto presales that offer clear usage and transparent mechanics rather than pure hype.

Avalon X also runs the Avalon X giveaway programs. A $1M crypto giveaway allocates $100k in AVLX per winner to ten winners, and a separate crypto townhouse giveaway offers a chance to win a luxury townhouse tied to Grupo Avalon. The fully deeded crypto townhouse is located in the gated Eco Avalon development. These programs sit alongside entry rules for wallet submission, minimum purchase, and referrals, and they present an engaging onramp for new users.

Under the hood, Avalon X ties the project to a developer pipeline approaching $1Bn in total value, while keeping AVLX as a utility token with a fixed two billion cap and deflationary design elements. That mix supports the narrative that tokenized property crypto can lower entry barriers and widen participation.

Why Avalon X Could Lead 2025’s Allocation Choices?

For traders watching XRP at decision levels, RWA themes may offer a complementary path. Avalon X combines transparent presale terms, visible utility, and a CertiK audited stack with headline-friendly programs like the Avalon X $1M prize and the Avalon X contest.

That combination makes the Avalon X token a nominee for the next big crypto 2025 lists and a practical way to invest in real estate crypto with clear utility.

Join the Community

Website: https://avalonx.io

$1M Giveaway: https://avalonx.io/giveaway

Telegram: https://t.me/avlxofficial

X: https://x.com/AvalonXOfficial

Disclaimer: This is a paid post and should not be treated as news/advice. LiveBitcoinNews is not responsible for any loss or damage resulting from the content, products, or services referenced in this press release.

You May Also Like

UK Looks to US to Adopt More Crypto-Friendly Approach

Crucial Fed Rate Cut: October Probability Surges to 94%