The Ethena team is facing a "credibility" crisis. Is the use of 180 million ENA to earn Sats intended to dilute rewards?

Author: Nomad

Compiled by: Felix, PANews

Ethena, the Ethereum stablecoin synthetic dollar project, has not yet gotten rid of the question of being the "next LUNA" and has recently suffered another "credibility crisis". A community user posted on the X platform questioning the use of 180 million ENA to earn Sats in Season 3, diluting the rewards of other participants. The following is the content details.

The Ethena team is using 180 million ENA tokens (25% of the SENA supply to earn Sats) for Sats liquidity mining in Season 3, which effectively dilutes the rewards of other participants. This move has raised great concerns about the ethics of the team.

Timeline of evidence:

August 22: Coinbase announced that its Prime service will become the primary custodian for Ethena Labs and Foundation’s ENA tokens.

August 23: The Coinbase Prime escrow address received more than 3 billion ENA tokens, which exceeded the total circulation of ENA at the time according to Ethena’s vesting plan. There is reason to believe that this is the Coinbase Prime escrow address for ENA tokens locked by the Ethena Labs core team and the Ethena Foundation.

October 3: When SENA staking was launched via the S2 airdrop, the Coinbase Prime Custody address distributed 180 million ENA tokens to six wallets:

- Day 1: 2 transfers (30 million and 35 million ENA)

- Next few days: 4 transfers (35 million, 30 million, 25 million, 25 million ENA)

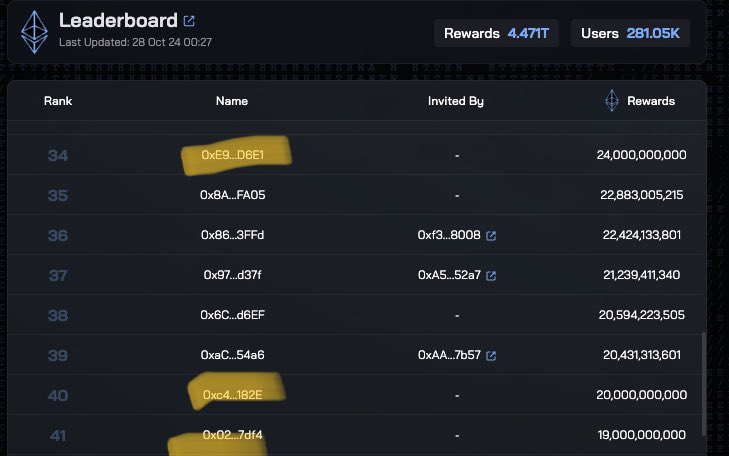

Ethena sats ranking shows :

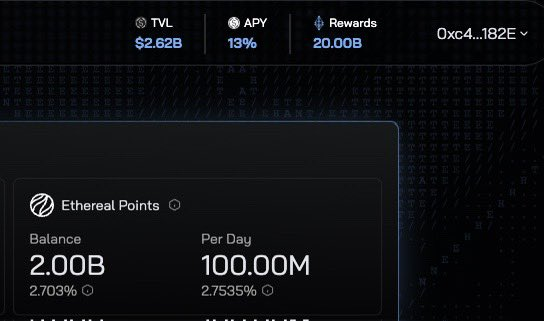

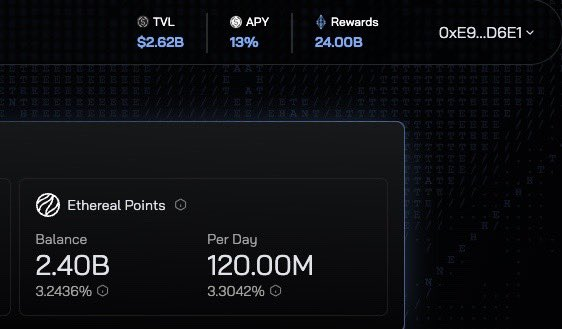

These SENA can not only earn Sats, but also Ethereal points (the DEX in cooperation with Ethena will be launched at the end of 2024). The figure below shows that the SENA of the Ethena team has currently accumulated 20% of the total Ethereal points.

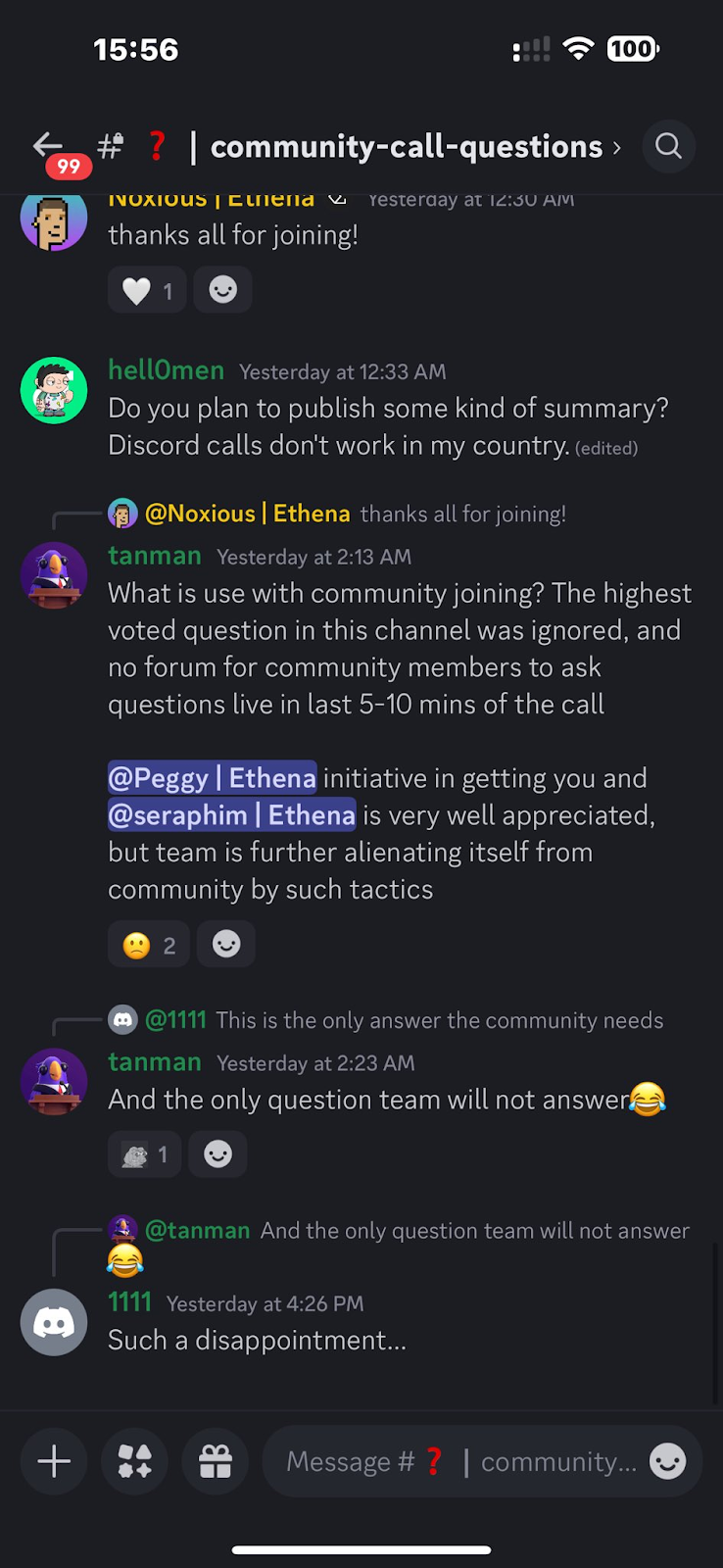

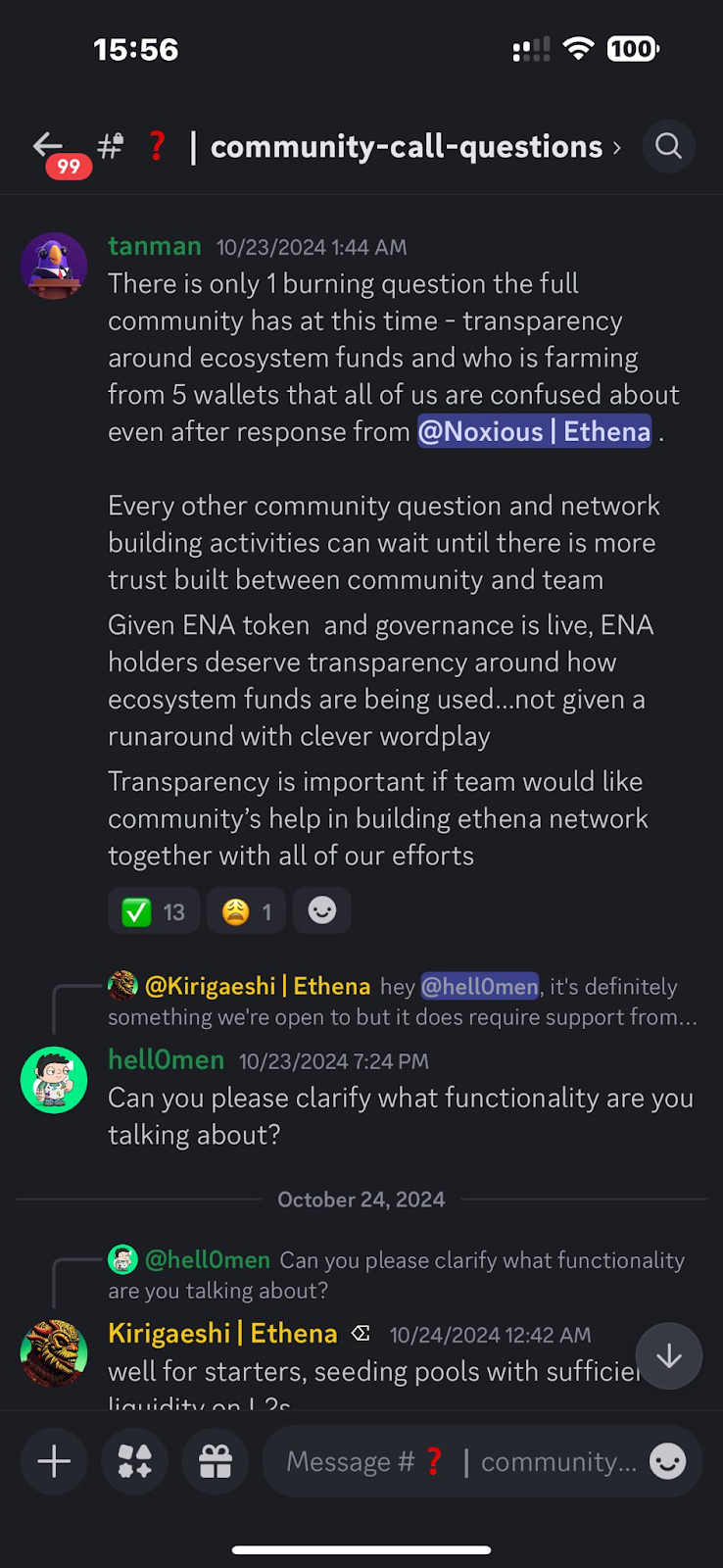

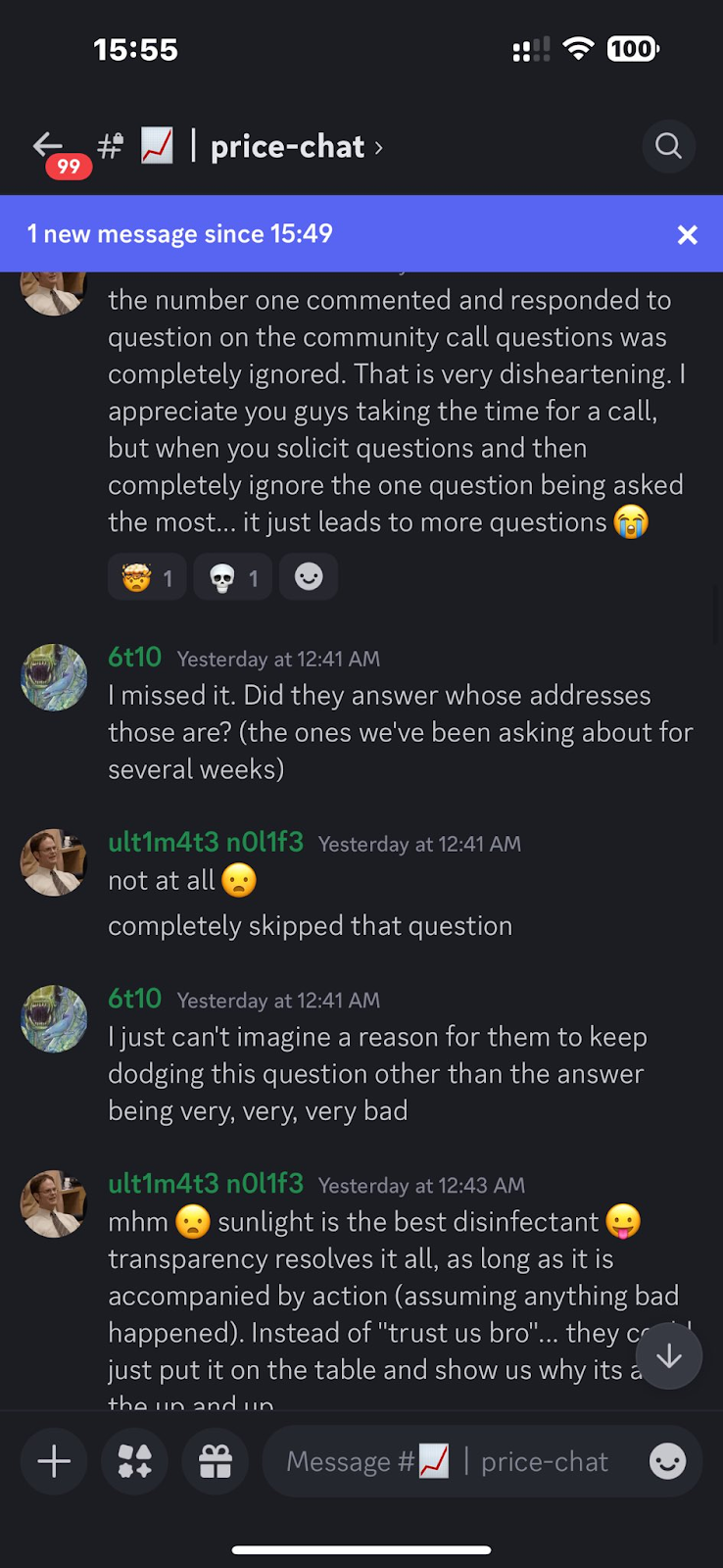

This is not the first time these suspicious addresses have raised questions. In Ethena’s first community call, this was the most voted-on question, but the Ethena team chose to completely ignore it, which speaks volumes about the team’s moral character and attitude.

The Ethena team has always had questionable ethics, having previously changed vesting rules at will. Users who participated in S1 mining may remember that the Ethena team forced them to stake 50% of their vested tokens halfway through the vesting schedule. Users who participated in S2 mining suffered losses due to the last-minute implementation of a 30-day average USDe holding rule. S2 YT holders suffered huge losses when they were about to be subject to the same average holding rule.

As a CeDeFi project, it is largely a black box in nature. Users have no choice but to trust the numbers released by the Ethena team. No one really knows how much revenue and staking income Ethena has received from the $2.6 billion user fund, or whether all the income has been passed on to SUSDe holders. While it is critical for a protocol like Ethena to establish a solid trust with users, the team's past performance has run counter to this concept.

Related reading: DeFi’s “old king” Andre Cronje wrote a long article questioning Ethena (USDe): The next UST?

You May Also Like

Trump erupts at Fox News reporter during roundtable: 'What a stupid question'

Fed Rate Cut and Tariff Effects: Powell’s Inflation Outlook