SEC Delays Franklin Spot XRP ETF — Hard Deadlines Hit Next Month

The US Securities and Exchange Commission has pushed back its decision on Cboe BZX’s proposal to list the Franklin XRP ETF, setting a new outer limit for action on the file. In an order dated Sept. 10, the Commission “designates November 14, 2025 as the date by which the Commission shall either approve or disapprove” the proposed rule change to list and trade shares of the fund. The filing, which advances under BZX Rule 14.11(e)(4), confirms the agency has used the full 60-day extension available after instituting proceedings, pushing the Franklin application to a hard deadline.

Franklin’s extension lands as the SEC’s XRP docket approaches a cluster of final decision dates across multiple exchanges and sponsors. Under Section 19(b)(2) of the Exchange Act, once the SEC opens proceedings on a 19b-4 proposal, it has up to 180 days from publication in the Federal Register—plus a single 60-day extension—to either approve or disapprove. That is why the new order matters: it does not merely “delay” in the colloquial sense; it exhausts the statutory clock and creates a date certain for a decision. The Franklin order lays this out explicitly before designating Nov. 14 as the deadline.

Final Deadlines For Spot XRP ETFs Now Locked In

The XRP queue is now crowded with final, non-extendable dates. Bitwise’s BZX filing reaches its endgame on Oct. 22, 2025, after the Commission extended the proceedings period to the maximum. “Accordingly, the Commission … designates October 22, 2025,” the order states, establishing the final day for an approve-or-deny outcome.

One day later, on Oct. 23, 2025, Nasdaq’s CoinShares XRP ETF proposal also hits its limit following a parallel “longer period” designation. Canary’s BZX proposal, a separate XRP vehicle, likewise terminates on Oct. 23, 2025. Two more Cboe BZX proposals are queued up just before and after those dates. The 21Shares Core XRP Trust proceeding must be decided by Oct. 19, 2025, per the Commission’s Aug. 18 order.

WisdomTree’s fund follows on Oct. 24, 2025, after the SEC extended its proceedings window the full 60 days beyond the initial 180. Together with Franklin’s Nov. 14 deadline, these orders outline a three-week window in which the SEC will be forced to issue a series of yes/no determinations on XRP products across three exchanges.

NYSE Arca’s Grayscale XRP Trust has its own finish line. In an Aug. 18 order, the SEC designated Oct. 18, 2025 as the date by which it “shall either approve or disapprove” NYSE Arca’s proposal to list and trade shares under Rule 8.201-E. That places the Arca application at the front of the XRP decision stack, potentially setting the tone for how the agency handles the cascade of BZX and Nasdaq decisions in the days that follow.

What, precisely, will be decided on these dates? Each of these actions concerns a Rule 19b-4 proposal—an exchange rule change determining whether a national securities exchange (Cboe BZX, Nasdaq, or NYSE Arca) can list and trade shares of an XRP-based commodity trust ETP.

Approval of a 19b-4 filing clears the exchange-listing hurdle, but it is not the final operational step. Trading cannot begin until the issuer’s registration statement becomes effective; as the Commission has repeatedly noted in prior ETP orders, “Shares will not trade on the Exchange until such time that the Registration Statement is effective.”

The practical effect of today’s Franklin order is to anchor the tail end of the calendar, with the SEC now facing a tightly packed sequence of statutory decision points from Oct. 18 through Nov. 14. Whether the Commission chooses to synchronize outcomes across exchanges and sponsors, as it ultimately did with spot Bitcoin in January 2024, remains to be seen; but unlike earlier phases of these dockets, there is no further room to “designate a longer period” once these dates arrive.

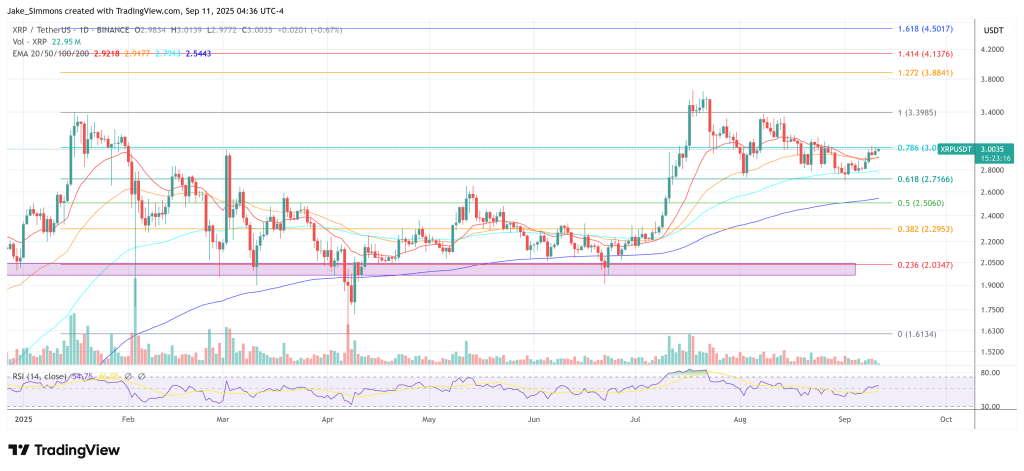

At press time, XRP traded at $3.00.

You May Also Like

The Channel Factories We’ve Been Waiting For

Fed Decides On Interest Rates Today—Here’s What To Watch For