Ethereum ‘Dying’ Debate Erupts As Messari Flags ETH Revenue Crash Despite All-Time High And Stablecoin Boom

A heated debate over whether Ethereum is “dying” has erupted online after a Messari analyst flagged a sharp decline in the blockchain’s revenue, even after ETH hit an all-time high and stablecoin activity on the network surges.

Messari analyst AJC highlighted on X that Ethereum generated $39.2 million in revenue in August, down 75% from $157.4 million in the same month in 2023 and 40% lower than last year’s $64.8 million. This marked the network’s fourth-lowest monthly revenue since January 2021.

“Ethereum is dying,” he said. “Ethereum’s fundamentals are collapsing, but the .eths don’t care so long as the price goes up.”

The analyst added that the decline in network fundamentals is “alarming,” despite ETH hitting a new all-time high of $4,953.73 on Aug. 24.

ETH price chart (Source: CoinMarketCap)

EHT has since retraced over 13% to trade at $4,300.40 as of 3:17 a.m. EST.

A large part of the drop in revenue happened after Ethereum developers rolled out the Dencun upgrade in March of last year, which lowered transaction fees for layer-2 networks that are built on top of the Ethereum chain.

Some On Crypto Twitter Say Ethereum Is Still Thriving

AJC’s post ignited a debate on X, with multiple Crypto Twitter community members arguing that Ethereum is actually thriving.

According to X user Tom Donleavy, using revenue to value a network is “counterproductive,” adding that this valuation method might work for apps, but not for networks.

Another X user agreed, and said that “revenue today is not relevant.”

“What you want is max revenue 10 years from now,” the X user said before adding that the ”best way to do that is to lower prices as low as possible and drive mass adoption, remain the winner of a winner-take-all market as you onboard a few billion users, and then price accordingly.”.

Ethereum On-Chain Metrics Rise, But Are They A True Indication Of Demand?

Another X user named “Rick” said that it’s difficult to say that Ethereum is dying when on-chain metrics ‘have actually started showing positive trends.”

“App revenue is reaching ATHs, stablecoin supply ATH, and continued L2 scaling all point to the most flourishing decentralized financial system ever created, powered by $ETH,” Rick said in a comment.

AJC replied to the comment and said those metrics “are all meaningless statistics” when it comes to demand for the Ethereum blockchain.

While active addresses could show increased usage, the rise in transaction count may also be due to a growing number of small transactions that are executed autonomously by bots and not actual users.

One Ethereum blockchain user can also spin up multiple addresses, so the number of active addresses on a network might not be a true indication of adoption.

With regards to layer-2 scaling, AJC argues that this “doesn’t mean all that much if there’s no marginal user demand for another L2.”

Stablecoin Boom Happening On Ethereum

While AJC and the crypto community debate whether Ethereum is indeed dying, data from Token Terminal shows that the supply of stablecoins on the blockchain is soaring and recently reached a new ATH.

According to a report by Token Terminal, Ethereum has added around $5 billion in new stablecoins over the past week, pushing the total to $165 billion. This is more than double the stablecoin supply on Ethereum from January 2024.

That’s after US President Donald Trump signed the GENIUS Act into law in July. It is the first comprehensive regulatory framework for payment stablecoins, and establishes licensing and regulatory requirements for domestic and foreign issuers.

The Act also mandates AML compliance and anti-terrorism regulations, as well as provides consumers with protections.

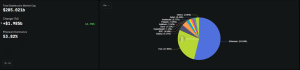

Stablecoin market share for each blockchain (Source: DeFiLlama)

Ethereum has been the blockchain of choice for stablecoin issuers, and currently has a 53.84% share of stablecoin market. This is almost double the next-biggest stablecoin market share of 27.86%, which belongs to Justin Sun’s TRON blockchain.

You May Also Like

Microsoft Corp. $MSFT blue box area offers a buying opportunity

Uniswap Gains Momentum While Pi Network Waits: Is BlockDAG At $0.001 The Best Crypto To Buy Now?