DeFi Development Corp. (DFDV) Stock: Dips 7.6% Amid $427M Solana Treasury Boost Pushing Total SOL Holding to 2M+ Tokens

TLDR

- DFDV stock dips, rebounds as Solana holdings surpass 2M tokens worth $427M.

- DeFi Dev boosts SOL treasury, per-share metrics climb despite stock volatility.

- DFDV bets big on Solana with $427M stash, SPS hits $16.70 per share.

- After stock drop, DFDV surges on Solana stake expansion and UK crypto push.

- Treasury-first strategy: DFDV grows SOL reserves, balances real estate & crypto.

DeFi Development Corp. (DFDV) shares fall 7.59% on September 4, closing at $15.21. The sharp drop occurred mid-morning, marking a steep decline during the trading session. However, in after-hours trading, the stock rose 2.17% to close at $15.54.

DeFi Development Corp. (DFDV)

This rebound followed a major announcement tied to the company’s growing Solana holdings. The positive reaction helped ease the earlier drop that erased short-term gains. Trading volumes remained elevated as markets absorbed the treasury-related update.

The company continued to show confidence in its strategic direction. The timing of the SOL purchase aligned with a price dip in the crypto market. This move reinforced its long-term bet on Solana’s ecosystem strength.

Solana Holdings Surge Past 2 Million Tokens, Worth $427 Million

DFDV confirmed the acquisition of 196,141 Solana tokens at an average price of $202.76 per token. With this transaction, the company now holds a total of 2,027,817 SOL. Based on current token prices, the SOL treasury is valued at approximately $427 million.

This marks an 11% increase in the company’s total SOL exposure compared to its last reported holdings. The company intends to stake the newly acquired SOL using its own validator infrastructure. This will allow it to generate native yield from staking rewards and fees.

The accumulation aligns with DFDV’s strategy as a Solana treasury-first entity. The company continues to deploy capital raised through recent equity deals into SOL. It has committed to holding and staking these assets for long-term value creation.

Per-Share Metrics Reflect Strong Crypto Leverage

As of September 4, the company reported 25,573,702 shares outstanding. This results in a Solana-per-share (SPS) figure of 0.0793, translating to $16.70 per share based on token price. SPS offers a direct view of shareholder exposure to the company’s Solana assets.

The share count excludes pre-paid warrants issued in a recent financing round. If those warrants were included, the share count would increase to approximately 31.4 million. Even with full warrant dilution, the company expects SPS to stay above 0.0675.

This suggests confidence in future SOL acquisitions and the treasury’s compounding yield. Management plans to update SPS as it deploys remaining cash proceeds. Future treasury growth will be reflected in adjusted metrics to maintain transparency.

Business Expansion and Future Growth Plans Underway

DFDV continues to build its AI-driven commercial real estate platform. The platform provides data tools and software to users across the real estate value chain. This remains the company’s operational foundation alongside its crypto strategy.

The firm also announced the expansion of its crypto operations to the UK. Five new financial vehicles are under development. These initiatives are designed to scale both technology and treasury-related operations.

DeFi Development’s dual-pronged strategy continues to evolve in a volatile but promising market environment. It leverages blockchain infrastructure while building traditional subscription-based revenue streams, a hybrid model that sets it apart from purely crypto-native or SaaS-focused peers.

The post DeFi Development Corp. (DFDV) Stock: Dips 7.6% Amid $427M Solana Treasury Boost Pushing Total SOL Holding to 2M+ Tokens appeared first on CoinCentral.

You May Also Like

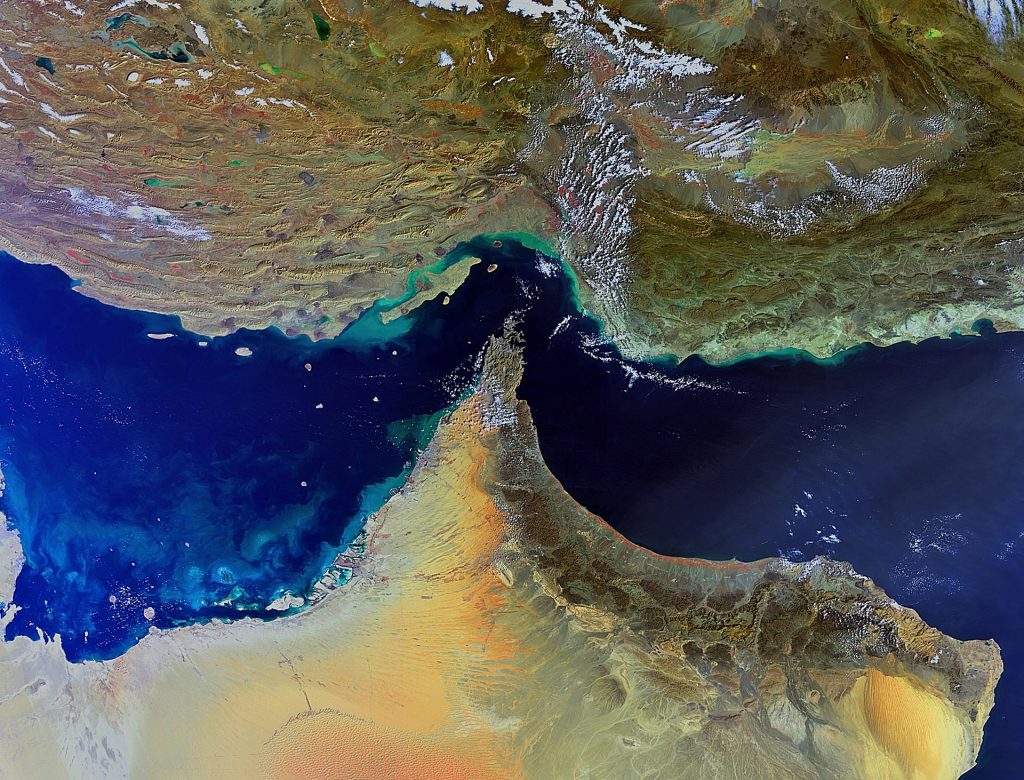

İran Hürmüz Boğazı’nı Kapatırsa Ne Olur? Verilerin Gösterdiği Tek Bir Şey Var!

TON Station Daily Combo 01 March 2026: Maximize Your $TONS Rewards Today