Bitcoin vs. Gold: The Old Store of Value Still Wins

Gold’s current price near $3,500 per ounce marks a historic milestone — exactly 100 times higher than the $35 level set when the U.S. abandoned the gold standard in 1971.

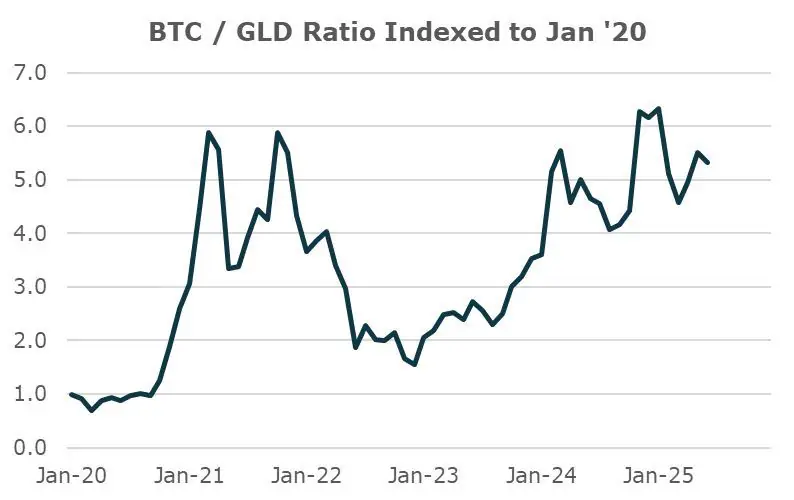

For comparison, Bitcoin has lagged behind not only in 2025 but also in the longer view: since their respective highs in November 2021, gold has climbed 85% while BTC is up just 61%.

Trump’s Second Term Brings Softer BTC Returns

The performance gap has been particularly striking under President Donald Trump’s current term. Back in 2017, during his first months in office, Bitcoin surged more than 400% in under a year.

By contrast, during the first 225 days of 2025, BTC has risen only 9%, moving from $102,000 at inauguration to $111,000 today.

READ MORE:

Bitcoin Crash Alert: Strategist Warns of $10K Meltdown

Digital Gold Narrative Under Pressure

Bitcoin’s advocates once framed it as a hedge against the same inflationary forces that have propelled gold for centuries. But as 2025 unfolds, the data shows gold outperforming both in short-term rallies and over longer cycles. For now, the oldest store of value still appears to be outshining the newest.

The information provided in this article is for informational purposes only and does not constitute financial, investment, or trading advice. Coindoo.com does not endorse or recommend any specific investment strategy or cryptocurrency. Always conduct your own research and consult with a licensed financial advisor before making any investment decisions.

The post Bitcoin vs. Gold: The Old Store of Value Still Wins appeared first on Coindoo.

You May Also Like

Strive Finalizes Semler Deal, Expands Its Corporate Bitcoin Treasury

Why 2026 Is The Year That Caribbean Mixology Will Finally Get Its Time In The Sun