Apple (AAPL) Stock Jumps 4.3% After Judge Clears $20B Google Search Deal

TLDRs;

- Apple (AAPL) stock jumped 4.3% after a U.S. judge allowed its $20B Google search deal to continue.

- Judge Mehta ruled Google can’t sign exclusive contracts but may remain Apple’s default search partner.

- The agreement generates nearly 20% of Apple’s services revenue, a key driver amid slowing hardware sales.

- U.S. regulators took a softer stance than Europe, where Google has faced multibillion-euro antitrust fines.

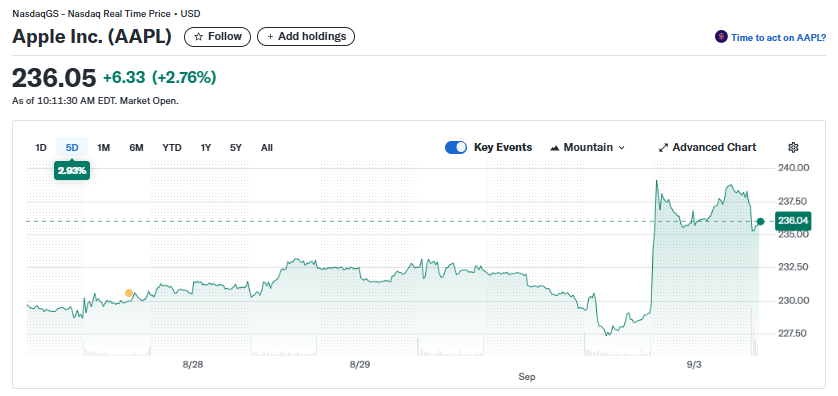

Apple Inc. (AAPL) saw its stock climb 4.3% before recoiling slightly on Wednesday after a U.S. federal judge ruled in favor of allowing its lucrative search deal with Google to continue, despite the ongoing antitrust case targeting Google’s agreements with browser companies.

The decision preserves one of Apple’s most profitable partnerships, which has generated approximately $20 billion annually for the iPhone maker.

Apple Inc. (AAPL)

Apple Inc. (AAPL)

The ruling and its implications

Judge Amit Mehta issued the decision, stating that while Google is barred from entering exclusive contracts for internet search, it can still strike deals allowing its search engine to be the default option on browsers, including Apple’s Safari. This effectively keeps intact one of the tech industry’s most consequential business arrangements.

The decision ensures that Google remains the default search engine on Apple devices, while still requiring Apple and other browser developers to provide users with alternative search options. The ruling also allows browsers to revise default search settings each year and mandates that companies promote competing search engines in certain operating modes, such as privacy browsing.

For users, this means little immediate change. Apple’s iOS has long allowed switching to search engines like Bing or DuckDuckGo, and since 2023, Safari’s private browsing mode has provided additional search engine options.

Stock market reacts positively

The decision was cheered by Wall Street, with Apple’s shares jumping 4.3% and Google’s parent Alphabet (GOOGL) surging up to 8.7%. Investors welcomed the clarity provided by the ruling, as it shields both companies from more severe outcomes, including the forced divestiture of Google’s Chrome browser.

Analysts noted that the continuation of the Google deal secures nearly 20% of Apple’s services revenue, a segment that has become increasingly vital as hardware sales growth slows. Without this partnership, Apple’s earnings per share could have taken a hit of as much as 15%, underscoring just how essential the agreement has become.

Apple’s growing reliance on services

The case highlights Apple’s heavy reliance on Google as a revenue source. The $20 billion search deal represents a significant concentration risk, as a single partnership contributes a large portion of Apple’s non-hardware revenue. This reliance has drawn scrutiny from regulators, who argue that such arrangements limit competition and consumer choice.

Still, for Apple, the deal is critical to its broader strategy of expanding its services ecosystem, which has helped offset slowing demand for iPhones and other devices. Maintaining the Google partnership gives Apple a steady revenue stream while it continues to diversify into areas like Apple TV+, Apple Music, and iCloud.

Regulatory contrasts

The U.S. ruling also illustrates the stark difference between American and European approaches to antitrust enforcement. While Judge Mehta’s decision prioritized avoiding downstream harms by maintaining the payments, European regulators have taken a more aggressive stance.

In 2019, the European Commission fined Google €1.49 billion for abusive practices in online advertising, accusing the company of imposing restrictive clauses to block competitors’ ads. The U.S. approach, by contrast, has been more cautious, emphasizing balance between preserving competition and minimizing market disruption.

This divergence underscores the fragmented global regulatory landscape facing major tech firms. Practices deemed acceptable in the U.S. may face heavy penalties in Europe, creating uncertainty for multinational corporations navigating different jurisdictions.

The post Apple (AAPL) Stock Jumps 4.3% After Judge Clears $20B Google Search Deal appeared first on CoinCentral.

You May Also Like

XRPL Validator Reveals Why He Just Vetoed New Amendment

Unleashing A New Era Of Seller Empowerment