Crucial Ruling: US Appeals Court Declares Most Trump Administration Tariffs Illegal

BitcoinWorld

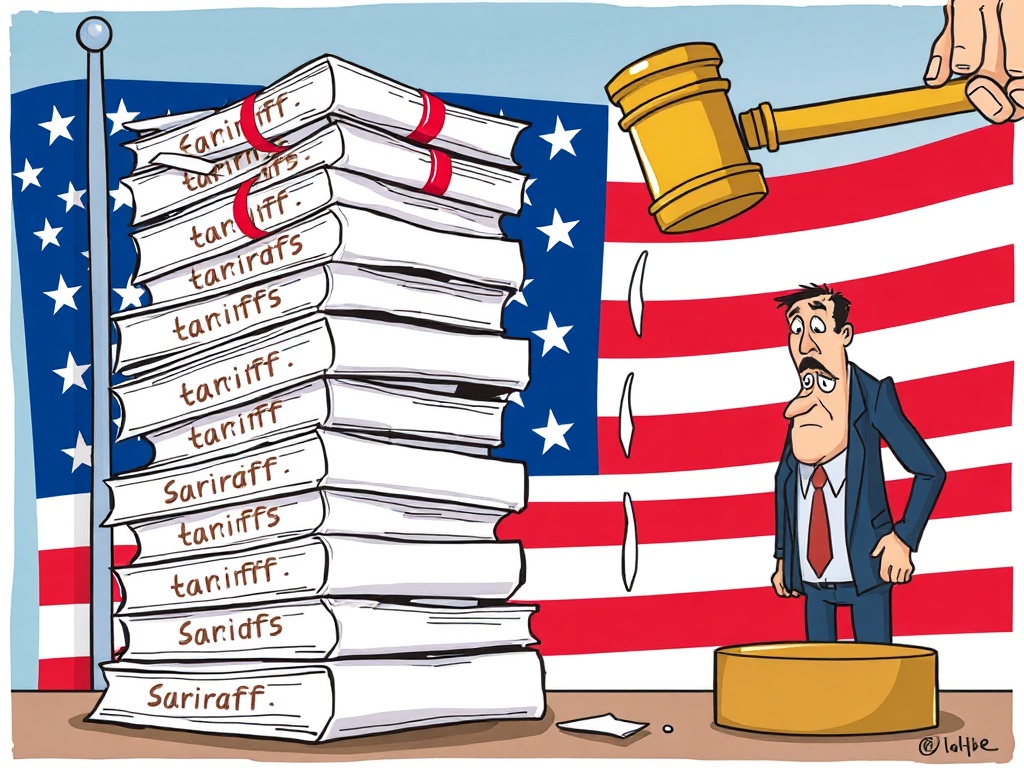

Crucial Ruling: US Appeals Court Declares Most Trump Administration Tariffs Illegal

In the fast-paced world of global finance, even seemingly distant legal battles can send ripples through various markets, including the dynamic cryptocurrency space. A significant development recently emerged from a U.S. appeals court regarding the legality of Trump administration tariffs. This ruling, while not directly about digital assets, highlights the interconnectedness of global economics and policy, which often influences investor sentiment and, by extension, the crypto market.

What’s the Verdict? A Crucial Decision on Trump Administration Tariffs

A U.S. appeals court has delivered a pivotal decision, ruling that most of the Trump administration tariffs imposed during the previous presidential term are, in fact, illegal. This news, initially reported by Walter Bloomberg on X, marks a substantial legal challenge to the trade policies of that era.

However, it is important to note a key detail: the court also stated that these tariffs may remain in place for the time being. This allows for further litigation to proceed, meaning the immediate impact on goods and prices is not an abrupt change, but rather a prolonged process.

Understanding the Legal Battle: Why Were These Tariffs Challenged?

The tariffs in question were primarily imposed on goods from various countries, most notably China, under Section 301 of the Trade Act of 1974. The Trump administration argued these tariffs were necessary to address unfair trade practices.

The legal challenge centered on whether the administration exceeded its authority in imposing these tariffs, particularly regarding the scope and justification for their continuation and expansion. The appeals court’s ruling suggests a finding that the executive branch overstepped its statutory powers in the implementation of a significant portion of these Trump administration tariffs.

What Does This Mean for Businesses and the Economy?

This ruling introduces a layer of uncertainty and potential change for businesses that have been operating under the weight of these tariffs for years. Here are some key implications:

- Potential Relief for Importers: If the ruling stands and tariffs are eventually removed, importers could see reduced costs for affected goods.

- Consumer Impact: Lower import costs could, in theory, translate to lower prices for consumers, boosting purchasing power.

- Trade Policy Scrutiny: The decision puts future presidential administrations on notice regarding the limits of their authority in imposing trade barriers.

- Market Reaction: While not immediate, the long-term prospect of tariff adjustments can influence investor confidence and supply chain strategies.

This legal challenge to the Trump administration tariffs underscores the intricate balance between executive power and legislative oversight in trade matters.

The Road Ahead: Will Trump Administration Tariffs Be Lifted?

The court’s decision that the tariffs may remain in place while litigation proceeds means the saga is far from over. This ongoing legal battle could involve:

- Appeals: The government could appeal this decision to a higher court, potentially even the Supreme Court.

- Remand to Lower Courts: The case might be sent back to a lower court for further proceedings consistent with the appeals court’s findings.

- Negotiations: The current administration might also use this ruling as leverage in ongoing trade negotiations.

Therefore, while the ruling is a significant legal blow, the actual removal or modification of these Trump administration tariffs is not guaranteed to happen quickly and will depend on the subsequent legal and political developments.

The Broader Impact on Global Markets and Crypto

Major economic news, such as this ruling on Trump administration tariffs, often affects investor sentiment across all asset classes. Here’s how it connects to the crypto world:

- Macroeconomic Sensitivity: The crypto market, particularly Bitcoin, is increasingly sensitive to macroeconomic indicators and global trade relations. Positive or negative shifts in the global economic outlook can influence investor risk appetite.

- Inflation and Supply Chains: Tariffs can contribute to inflation by increasing import costs. A potential reduction or removal of these tariffs could ease inflationary pressures, which might be seen as a positive for assets like Bitcoin, often viewed as a hedge against traditional economic instability.

- Investor Confidence: A clearer, more predictable global trade environment can foster greater investor confidence, potentially encouraging broader investment across various markets, including digital assets.

While the link is indirect, a healthier global economy and stable trade relations generally create a more favorable environment for all investments, including cryptocurrencies.

This crucial appeals court ruling on Trump administration tariffs highlights the ongoing complexities of international trade policy. While the tariffs remain in place for now, the legal precedent set could have far-reaching implications for future trade strategies and the broader economic landscape. For cryptocurrency enthusiasts, understanding these macro-level shifts is vital, as they often shape the underlying currents of market sentiment and investment flows.

Frequently Asked Questions (FAQs)

What exactly did the appeals court rule regarding Trump administration tariffs?

The U.S. appeals court ruled that most of the Trump administration tariffs were illegal, finding that the administration exceeded its legal authority in their implementation.

Why were these tariffs considered illegal?

The ruling suggests that the legal basis for imposing and continuing these specific tariffs under Section 301 of the Trade Act of 1974 was not sufficiently met or that the executive branch overstepped its statutory powers.

Will the tariffs be removed immediately?

No, the court stated that the tariffs may remain in place for the time being while further litigation proceeds. This means the process for their potential removal or modification will likely be lengthy.

How might this ruling impact the US economy?

If the ruling ultimately leads to the removal of these tariffs, it could potentially lower import costs for businesses, ease inflationary pressures, and result in lower prices for consumers, influencing overall economic activity.

Could this ruling affect future trade policy?

Absolutely. This decision sets a precedent that could limit the scope of executive power in imposing tariffs under Section 301, influencing how future administrations approach trade disputes and implement trade policies.

Is there any direct impact on the cryptocurrency market?

While there’s no direct impact, macroeconomic shifts resulting from trade policy changes, such as reduced inflation or increased global economic stability, can indirectly influence investor sentiment and risk appetite, which in turn can affect the cryptocurrency market.

Did you find this analysis helpful? Share this article with your network to keep others informed about the critical developments shaping global trade and its wider economic implications!

To learn more about the latest crypto market trends, explore our article on key developments shaping Bitcoin’s institutional adoption.

This post Crucial Ruling: US Appeals Court Declares Most Trump Administration Tariffs Illegal first appeared on BitcoinWorld and is written by Editorial Team

You May Also Like

WLD Price Prediction: Targets $0.73 by February as Bullish Momentum Builds

Hashdex Expands Nasdaq Crypto Index ETF, Adding XRP, SOL, XLM to US Portfolios