BTC, ETH, XRP, BNB Warnings: Profit Status Could Trigger Price Declines Soon

TL;DR

- Doctor Profit warns that 90–100% of crypto investors in profit could trigger mass profit-taking and subsequent price drops.

- XRP weakens while BNB fully peaks, but Solana shows strong growth with rising network activity.

- $261M liquidations hit both longs and shorts, raising doubts despite near-universal profitability.

Investors Deep in Profit

A sharp rise in profitability among major cryptocurrencies has prompted analysts to warn of potential profit-taking.

Doctor Profit wrote,

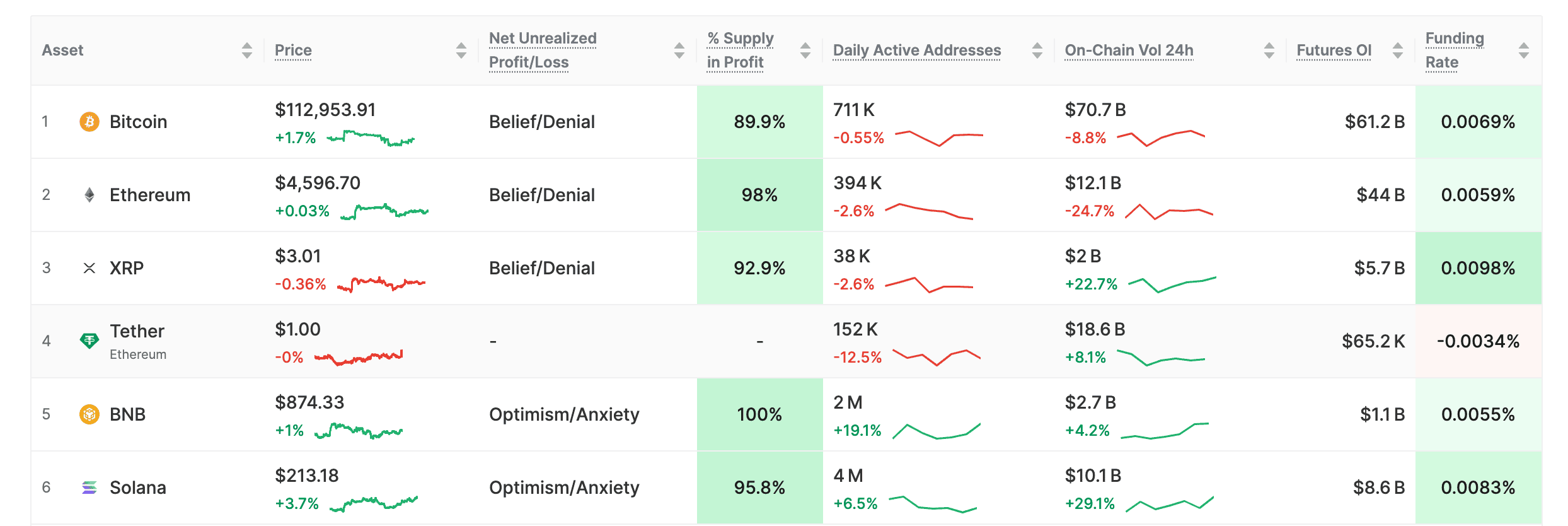

Bitcoin trades at $113,000, with nearly 90% of supply in profit. Daily active addresses stand at about 711,000, though on-chain volume fell almost 9%. Futures open interest is $61.2 billion, supported by a small positive funding rate.

Ethereum shows an even stronger picture. At $4,600, about 98% of the supply is in profit. Activity has cooled, with daily active addresses down 3% and on-chain volume off nearly 25%. Futures open interest is $44 billion, with longs still leading.

Source: Glassnode

Source: Glassnode

XRP Slips, BNB Peaks, Solana Soars

XRP trades at $3, with 92% of supply in profit. Daily addresses fell to 38,000, but on-chain volume rose 23% to $2 billion, suggesting some investors are starting to take gains.

BNB, at $870, has 100% of its supply in profit, a rare situation. Activity surged 19% to 2 million daily addresses, and volume grew to $2.7 billion. Funding rates, however, slipped into negative territory at -0.0034%, pointing to hedging against downside risk.

Solana is trading at $213, with 96% of supply in profit. Network use is strong, with 4 million daily addresses, up 7%. On-chain volume jumped 29% to $10.1 billion. Futures open interest is at $8.6 billion, with positive funding. Unlike Bitcoin and Ethereum, Solana’s profitability is paired with rising usage.

In addition, Cronos (CRO) has surged 59% in 24 hours to $0.37, making it one of the best performers in the market. On-chain data shows 87% of CRO holders are in profit, placing it alongside other major coins flashing high profitability.

Trading volume has jumped to multi-month highs. The move follows weeks of steady recovery and was accelerated by news of a Trump Media partnership with Crypto.com. Sentiment around CRO shows both optimism and anxiety, with analysts cautioning that such profit levels often precede selling pressure.

Liquidations Sweep the Market

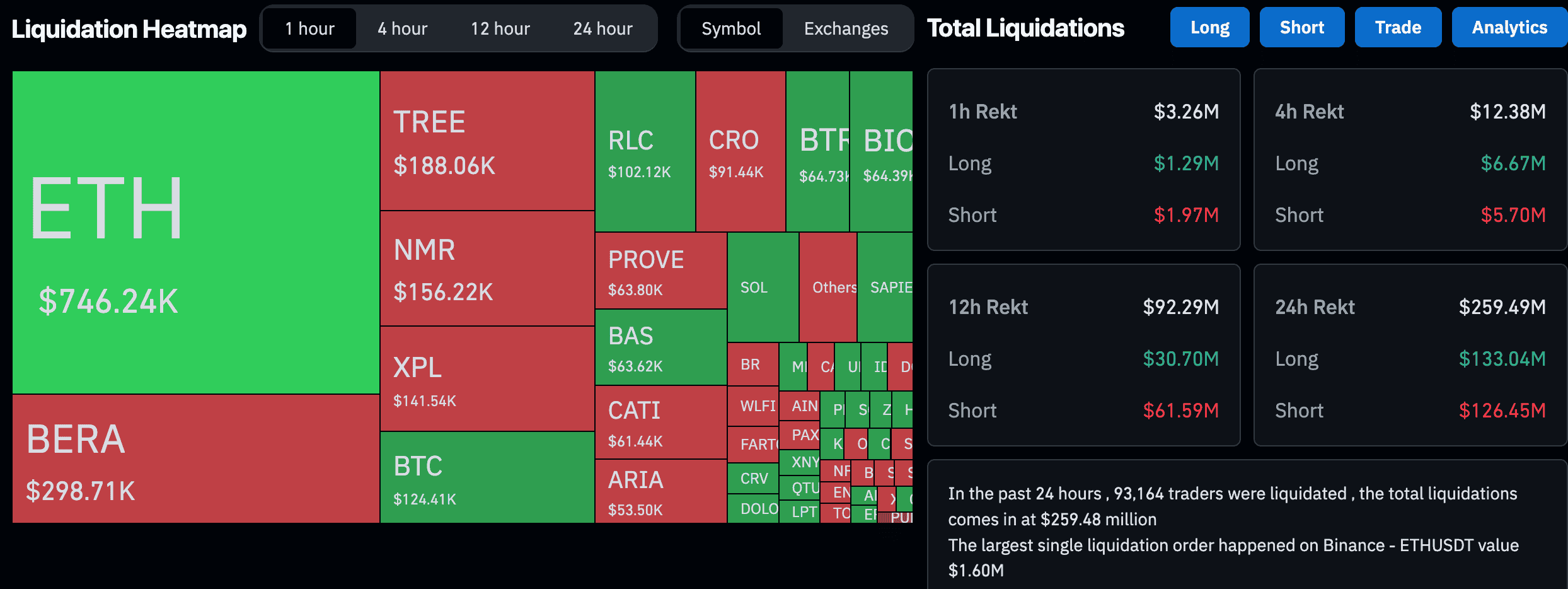

Even with most investors in profit, liquidations remain heavy. In the past day, over 93,900 traders were liquidated, totaling $261 million. Longs accounted for $134.52 million, while shorts lost $126.35 million.

Source: Coinglass

Source: Coinglass

Ethereum led with $746,000 liquidated, followed by BERA at $298,000. Bitcoin saw $124,000 in liquidations. Mid-cap and smaller tokens like NMR, XPL, and RLC ranged from $50,000 to $150,000.

DeFi Planet questioned the disconnect:

The post BTC, ETH, XRP, BNB Warnings: Profit Status Could Trigger Price Declines Soon appeared first on CryptoPotato.

You May Also Like

Taiko Makes Chainlink Data Streams Its Official Oracle

Kalshi Prediction Markets Are Pulling In $1 Billion Monthly as State Regulators Loom

![[Pastilan] End the confidential fund madness](https://www.rappler.com/tachyon/2024/05/commission-on-audit-may-28-2024.jpg?resize=75%2C75&crop=301px%2C0px%2C720px%2C720px)