Dogecoin Sees Weekly Bearish Cross: Bottom Or Breakdown Next?

Dogecoin is flashing a rare weekly “bearish cross” just as traders debate whether last week’s $0.08 washout was the cycle’s reset or merely the first leg lower. The setup matters beyond DOGE itself because memecoin flows are increasingly being treated as a proxy for risk appetite across crypto.

Is The Dogecoin Bottom In?

A chart shared by Charting Guy shows the 20-week EMA crossing below the 200-week EMA, a technical event he argues has historically aligned with DOGE capitulation. “DOGE typically bottoms around when the 20 weekly EMA crosses below the 200 weekly EMA. That happened last week” he wrote, adding that he “increased my position by 50% at the lows” and that his community received buy alerts.

That framing is colliding with more cautious range-based reads from other analysts watching spot structure instead of the moving-average signal alone.

Daan Crypto Trades described the post-dip bounce as constructive, but explicitly framed it as range trade rather than trend confirmation. “DOGE Decent price action here over the past few days after the big $0.08 test last week. Currently seeing this $0.08-$0.13 area as a large range,” he posted.

“Anything above that point would make me confident in a further move towards the Daily 200MA/EMA. Currently near the middle so hard to really assume a direction here the way it’s trading.”

On his chart, DOGE/USDT was sitting around the middle of that band near $0.10–$0.11, with the upper range marker around $0.132 and the lower boundary near $0.088. In other words: not a clean trend, not a clean mean reversion, just a market waiting for a push.

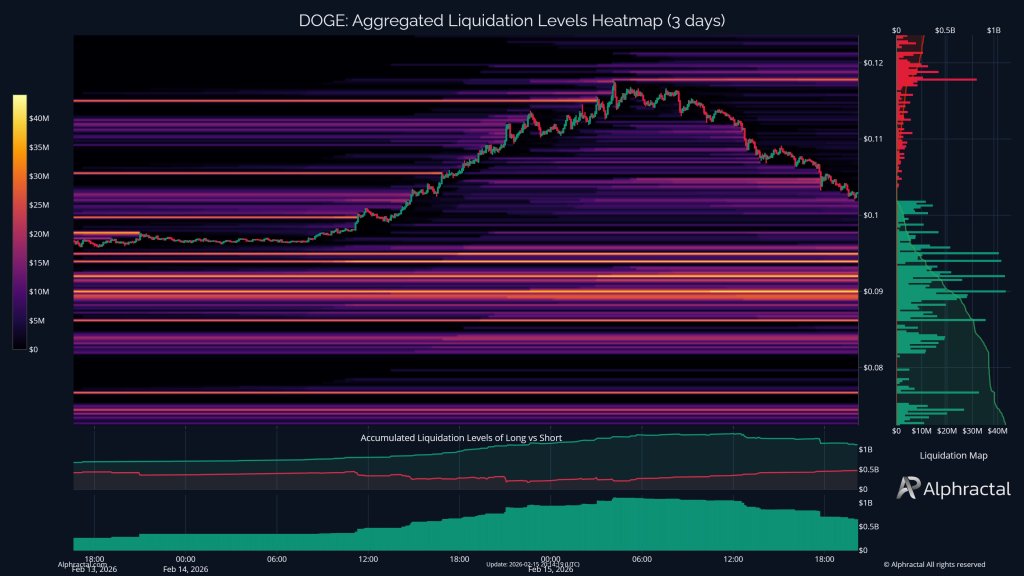

That “waiting” can be expensive in a leverage-heavy coin. CEO of Aphractal João Wedson struck a stark tone, warning: “If you are long on Doge, you will likely be liquidated soon!”

An aggregated liquidation heatmap shared by Alphractal highlights why this warning resonates with derivatives traders: thick bands of potential liquidation levels sit below current price over the past three days, suggesting stop-driven moves could cascade if DOGE starts trending instead of chopping.

Wedson also argued that DOGE rallies can function as a broader volatility tell for Bitcoin, calling them “a risk signal for Bitcoin” and saying it “usually happens when Bitcoin is moving sideways.”

Alphractal echoed the rotation narrative in a longer note on flows. “Over the past few days, memecoins have significantly outperformed BTC and other altcoins. What stood out the most was Dogecoin, where the number of trades surpassed all others in its category,” the account wrote. “However, in the last few hours, memecoins have started to correct while BTC remains relatively stable.”

The near-term map is clean even if the conviction isn’t. Bulls need a decisive reclaim of the top of the $0.08–$0.13 range to credibly reopen the path toward the daily 200 MA/EMA that Daan flagged. Bears, meanwhile, will focus on whether the market revisits the $0.08 area and whether that level holds on a second test with liquidation clusters in play.

At press time, Dogecoin traded at $0.10.

You May Also Like

SEC Clears the Way for Spot Crypto ETFs with New Generic Rules

Raydium’s 200% volume spike tests RAY’s breakout strength – Here’s why