XRP Ledger Activates XLS-85 as Native Token Escrow Goes Live

Key Insights:

- XLS-85 enables native escrow for all tokens issued by the XRP Ledger XRPL.

- Issuers have to subscribe through issuer-level escrow flags.

- The demand for XRP is influenced by actual adoption and an increase.

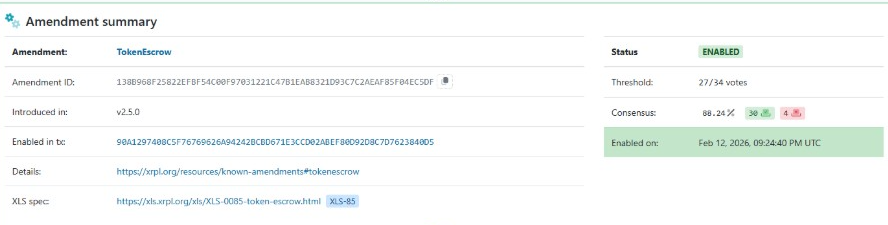

XRP Ledger (XRPL) activated the XLS-85 amendment on February 12, 2026. It introduced the native escrow functionality for all Trustline-based tokens and Multi-Purpose Tokens (MPTs).

The upgrade massively extends XRPL’s programmable settlement capabilities beyond XRP itself. While the change boosts the network’s infrastructure, its direct effect on XRP price is uncertain.

XLS-85 Expands Native Escrow Across XRP Ledger

The XLS-0085 amendment lifts a long-standing limitation on the XRP Ledger. In the past, the native escrow feature of XRPL was only applied to XRP. With this activation, escrow functionality now extends to issued tokens, such as stablecoins and other IOUs.

Amendment Summary | Source: XRPScan

Amendment Summary | Source: XRPScan

RippleX affirms that stablecoins like RLUSD gain secure, conditional settlement. It also enables tokenized real-world assets to benefit from on-chain settlement. The upgrade improves the current EscrowCreate, EscrowFinish, and EscrowCancel transaction types.

Importantly, token issuers retain control. Tokens have to support escrow functionality via issuer-level flags explicitly. This ensures maintenance of compliance requirements and governance structures for regulated issuers.

The change essentially turns XRPL into a network where all supported assets are able to use time-lock and conditional release mechanisms. That is a substantial change in how value can be handled on the ledger.

XRP Ledger Institutional Use Cases Grow

The extension of the escrow opens up several new use cases. Token vesting schedules can now be written, without custom smart contracts, natively on XRP Ledger. Institutional settlement workflows can include conditional release structures as part of the ledger.

XRPL Token Escrow | Source: RippleX, X

XRPL Token Escrow | Source: RippleX, X

Treasury management becomes more flexible for token issuers. Stablecoins can be used for structured payouts and escrow-backed disbursement programs. Structured financial products can be designed using built-in ledger functionality.

One analyst described the upgrade as a step towards making XRPL’s decentralized exchange more institution-ready. The comment suggested that the institutional capital deployment can be increased after the activation.

Earlier in the month, XRPL enabled Permissioned Domains. That’s another feature that supports institutional adoption. Together, these updates signal a wider push for tokenized finance infrastructure.

Network Effects vs. Instant XRP Demand

Despite the upgrade in the structure, XLS-85 is not directly increasing demand for XRP. The amendment covers Trustline-based tokens and MPTs, instead of extending the use of escrow for XRP itself. That means that it does not automatically make more XRP lockups.

However, long-term implications are more complex. If stablecoin issuers, tokenization platforms, and institutions embrace XRPL due to native token escrow, network activity could grow considerably.

More token issuance would mean more XRP Ledger accounts. Each account needs a base XRP reserve. Transaction volume would also increase as the number of escrow accounts and tokens increases.

XRP remains the native asset for transaction fees and account reserves. Increased usage directly drives incremental demand for XRP. In the long run, this can shape supply and demand.

Nevertheless, this effect hinges on actual adoption. Infrastructure improvements do not necessarily create capital inflows. Institutional participation must materialize before network effects can shape valuation meaningfully.

Sentiment, Competition, And XRP Price

Beyond direct utility, perception plays a role in crypto markets. XLS-85 makes XRP Ledger a better competitor in the tokenization space. Ethereum and other platforms historically dominated the programmable assets issue.

If markets perceive XRPL as acquiring institutional capabilities, sentiment can improve even before the number of usage metrics grows. Crypto assets are sometimes as responsive to shifts in the narrative as they are to fundamentals on-chain.

In the short term, general market conditions continue to dominate price movements. At press time, XRP was trading at $1.36, down 1.35% in the past 24 hours. The asset remains in line with the general sentiment of the crypto market.

Over the longer term, persistent ecosystem growth could provide for stronger fundamentals. Token-enabled escrow drives greater issuance, settlement volume, and account activity. This makes XRP’s role as the ledger’s gas and reserve asset more central.

The post XRP Ledger Activates XLS-85 as Native Token Escrow Goes Live appeared first on The Market Periodical.

You May Also Like

The founder of OpenClaw joined OpenAI with the goal of "developing an AI assistant that even my mother can use".

ASI Alliance merger collapses: Ocean demands Fetch.ai inject 110.9 million $FETs into token migration contract as soon as possible