National Bitcoin Reserve Strategy: Can It Succeed in Asia?

Bitcoin now sits at the center of Asia’s financial debate. Legislators and regulators—not retail traders—determine how it flows through markets. Their decisions affect liquidity, credibility, and whether Asia joins a global competition for national bitcoin holdings.

Hong Kong now anchors digital assets in market infrastructure. ETFs provide compliant exposure, while the Stablecoins Bill created licensing for fiat-referenced issuers. Together, they transform crypto from speculative sidelines into financial plumbing.

Hong Kong Writes the Rulebook

Background Context – On April 30, 2024, HKEX listed Asia’s first spot bitcoin and ether ETFs, with in-kind creation reducing friction. The ASX followed on June 20, 2024. Korea’s Virtual Asset User Protection Act took effect on July 19, 2024, requiring 80% cold storage and insurance. In January 2025, Indonesia’s OJK assumed oversight, shifting supervision into financial regulation.

Behind the Scenes – China has no unified rules for seized bitcoin. Local governments dispose of them inconsistently, prompting calls for central coordination, Reuters noted. In Hong Kong, banks and fintechs prepare applications under the new licensing regime. Japan’s Diet asked in December 2024 whether bitcoin could serve as reserves; the government dismissed the idea in its official record. In Taiwan, a legislator proposed allocating 0.1% of GDP to a national bitcoin reserve, according to CommonWealth Magazine.

Wider Impact – Australia’s ETF enabled superannuation funds to allocate legally. Hong Kong’s listings drew custodians and auditors. Korea emphasizes protection, Hong Kong emphasizes access, and Indonesia strengthens supervision—divergent policies shape where capital flows.

Latest Update – The US refrained from confiscating bitcoin as a strategic reserve, and plans to include crypto in 401(k)s could expose savers to political and market risks. China is reviewing yuan-backed stablecoins to boost renminbi use in global trade. Hong Kong passed its Stablecoins Bill in May and started licensing for fiat-referenced issuers under the Hong Kong Monetary Authority.

Seizures Create Strategic Dilemmas

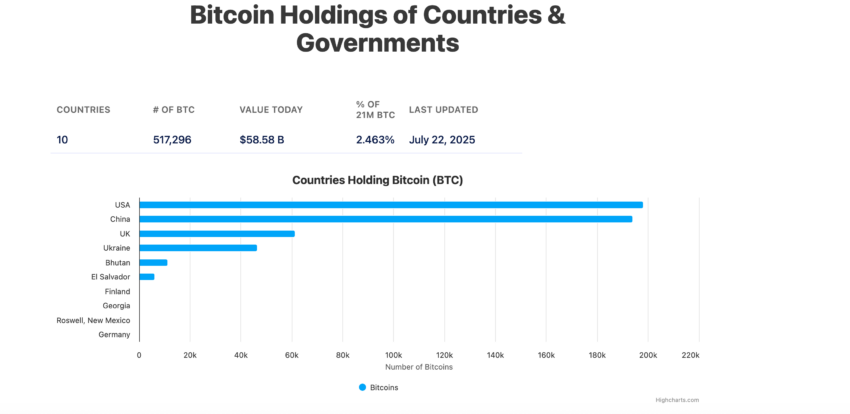

Most state-controlled bitcoin comes from seizures, not reserves. China’s PlusToken case yielded about 195,000 BTC. The CPS announced record seizures in the U.K. in 2024. The U.S. chose retention, while Germany liquidated. Divergent policies inject volatility when states suddenly sell.

Bitcoin Holdings of Countries & Governments | BiTBO

Bitcoin Holdings of Countries & Governments | BiTBO

According to CoinGecko, governments worldwide now hold about 463,741 BTC—2.3% of the supply. These caches reflect enforcement more than strategy. Whether they remain dormant, liquidated, or reclassified remains unsettled.

Historical Perspective – Gold ETFs, two decades ago, unlocked institutional flows. Crypto ETFs follow that arc but face AML and custody hurdles. Bitcoin differs: its government balances come mainly from seizures. IMF frameworks exclude crypto from reserves, which is blocking official adoption for now.

Possible Risks – Uncoordinated government sales could shake markets. Weak backing risks destabilizing stablecoins. Overregulation drives liquidity offshore. BeInCrypto reported that poorly designed U.S. retirement integration could amplify volatility. Declaring reserves without accounting legitimacy risks credibility loss.

Politics Enter the Reserve Debate

Legislatures increasingly test the reserve question. Taiwan’s proposal sparked debate. Japan’s Diet raised the issue, but the finance ministry dismissed it. According to the Brazilian Chamber record, Brazil’s Chamber of Deputies held a 2025 hearing on allocating up to 5% of reserves to Bitcoin. In the US, Texas codified a state-level bitcoin reserve. These moves show that politics, not just markets, drive the reserve conversation.

Data Breakdown

- 2.3%: share of bitcoin controlled by governments

- 195,000: bitcoin seized in China’s PlusToken case

- 80%: cold-storage requirement in Korea

- April 30, 2024: Hong Kong ETF launch

- May 21, 2025: Hong Kong stablecoin law passed

Expert Opinion

China’s decisions on seized bitcoin and yuan-backed stablecoins will set the tone. Hong Kong’s licensing regime could bring banks into the issuance process. U.S. reserves and retirement debates may pressure others to adjust. Asia must decide whether to prepare or remain cautious.

You May Also Like

Is Doge Losing Steam As Traders Choose Pepeto For The Best Crypto Investment?

Fed Decides On Interest Rates Today—Here’s What To Watch For