XRP vs HBAR: SWIFT Blockchain Pilot Could Trigger the Next Price Breakout

The post XRP vs HBAR: SWIFT Blockchain Pilot Could Trigger the Next Price Breakout appeared first on Coinpedia Fintech News

Global payments giant SWIFT has officially begun live blockchain trials, with XRP and HBAR emerging as two of the primary assets under consideration. This development has sent waves across the crypto market, as both projects now stand at the center of a transformation that could reshape cross-border payments and tokenised asset transfers.

For investors, the implications go beyond technology. SWIFT processes over $150 trillion annually, and even a fraction of that volume routed through blockchain networks could trigger massive demand for digital assets like XRP and HBAR. XRP’s strength in instant settlement and liquidity management makes it a natural fit for banks, while HBAR’s high throughput and enterprise governance align with large-scale tokenisation needs.

With both assets now tied to SWIFT’s roadmap, traders are asking: could this be the catalyst for the next major price surge in XRP and HBAR?

XRP vs. HBAR: Which Fits Better into SWIFT’s Future?

As SWIFT accelerates its shift toward blockchain-enabled financial messaging, two assets consistently emerge in the spotlight: XRP (Ripple) and HBAR (Hedera). Both offer speed, scalability, and cost-efficiency, but their design philosophies and strengths differ, making them potentially complementary rather than direct rivals.

Technical Comparison

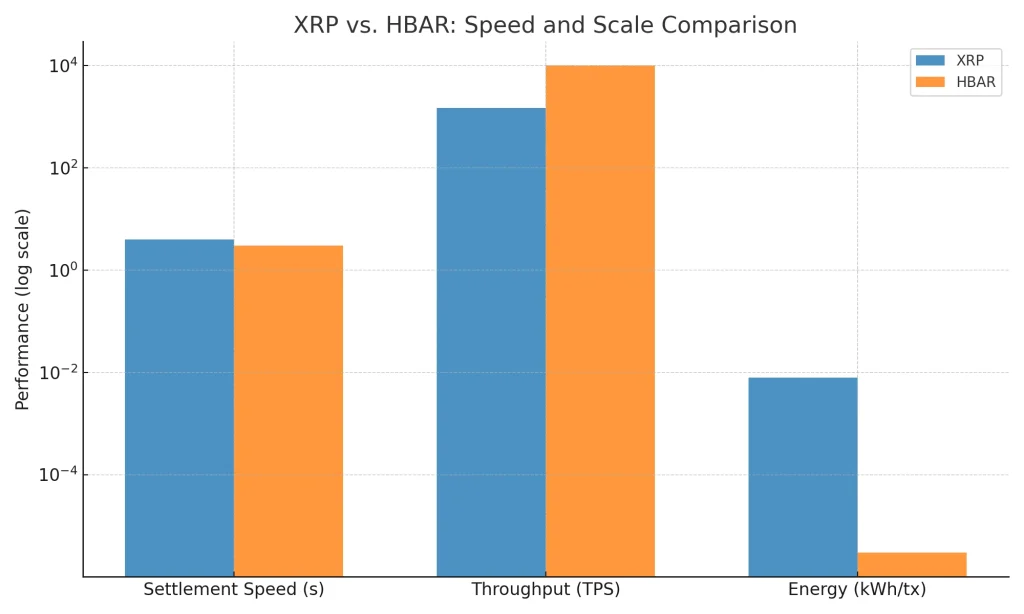

| Feature | XRP (Ripple) | HBAR (Hedera) |

| Settlement Speed | 3–5 seconds | ~3 seconds with finality |

| Consensus | Ripple Protocol Consensus (RPCA) | Hashgraph Gossip + Virtual Voting (aBFT) |

| Throughput (TPS) | ~1,500 TPS | 10,000+ TPS (scalable via sharding) |

| Governance | Validator list (UNL), Ripple-linked partners | 39-member Governing Council (Google, IBM) |

| Energy Efficiency | ~0.0079 kWh/tx | ~0.000003 kWh/tx (carbon negative) |

| Main Use Case | Cross-border payments, remittances | Tokenisation, enterprise-grade applications |

Adoption | Banks, payment providers (Santander, SBI) | Corporations, tech giants (Google, Boeing) |

XRP is built for global payments, offering fast settlement and liquidity solutions that align with banking needs. HBAR is designed for enterprise-scale tokenisation, with unmatched throughput, carbon-negative operations, and strong governance. Together, they could form a dual solution: XRP for liquidity and payments and HBAR for tokenised assets and enterprise rails.

Conclusion: XRP vs. HBAR – Which Will SWIFT Choose?

As SWIFT’s digital asset trials progress, both XRP and HBAR have carved out unique strengths—XRP as a liquidity bridge for global payments and HBAR as the scalable backbone for tokenised economies. The real impact, however, may be felt in their prices. If even a portion of SWIFT’s $150 trillion ecosystem flows through these networks, demand could drive significant upside. Rather than a single winner, the future may see both XRP price and HBAR price thriving together—fueling speculation that this integration could mark the start of their next major bull run.

You May Also Like

Fed rate decision September 2025

GBP/USD rallies as Fed independence threats hammer US Dollar