XRP SOPR Turns Negative as Holders Realise Losses—Is the Price at Risk of Slipping Below the $1?

The post XRP SOPR Turns Negative as Holders Realise Losses—Is the Price at Risk of Slipping Below the $1? appeared first on Coinpedia Fintech News

XRP has returned to focus as recent price weakness coincides with a noticeable shift in on-chain behavior. The token is currently trading in a very tight range, with both volume and volatility compressing significantly. At the same time, on-chain data indicates that a growing number of market participants are selling XRP at a loss. This combination of muted price action and rising holder stress has raised concerns about the near-term outlook, keeping the $1 level in focus as traders assess the risk of further downside.

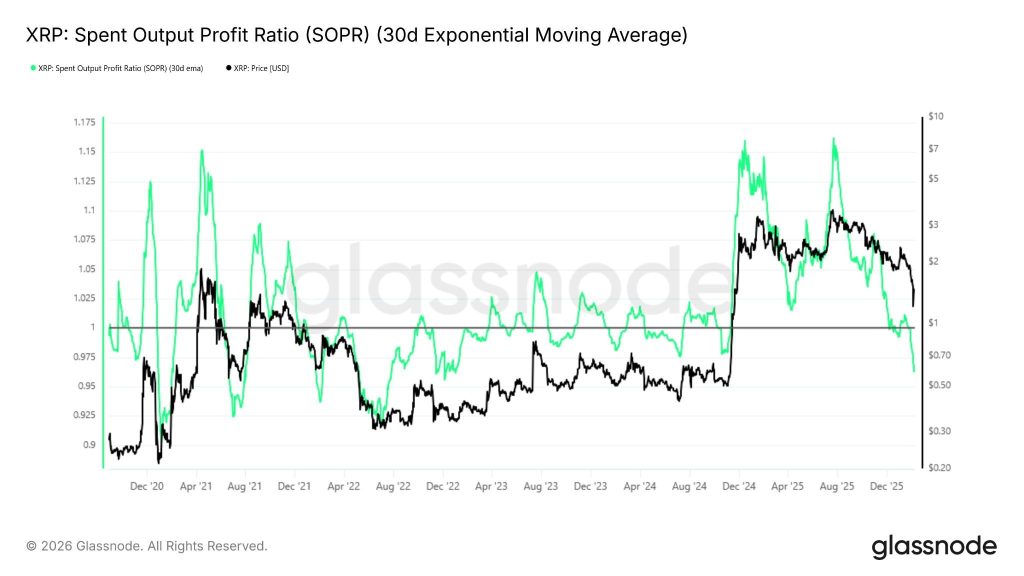

XRP SOPR Turns Negative, Signalling Loss-Driven Selling

The on-chain data from Glassnode shows clear signs of stress among XRP holders. The Spent Output Profit Ratio (SOPR) has dropped below the key 1.0 level, which means that, on average, XRP is now being sold at prices lower than where it was bought. The 7-day average SOPR has dropped from around 1.16 in mid-2025 to about 0.96, highlighting a steady increase in loss-driven selling.

Historically, this kind of setup has appeared during periods of heavy pressure rather than during strong trends. A similar pattern played out between September 2021 and May 2022, when XRP spent months consolidating after holders absorbed losses. While a negative SOPR does not guarantee an immediate recovery, it often suggests that much of the emotional selling is already underway, a phase that can eventually lead to stabilization once selling pressure begins to fade.

Will XRP Price Drop Below $1 And Keep Grinding?

XRP price has struggled to deliver any meaningful upside since July 2025, when the price was rejected from its all-time high. Since then, the weekly structure has remained weak, marked by a steady sequence of lower highs and lower lows, reflecting sustained bearish control. More recently, however, price action has slowed considerably, with both buyers and sellers showing little urgency. This pause suggests XRP may either be entering a prolonged consolidation phase or quietly building toward a larger move.

From a broader perspective, the weekly structure shows limited demand until the $0.50 region, a zone where buyers previously stepped in aggressively. Adding to this, open interest has been declining alongside price, indicating traders are closing positions rather than aggressively shorting. This behavior often appears in the later stages of a bearish trend, when selling pressure begins to fade. With positioning thinning out, XRP is more likely to drift sideways or grind slowly rather than see a sharp continuation lower in the near term.

What’s Next for XRP Price?

XRP price remains in a wait-and-watch phase as long as the price holds above the $1.00 psychological zone. A sustained breakdown below this level could open the door for a deeper move toward $0.75, with $0.50 standing out as the next major demand area where buyers previously stepped in aggressively. On the upside, bulls would need a clear weekly reclaim above $1.25–$1.30 to signal improving structure and shift momentum toward $1.50. Until then, thinning open interest and muted volatility suggest consolidation or a slow grind is more likely than a sharp trend move.

You May Also Like

Hadron Labs Launches Bitcoin Summer on Neutron, Offering 5–10% BTC Yield

South Korea Launches First Won-Backed Stablecoin KRW1 on Avalanche