XRP Gets A Wall Street Wrapper: Evernorth CEO Teases Q1 2026 Nasdaq IPO

Evernorth CEO Ashish Birla said the firm is preparing for a Q1 2026 IPO on Nasdaq, pitching the listing as a simplified, public-markets route for institutions to gain exposure to XRP without building the custody, compliance, and security stack themselves.

Speaking on Nasdaq’s Live from MarketSite on Jan. 15 with host Kristina Ayanian, Birla framed the planned offering as a response to what he described as growing institutional readiness and a shifting regulatory backdrop. Ayanian said: “Evernorth is gearing up for a Q1 2026 IPO.”

Birla responded: “I’ve been waiting for this moment for a long time. I’ve been in blockchain since 2013,” Birla said. “The timing couldn’t be more perfect. We have the right kind of regulation. We have the right kind of administration and institutions are ready to adopt.”

XRP Gets A Wall Street Wrapper

At the center of Evernorth’s pitch is the XRP treasury strategy, which Birla described as “the digital asset underpinning Evernorth’s digital asset treasury.” In Birla’s telling, Evernorth’s equity is meant to function as an exposure vehicle for investors who prefer traditional market rails over direct token custody.

“Prior to Evernorth … you would have to go in, you know, custody digital assets on your own. You would have to worry about compliance. You’d have to worry about security,” he said. “But a large lion’s share just wants to buy a public stock. So we made it as easy as buying a public stock. And we’ll figure that stuff out for you.”

Birla also suggested Evernorth intends to brand that exposure explicitly through its stock identity, referring to “XRPN as the Evernorth stock,” and repeating that the proposition is to “just buy the stock … and we’ll take care of all that heavy lifting for you.” For investors, the value proposition is less about novel financial engineering than operational outsourcing: Evernorth claims it can package custody, compliance, and blockchain participation behind a public equity wrapper.

The executive tied the timing of Evernorth’s public-market push to what he described as rising demand for regulated exposure. Asked about “XRP ETFs … making a big splash,” Birla said the category had seen “a record breaking last few weeks,” arguing that it signaled appetite from traditional investors. “That shows that there is the demand from the public markets to gain exposure to XRP,” he said, adding that Evernorth intends to go beyond simple spot exposure by supporting the broader ecosystem.

That “beyond” hinges on yield generation and active treasury management. Birla said Evernorth expects to “be generating yield as well on the XRP asset,” and that the proceeds would be recycled into the treasury: “We’ll use [it] to go and buy more of the digital asset for the treasury. So we’ll be actively out there.” He positioned the company as an active participant in product development on-chain, saying Evernorth will “help develop that XRP ecosystem, help bring financial products to the blockchain.”

Pressed on what separates durable “digital asset treasury” strategies from the rest, Birla emphasized scale and activity. “One, you have to have scale. And Evernorth as of today is by far the largest XRP digital asset treasury out there,” he said. The second criterion, he argued, is avoiding a purely passive posture. “They can’t be passive. They have to be active stewards of helping the ecosystem flourish and develop,” Birla said, adding that he plans to continue “helping the XRP ecosystem develop” and that Evernorth could “generate yield for the for the treasury as well.”

For prospective institutional buyers and public-market investors, the message was blunt: the company sees the last missing piece as capital access, and it is building a listed vehicle around it. “You’ve got regulation, you’ve got the products, and now you’ve got institutional capital,” Birla said. “I think timing is right to adopt blockchain for financial products.”

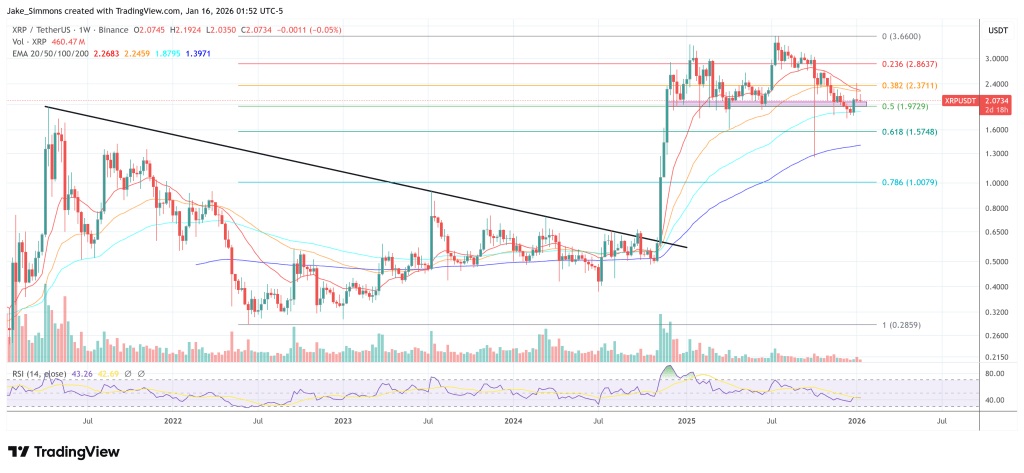

At press time, XRP traded at $2.07.

You May Also Like

Tom Lee, 2026’yı “Ethereum Yılı” İlan Etti: Fiyat Tahminini Paylaştı!

How to earn from cloud mining: IeByte’s upgraded auto-cloud mining platform unlocks genuine passive earnings