XRP Price Shows Reversal Signal as US CLARITY Act Nears

This article was first published on The Bit Journal.

XRP price is drawing sharp attention as traders track a rare chart signal forming just days before a major US policy review. This setup has created a sense of curiosity among crypto circles, especially as the token trades in a narrow range near $2.

As of the latest market reading, XRP is priced at $2.0840, sitting roughly 43% below its all-time high, mirroring weakness across the wider crypto sector.

According to the source, the broader market has cooled after weeks of shaky performance. Many investors now watch global indicators more carefully, trying to understand how XRP may react to key events that could shift market behavior.

Chart Signal Sparks Fresh Concerns Among Traders

The weekly chart has formed a dragonfly doji, a pattern often showing indecision after a struggle between buyers and sellers. Traders frequently regard it as an early sign of waning momentum, especially when this accompanies strong resistance levels that are already in the process of being tested to destruction by previous rallies.

The current data still tells the story of XRP price above two dollars, but the chart suggests that risks are rising. Two dollar symbols at three dollar level suggest they are weakening and moving under 50-week as well as 100-week moving averages also have given even greater worries about heavier pressure.

Market watchers now focus on the support zone around one dollar and sixty-two cents. If the token falls through this level, studies suggest it could drift toward one dollar and fifty cents. With volatility picking up, traders remain alert to how these signals unfold in the days ahead.

Macro Pressures Add to Volatility Fears

Investors are also watching fresh US inflation data, with recent records showing headline CPI near 2.6 percent. That level sits close to the central bank’s goal, yet still carries enough weight to influence risk-heavy markets.

Falling oil prices and easing mortgage rates hint that inflation may cool further, but any upside surprise could pressure digital assets. Traders often pull back from volatile tokens during inflation spikes, which is why a hotter reading could weigh on XRP price.

Regulation adds its own layer of uncertainty. The US Senate is preparing to review the CLARITY Act, which aims to divide oversight between securities and commodities regulators.

Some believe clearer rules could strengthen long-term stability, though policy shifts tend to spark short-term market swings. With XRP often tied to regulatory discussions, many expect the token to respond quickly once new details are released.

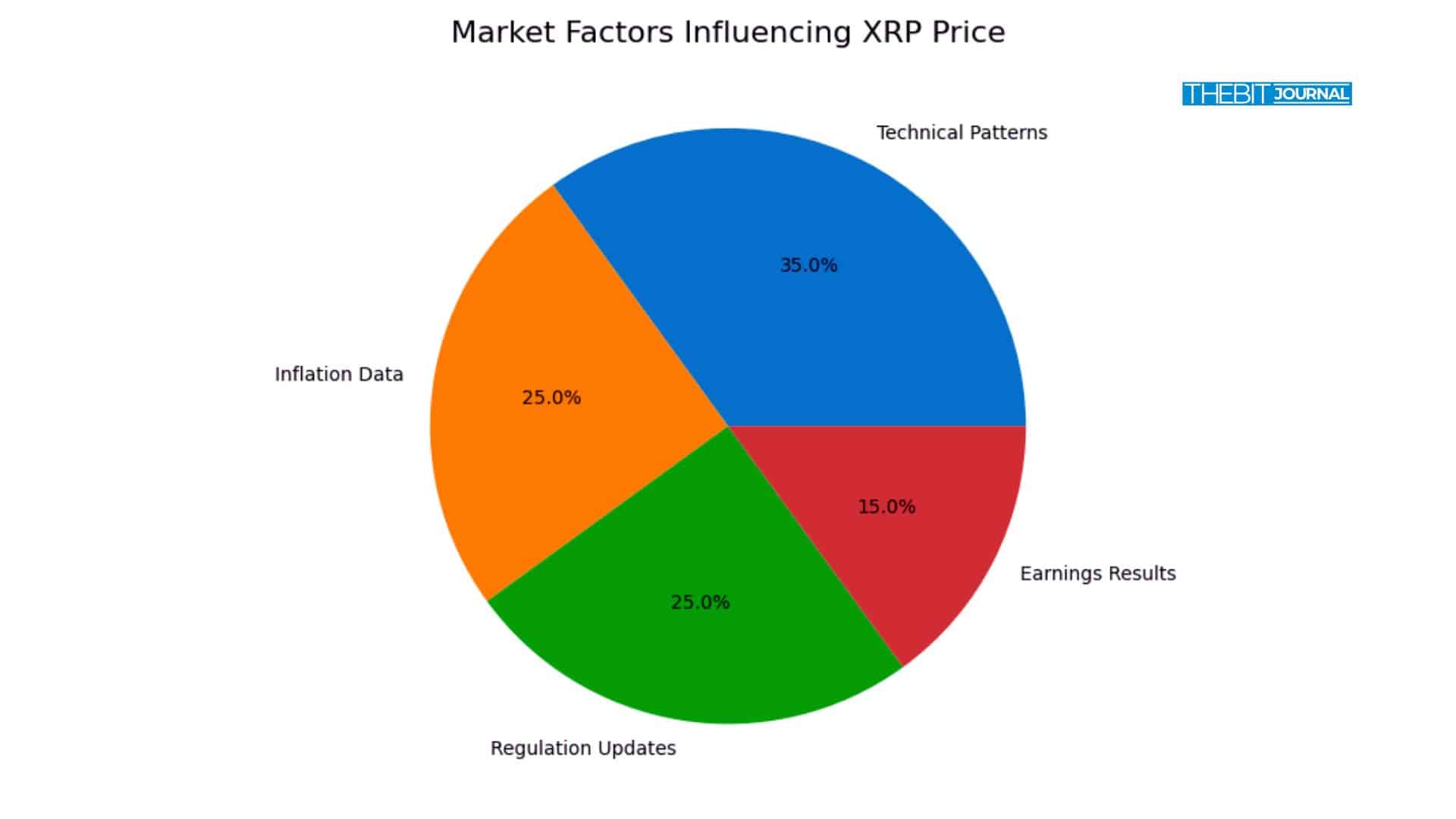

Key Market Forces Shaping the Current XRP Price Outlook

Key Market Forces Shaping the Current XRP Price Outlook

Earnings Season Holds Influence Over Market Sentiment

Another factor shaping the week is earnings season. Major banks will report quarterly results, and positive performance often boosts investor confidence. When confidence rises, both traditional and digital markets can see fresh inflows. Analysts remind traders, however, that sentiment can just as easily reverse if results disappoint.

Some developers continue to highlight the practical use of XRP, noting its role in cross-border payment systems. These use cases support long-term demand, even when short-term technical signals point to uncertainty. Updated figures show steady trading volume, suggesting the community continues to watch the token closely.

Sources: Coinmarketcap

Sources: Coinmarketcap

Conclusion

In the end, XRP price stands at an important crossroads. Inflation data, regulation updates, earnings results and chart patterns are converging at once. Traders, students and analysts may view this moment as a reminder that markets evolve quickly and that understanding these forces can help guide smarter decisions in the days ahead.

Glossary of Key Terms

Dragonfly Doji: A candle pattern showing indecision after buyer-seller conflict.

Double Top: A chart formation that signals weakening momentum.

CPI: A measure tracking changes in consumer prices.

Support Level: A price where buying interest often appears.

FAQs About XRP Price

Why is XRP facing uncertainty this week?

Key US data and policy decisions may influence market direction.

What makes the dragonfly doji important?

It often hints at potential trend shifts after market hesitation.

Can regulation affect XRP?

Yes. New rules can influence liquidity and investor confidence.

Is XRP still near a critical support level?

Yes, the next major support sits near one dollar and sixty-two cents.

References

Tradingeconomics

Coinmarketcap

Read More: XRP Price Shows Reversal Signal as US CLARITY Act Nears">XRP Price Shows Reversal Signal as US CLARITY Act Nears

You May Also Like

Vitalik Buterin Reaffirms Original 2014 Ethereum Vision With Modern Web3 Technology Stack

Fed Decides On Interest Rates Today—Here’s What To Watch For