XRP price eyes a rebound as a key stablecoin metric crosses $400m milestone

XRP price suffered a big reversal and dropped for four consecutive days as the recent crypto market rally lost momentum.

- XRP price has retreated in the past few days, erasing some of the recent gains.

- The supply of stablecoins in XRP Ledger has crossed the $400 million milestone.

- Technical analysis suggests that the token has more gains ahead.

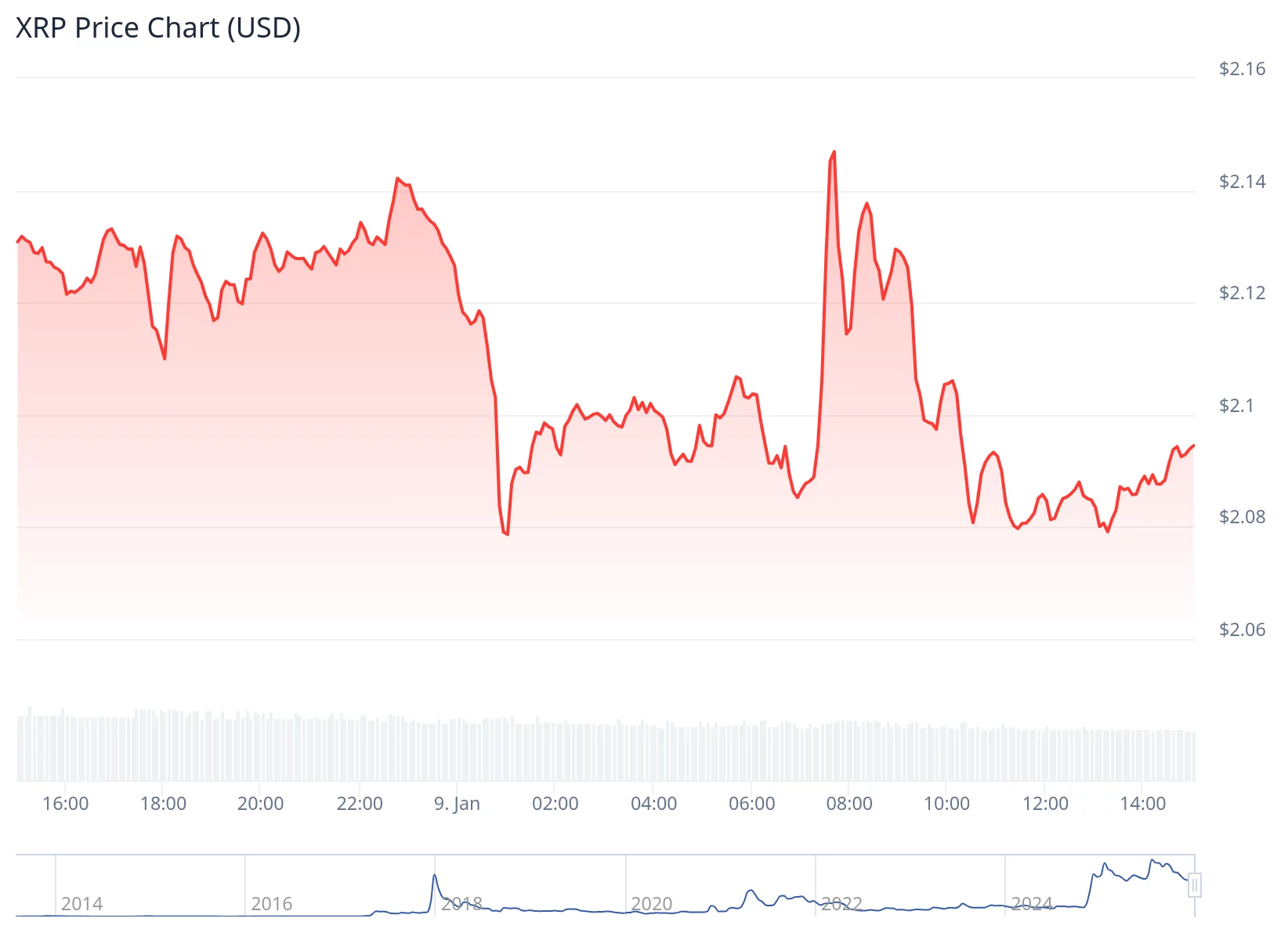

Ripple (XRP) dropped to $2.09 at last check on Friday, Jan. 9. That’s down by nearly 15% from its highest point this year. See below.

Still, technicals and its stablecoin growth mean that the token may be on the verge of a strong rebound in the near term.

XRP Ledger stablecoin growth is accelerating

DeFi Llama data shows that the supply of stablecoins in XRP Ledger has continued rising this year. It has jumped by 33% in the last seven days to over $406 million, much higher than $93 million, which it had in the same period last year.

This growth has been driven by the Ripple USD (RLUSD) coin whose supply has jumped by 42% in the last 30 days to $332 million. The other top stablecoins in the ecosystem are OpenEden Tbill, USD Coin, and EURQ.

Stablecoins, which are cryptocurrencies backed by fiat currencies, have become major players in the payment industry. Data shows that there are over $308 billion worth of stablecoins in circulation today, a figure that will continue to grow.

Ripple USD, launched in December 2024, has grown into one of the largest stablecoins, with a total supply of $1.4 billion. Most of the supply is in Ethereum (ETH), which is the most popular chain for stablecoin transactions. The supply will likely increase as Ripple extends it to other layer-2 networks such as Base and Optimism.

XRP is also seeing some demand from American investors, who acquired ETFs worth over $8.7 million on Thursday after shedding $40 million in assets a day earlier. Total inflows in XRP ETFs has jumped to $1.21 billion, while the net assets have moved to $1.49 billion

XRP price technical analysis

The daily timeframe chart shows that the XRP price has retreated in the past few days, moving from a high of $2.4153 on January 6 to $2.09 by Friday evening.

On the positive side, the token remains above the 50-day Exponential Moving Average, which is a bullish sign. It also remains above the Supertrend indicator.

The coin is also above the upper side of the falling wedge pattern, a common bullish reversal sign. Therefore, the token will likely rebound and initially retest the year-to-date high of $2.4153, which is about 15% above the current level.

A move above that level will point to more gains, potentially to the psychological point at $3, which is ~42% above the current level.

You May Also Like

Solstice Finance Officially Launches USX, A Solana-Native Stablecoin With $160M Deposited TVL

Indonesia approves $70 million-backed ICEx as the country's second official cryptocurrency exchange.