XRP Whales Wake Up: $100,000+ Transfers Hit 3-Month High

XRP Ledger whale activity spiked sharply at the start of the week, with on-chain data provider Santiment flagging a surge in large-value transfers that pushed the network to its highest $100,000+ transaction count in roughly three months, a setup the firm says typically coincides with elevated volatility.

XRP Whales Are Waking Up Again

“XRP Ledger has seen a major increase in whale transactions (moved valued at $100K or more on the network),” Santiment wrote in a post on Wednesday via X alongside a Sanbase chart. “Monday saw 2,170 of them, and yesterday shot all the way up to 2,802 (a 3-month high). Volatility should be higher than usual.”

The chart, labeled “XRP $1M+ & $100K+ Whale Transactions Per Day,” highlights two specific data points for the $100K+ threshold: 2,170 transactions on Jan. 5, 2026 and 2,802 transactions on Jan. 6, 2026. The Jan. 6 print is marked as the local peak and, per Santiment’s commentary, the strongest reading in approximately three months, the highest shown since the infamous October 10 liquidation event.

While Santiment’s post spotlights $100K+ transfers, the chart also tracks $1 million-plus whale transactions. That series suggests large-holder activity picked up across multiple size bands into the early-January move, with $1 million transactions pushing to a one-month high, the strongest reading since early December.

The jump stands out because $1 million-plus activity appears to have been comparatively muted through most of December, especially when set against the mid-October to November stretch, when the chart shows more frequent days with higher counts.

In practical market terms, traders tend to watch bursts in large on-chain transfers for what they might represent rather than treating the raw counts as a directional signal. Spikes can reflect accumulation or distribution, internal treasury movements by large entities, exchange-related transfers, or positioning around liquidity events. What they often share is mechanical impact: when large holders move size, the probability of sharper intraday swings tends to increase, particularly if that activity persists over multiple sessions.

XRP Also Re-Enters The Social ‘Trending’ Set

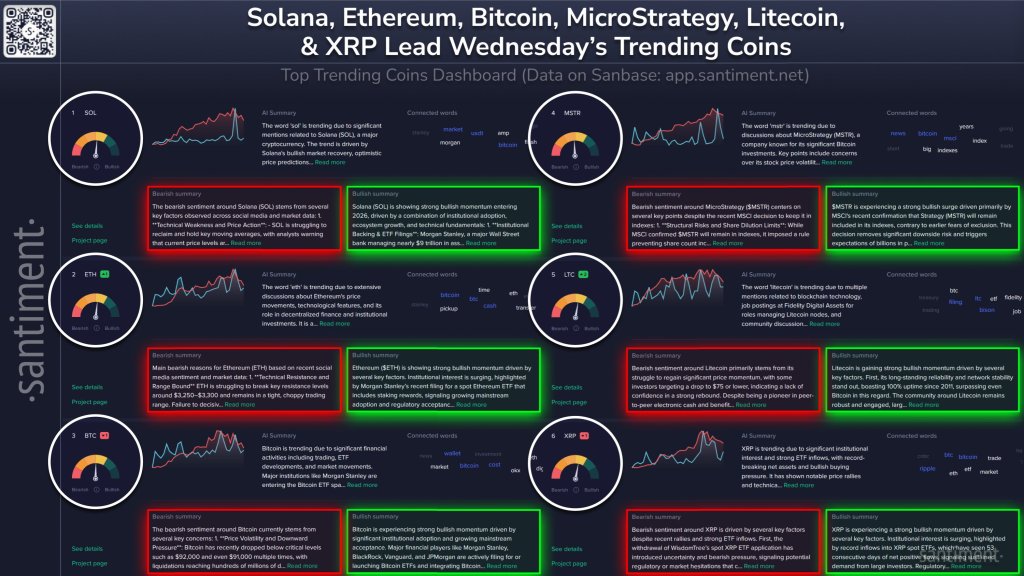

The whale-transaction alert landed alongside a separate Santiment update that placed XRP among the assets seeing the biggest jumps in discussion across social channels. In that post, Santiment grouped XRP with Solana, Ethereum, Bitcoin, MicroStrategy, and Litecoin as the day’s top “trending” tickers by changes in conversation volume for Wednesday.

For XRP specifically, Santiment said the discussion mix leaned heavily institutional in tone: ETF flows, “record-breaking net assets,” and the idea of XRP as a high-beta trade into 2025–2026 narratives while also referencing perceived regulatory clarity after the SEC case resolution and use cases such as bridge activity for stablecoins and tokenized real-world assets. Those claims were presented as themes circulating in social chatter rather than as independently verified developments in the post itself.

At press time, XRP traded at $2.127.

You May Also Like

Tether CEO Delivers Rare Bitcoin Price Comment

Markets await Fed’s first 2025 cut, experts bet “this bull market is not even close to over”