Ripple Updates XRP ‘Fast Facts’ As ETF And Institutional Momentum Grows

RippleX, the developer-focused arm of Ripple,used a Jan. 6 X thread to refresh a set of “FAST FACTS” about XRP, framing the asset less as a speculative ticker and more as market infrastructure, arriving as spot ETF momentum and early institutional treasury narratives begin to form around the token.

“XRP is a digital asset of choice for real-world utility – from stablecoin settlement to real-world assets, to institutional payments,” RippleX wrote. “With new momentum around XRP ETFs and institutional treasuries forming, here are some updated FAST FACTS about XRP.”

What Is XRP?

The thread’s opening points stick to the positioning Ripple has leaned on for years: XRP as a liquidity and settlement rail between financial systems rather than an app-layer bet.

RippleX described it as “a functional digital asset designed for settlement and liquidity, focusing on moving value between financial systems,” adding that, “acting as a neutral bridge, it helps move value between payments, stablecoins, tokenized financial assets, and collateral across the global economy.”

RippleX also reiterated supply constraints and control narratives that frequently resurface in institutional due diligence. “XRP was created at the launch of XRPL in 2012 and its supply is permanently capped at 100B – no additional XRP can ever be minted and no single entity (including Ripple) controls or can change the total supply,” the post said.

Other “fast facts” were more about market posture than mechanics, including the claim that XRP is “one of the few digital assets with clear regulatory standing in the US” and that it remains a top-three asset by market capitalization.

RippleX devoted several entries to XRPL’s decentralization metrics and operational history, emphasizing that the ledger runs independently of Ripple the company.

“XRPL is a public, decentralized blockchain with 116+ independent validators and 910+ public nodes – it operates independent of Ripple as an entity,” RippleX wrote. “XRP plays a core role on the network as its native settlement and liquidity asset.”

On consensus and execution, RippleX said XRPL uses “Proof-of-Association (PoA),” describing a model with “no mining, no staking, no block rewards,” and “transaction finality in 3–5 seconds.” It also pointed to network-scale usage stats since inception: “4B+ transactions,” “100M+ ledgers,” “6.4M+ wallets,” and “$1T+ in value” settled.

Real-World Assets And Stablecoins

A notable portion of the thread focused on RWAs and stablecoins,two categories where issuers and liquidity relationships matter more than raw TPS.

RippleX said XRPL is “now one of the top 10 blockchains for RWA activity,” listing issuers and initiatives “such as Ondo Finance, OpenEden, Archax/abrdn, Guggenheim Treasury Services, Mercado Bitcoin, VERT, and the Dubai Land Department” as building or launching assets on XRPL.

On stablecoins, RippleX cited a “growing stablecoin ecosystem” including “RLUSD, USDC, XSGD, AUDD, BBRL/USBD, and EURCV,” adding that “XRP often serves as a liquidity pair,” facilitating exchange between stablecoins and other assets on the network.

RippleX’s final “fast facts” aimed directly at regulated access and institutional balance sheets. It claimed XRP “now has its first institutional treasury” via Evernorth, which “has secured more than $1B in commitments,” describing this as a shift “from a traded asset to a regulated, balance-sheet asset for institutions.”

It also said XRP is “now supported by multiple spot ETFs,” naming Bitwise (XRP), Canary Capital (XRPC), Franklin Templeton (XRPZ), and Grayscale (GXRP) as issuers—positioning ETFs as a bridge into “regulated, mainstream investment products.”

Finally, RippleX pointed to wrapped XRP as an interoperability lever, saying it extends XRP’s utility to the “XRPL EVM Sidechain” and to ecosystems including “Ethereum, Solana, Optimism, and HyperEVM.”

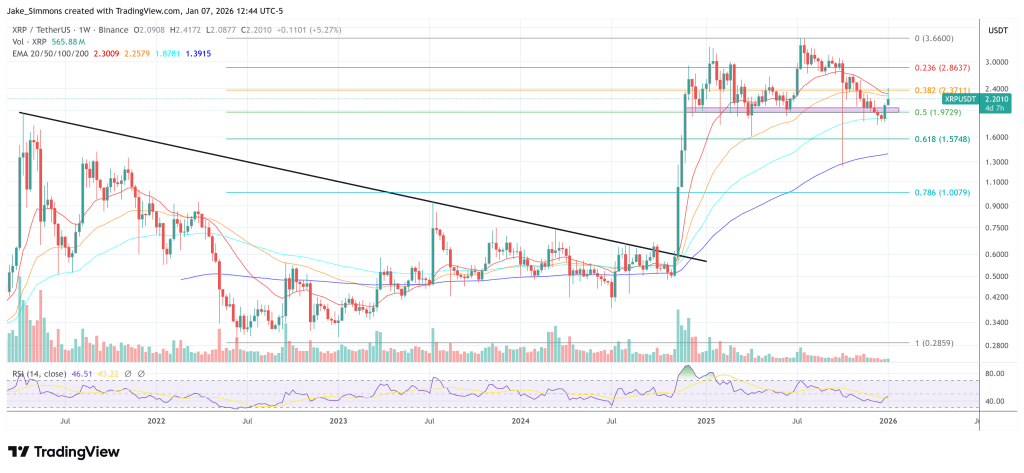

At press time, XRP traded at $2.20.

You May Also Like

Fed Decides On Interest Rates Today—Here’s What To Watch For

MicroStrategy Eyes New Bitcoin Milestone With Another Purchase