Morgan Stanley Seeks SEC Approval for Spot Bitcoin ETF

Bitcoin Magazine

Morgan Stanley Seeks SEC Approval for Spot Bitcoin ETF

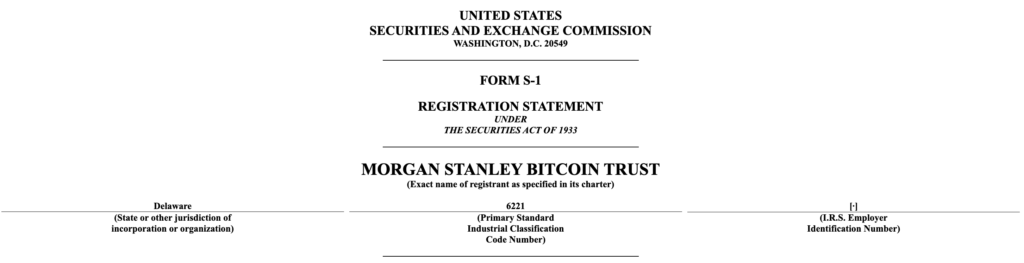

Morgan Stanley has filed with U.S. regulators to launch a spot bitcoin exchange-traded fund, marking the first time a major U.S. bank has sought approval to issue an ETF tied directly to the price of bitcoin.

The filing, submitted to the Securities and Exchange Commission, proposes the Morgan Stanley Bitcoin Trust, an exchange-traded fund designed to track the price of bitcoin, net of fees and expenses.

If approved, the fund would hold bitcoin directly rather than relying on futures, derivatives, or leverage, according to the registration statement.

The move places Morgan Stanley alongside asset managers that have dominated the bitcoin ETF market since regulators approved the first U.S. spot products in early 2024.

Those funds now manage more than $120 billion in assets, representing a meaningful share of bitcoin’s total market value. Much of that growth has flowed into bitcoin-only products from firms such as BlackRock and Fidelity.

Morgan Stanley’s entry signals a shift by large banks from distributing third-party crypto products toward issuing their own.

Until recently, U.S. banks largely limited their role to custody and brokerage services, citing regulatory uncertainty and risk controls. That stance has begun to change as federal agencies clarified how banks can engage with digital assets.

In December, the Office of the Comptroller of the Currency said banks may act as intermediaries for crypto transactions, narrowing the divide between traditional finance and digital markets. The SEC has also adjusted listing standards for spot crypto ETFs, smoothing the approval path for new issuers.

Morgan Stanley steps deeper into bitcoin

The proposed bitcoin trust would be sponsored by Morgan Stanley Investment Management. Shares would be created and redeemed in large blocks by authorized participants, either in cash or in kind.

The fund’s net asset value would be calculated daily using a pricing benchmark based on activity across major spot bitcoin exchanges. Retail investors would trade shares on a secondary market through standard brokerage accounts.

For Morgan Stanley, the filing builds on steps taken last year to expand crypto access across its wealth management business. In October, the bank widened eligibility for crypto investments to include all clients and account types.

By offering a proprietary bitcoin ETF, the firm can integrate the product directly into client portfolios and retain management fees that might otherwise go to rival issuers.

The move also reflects the economics of the bitcoin ETF market. Spot bitcoin funds have become some of the fastest-growing products in the U.S. ETF industry, with steady inflows even during periods of price volatility. BlackRock’s bitcoin ETF emerged as one of the firm’s top revenue contributors within its first year.

Morgan Stanley also filed paperwork for a similar fund tied to Solana, but bitcoin remains the core focus of institutional demand. Most assets in U.S. crypto ETFs are concentrated in bitcoin products, while funds linked to other tokens have drawn limited capital.

This post Morgan Stanley Seeks SEC Approval for Spot Bitcoin ETF first appeared on Bitcoin Magazine and is written by Micah Zimmerman.

You May Also Like

SHIB Burn Rate Plunges as Whale Activity Lags Behind PEPE and FLOKI

CME Group to launch Solana and XRP futures options in October