Why XRP Is Going up Today?

The post Why XRP Is Going up Today? appeared first on Coinpedia Fintech News

XRP, the fourth-largest cryptocurrency by market cap, has started 2026 on a strong note. In just six days, XRP has climbed nearly 30% from $1.78, and today alone it surged close to 13%, trading around $2.40. This sharp move has made XRP one of the top-performing crypto assets today.

So, what’s behind this sudden bullish rally in XRP? Let’s take a closer look.

Spot XRP ETFs Record Highest Volumes

One of the biggest drivers behind XRP’s rally is the surge in spot XRP ETF inflows. On January 6, 2026, spot XRP ETFs recorded around $46 million in net inflows, their highest single-day inflow since launch, led by Franklin Templeton, Bitwise, and Canary Capital led the activity.

A day earlier, total trading volume across U.S. spot XRP ETFs hit a peak of $64 million.

Even more important, cumulative ETF inflows since November 2025 have now hit $1.23 billion, with no recorded outflow days, showing steady institutional demand.

Geopolitical Events Boost Market Sentiment

Lately, the U.S. military has carried out an operation to capture Venezuelan President Nicolas Maduro, which has sparked geopolitical tension between many countries.

Despite the uncertainty, the news pushed investors toward risk assets, helping improve overall market sentiment, including crypto. As the broader crypto market turned bullish, XRP benefited from the shift, seeing a nearly 30% gain.

XRP Supply Tightens on Exchanges

According to Glassnode, XRP balances on exchanges have dropped sharply over the past 90 days. Exchange reserves fell from roughly 3.95 billion XRP to about 1.6 billion XRP, pushing available supply to its lowest level in eight years.

Lower exchange balances often mean fewer tokens available for immediate selling. While this does not guarantee higher prices, it can see rallies when demand rises, which appears to be happening now.

Capital Rotates From Bitcoin Into Altcoins

As XRP began to rally, many traders started noticing a broader shift in the market. XRP is often seen as an early mover during altcoin rallies, which is why it is sometimes called the market’s “canary in the coal mine.”

Historically, when XRP rises sharply, it has signaled that capital is starting to move away from Bitcoin and into altcoins.

With strong ETF demand, shrinking supply on exchanges, and fresh money flowing into risk assets, XRP’s strong start to 2026 looks more than just a short-term price spike.

- Also Read :

- Bitcoin Price Hits $94k Fueled By Whale Accumulation and Retail Profit-taking

- ,

XRP Price Eyeing $3.40 Level

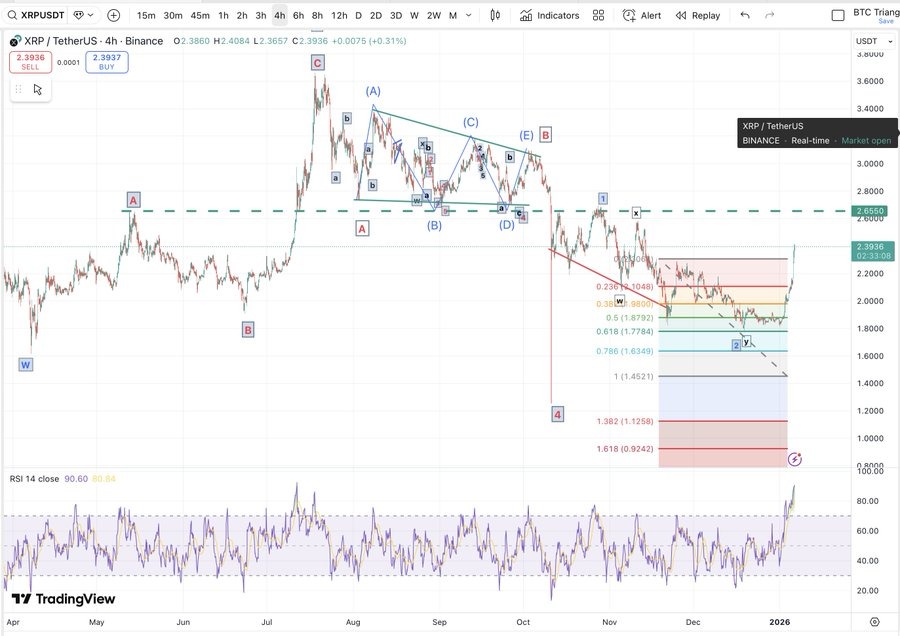

After months of slow and weak movement, XRP’s price is starting to show a clear direction. Veteran trader Matthew Dixon says XRP has formed a large triangle pattern, which usually signals a correction, not a breakdown.

He points to $2.68 as the key resistance level. XRP has struggled to move above this price several times. A daily close above $2.68 would confirm a breakout and could push XRP toward the $3.40 range.

On the downside, strong buying support remains between $1.90 and $2.10, where the price has repeatedly bounced.

FAQs

Strong spot XRP ETF inflows, shrinking exchange supply, and broader bullish crypto sentiment from geopolitical shifts are fueling XRP’s nearly 30% surge to around $2.40.

Investors are piling into regulated XRP exposure, with $46 million in net inflows on January 6, 2026—the highest single-day total—pushing cumulative inflows past $1.23 billion since launch, showing steady institutional demand.

Yes, XRP often acts as an early mover. Its sharp rally suggests capital is rotating from Bitcoin into altcoins, a classic sign of broader market shifts toward riskier assets.

Analysts note key resistance at $2.68. A sustained break above could target $3.40, with strong support between $1.90-$2.10, indicating a clearer bullish structure.

You May Also Like

Crypto Executives Advocate for U.S. Strategic Bitcoin Reserve Legislation

a16z names privacy as top priority for 2026