The Great XRP Exodus: Here’s How Much Is Left On Crypto Exchanges

XRP is quietly going through one of its most dramatic supply changes in years, and it is happening away from price charts and headlines. The real change is happening in crypto exchanges, as on-chain data shows a steady and persistent drawdown of XRP balances on these platforms.

The latest data from CryptoQuant highlights just how pronounced this trend has become, with exchange reserves now sitting at their lowest level in several years.

Exchange Reserves Breakdown After Year-End

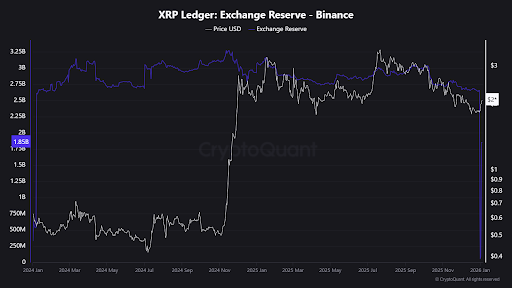

The pattern of XRP exodus on crypto exchanges is visible on major trading venues, particularly Binance, which accounts for a large share of XRP liquidity. The CryptoQuant chart tracking the amount of XRP held on crypto exchange Binance shows a clear back-and-forth movement through 2024 and 2025, which eventually culminated in a sharp drop into early 2026.

Between 2024 and early 2025, centralized crypto exchanges collectively held well above 3 billion XRP in their reserves. That figure has since fallen to the 2 billion XRP range in late 2025, with some brief spikes that were quickly reversed. Interestingly, the most recent data shows that exchange balances have fallen further at the beginning of 2026.

However, XRP balances on Binance were still elevated as 2025 came to a close, holding steady above 2 billion XRP tokens through the final trading days of the year. At the time of writing, on-chain data from CryptoQuant shows that the total XRP has dropped to about 1.85 billion tokens, down from roughly 2.65 billion XRP on December 31, 2025. That represents an exit of nearly 800 million XRP from the exchange within the first five days of 2026.

Glassnode Data Shows Even Fewer Tokens On Exchanges

An even tighter picture of XRP’s exchange supply can be seen through Glassnode data highlighted on X by an account known as BULLRUNNERS. A chart shared on X by BULLRUNNERS shows that XRP balances across all exchanges may be far lower than many traders realize.

Reacting to the data, the account noted that only 1.44 billion XRP is left on crypto exchanges. The chart shows a steep drop in XRP reserves from above 1.53 billion XRP to 1.44 billion XRP within the most recent trading sessions.

Reduced supply on exchanges can affect price reactions and is bullish for cryptocurrencies, at least in theory. Interestingly, XRP price’s action is starting to react to the outflows, amongst other factors, in the past 48 hours.

At the time of writing, XRP is now back above $2 and is trading at $2.15. The significance of the ongoing exchange outflows becomes clearer when they are considered alongside the steady inflows into Spot XRP ETFs, which, so far, have not recorded a single day of net outflows since launch.

You May Also Like

Crucial ETH Unstaking Period: Vitalik Buterin’s Unwavering Defense for Network Security

White House adviser: Cryptocurrency bill is "very close" to passage