XRP Breaks $2 as ETF Inflows Fuel Early-2026 Rally

- XRP rose to $2.11 and became the fourth-largest cryptocurrency by market cap, fueled by $13.59 million in net ETF inflows on January 2.

- While broader crypto markets and Bitcoin funds remained flat, spot XRP ETFs reached a cumulative inflow total of approximately $1.18 billion.

- The price surge is linked to the departure of SEC Commissioner Caroline Crenshaw and anticipation of a Market Structure Bill markup on January 15.

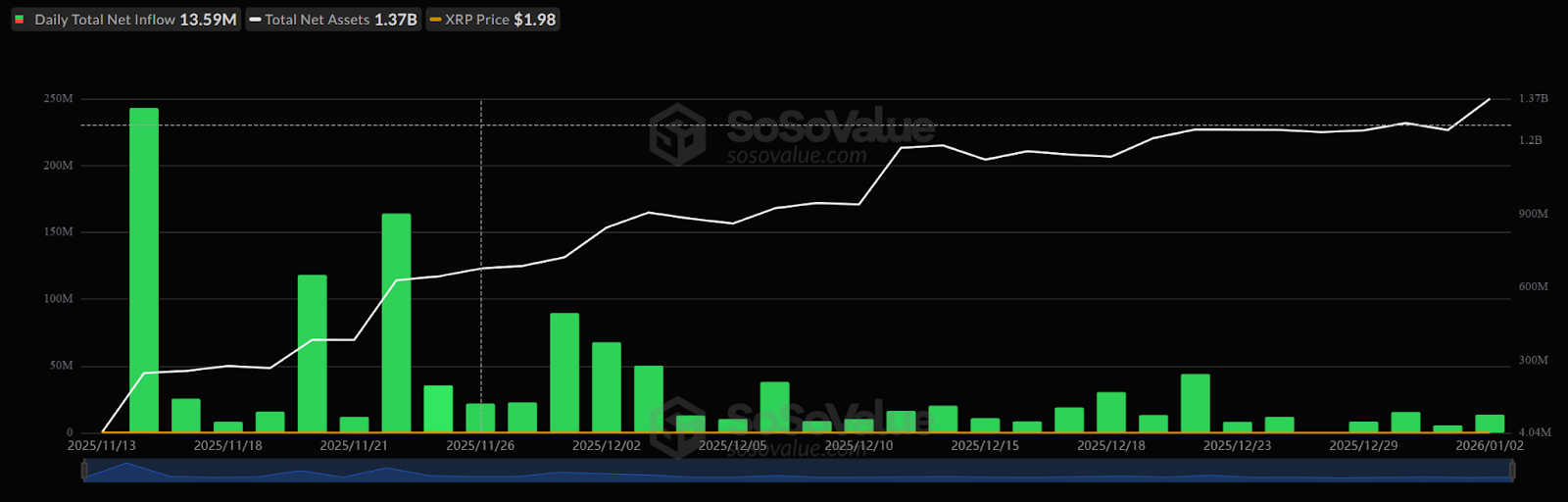

US spot XRP ETFs recorded US$13.59 million (AU$20.7 million) of net inflows on Jan. 2, lifting cumulative inflows since launch to about US$1.18 billion (AU$1.8 billion), according to data cited by SoSoValue. Traders said the ongoing buying has supported XRP in early 2026, even as broader crypto markets have been relatively flat.

XRP moved above US$2 (AU$2.9) on Friday for the first time since mid-December, with market participants pointing to the combination of ETF demand and shifting expectations around US regulation.

Total XRP Spot ETF Net Inflow. Source: SoSo Value.

Total XRP Spot ETF Net Inflow. Source: SoSo Value.

By this Monday morning, XRP trades at US$2.11 (AU$3.16), a 12% increase in the last seven days, and one of the best performers this Monday with a surge of over 5%, dethroning Binance Coin (BNB) from the fourth place as the largest crypto asset by market cap.

Source: TradingView.

Source: TradingView.

Related: Crypto Hack Losses Plunge 60% in December Despite $50M Address Poisoning Scam

A Friendlier SEC?

Part of XRP’s price shift is tied to the departure of SEC Commissioner Caroline Crenshaw. Some traders viewed her exit as reducing resistance to more crypto-friendly policy decisions. Crenshaw had been a prominent critic of spot crypto ETFs and, according to market commentary, opposed the SEC dropping its appeal in the Ripple case.

Policy speculation also contributed to sentiment and traders highlighted a possible markup of a Market Structure Bill on Jan. 15, keeping expectations elevated into the first quarter and helping XRP outperform.

Flows into other major crypto ETF products were described as less supportive over the same period, with weaker demand for Bitcoin funds cited by analysts. That divergence reinforced the view that XRP’s move has been driven mainly by XRP-specific catalysts rather than a broad risk-on push across crypto.

Read more: Beckham-Backed Prenetics Drops Bitcoin Treasury Plans After $48M Raise

The post XRP Breaks $2 as ETF Inflows Fuel Early-2026 Rally appeared first on Crypto News Australia.

You May Also Like

The Best Crypto Presale in 2025? Solana and ADA Struggle, but Lyno AI Surges With Growing Momentum

What to Look for in Professional Liability Insurance for Beauty Professionals