Everyone Is Searching for XRP, What’s Going On?

- Global search interest for XRP spiked to a peak score of 100, signaling a sudden and widespread surge in attention.

- Analysts link the spike to infrastructure and policy developments, including RLUSD pilots, ETF momentum, and regulatory progress.

- The rise in searches suggests renewed engagement, with investors and institutions reassessing XRP’s role in regulated digital finance.

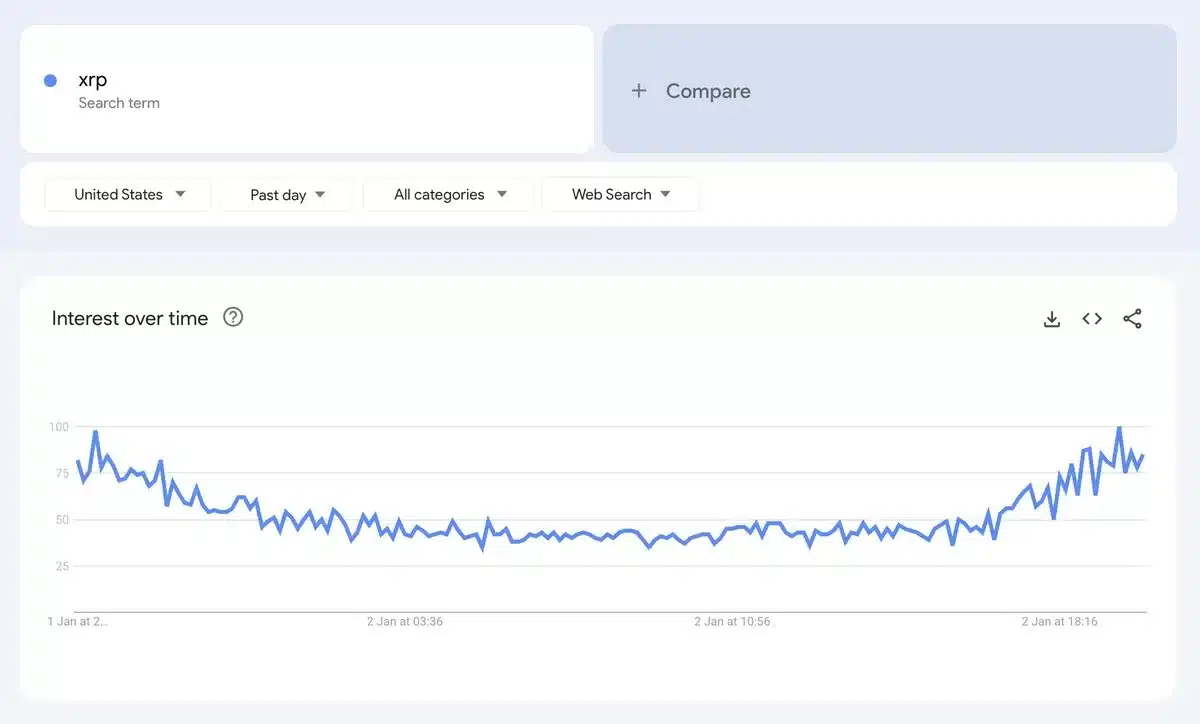

Online interest in XRP has surged sharply, with search data showing a rapid spike in global queries over the past few hours. According to Google Trends, searches for “XRP” reached a peak score of 100 worldwide, indicating the highest level of relative interest recorded in the selected timeframe.

The sudden acceleration suggests renewed attention from both retail participants and market observers, pushing XRP back into the spotlight. The spike was visible in near real time, with search interest climbing steadily before breaking higher, a pattern that often accompanies major narrative shifts or heightened market anticipation.

Google Trends Highlights Sudden Acceleration in Interest

Google Trends data shows XRP search activity rising from already elevated levels to a clear peak. The data, captured on January 2, 2026, reflects worldwide interest over the past four hours, emphasizing how quickly attention intensified.

While Google notes that the most recent data point may be partially incomplete, the trend itself signals a decisive jump rather than a gradual build. Historically, similar spikes in search activity have coincided with major announcements, regulatory developments, or early stages of broader market re-engagement.

Also Read: The Last Time This Happened, XRP Rallied 69% – Major Pump on the Horizon?

Analysts Link Spike to Infrastructure and Policy Developments

Crypto analyst Steph Is Crypto reacted to the data by highlighting the unusual scale of the search surge, questioning what catalyst could be driving such widespread attention. Rather than pointing to price speculation alone, the timing appears aligned with several structural developments surrounding XRP.

XRP community member Monica Anderson noted that the renewed search acceleration followed closely after RLUSD pilot programs, growing ETF traction, and continued policy progress. According to Anderson, these factors suggest a shift in focus back toward real financial infrastructure rather than short-term trading narratives.

Source: Google Trends

From Speculation to Infrastructure Narrative

Market participants increasingly point out that XRP discussions are evolving away from purely speculative price talk. The combination of stablecoin pilots on the XRP Ledger, expanding regulated investment products, and clearer policy signals appears to be drawing fresh attention from a broader audience.

Analysts argue that rising search interest often reflects curiosity about what comes next, not what has already happened. In this context, the surge may indicate that investors and institutions alike are reassessing XRP’s role within regulated digital finance.

What the Search Spike Could Signal Next

While a surge in search traffic does not guarantee immediate market moves, it often precedes increased engagement across trading platforms, social media, and institutional research desks.

If infrastructure milestones continue to stack up, analysts suggest XRP could remain a focal point of discussion in the weeks ahead. For now, the data points to one clear conclusion: attention is returning to XRP in a meaningful way, driven less by hype and more by developments tied to long-term utility and adoption.

Also Read: RippleX Engineer Drops Bold 2026 Outlook That Has XRP Community Watching

The post Everyone Is Searching for XRP, What’s Going On? appeared first on 36Crypto.

You May Also Like

How to earn from cloud mining: IeByte’s upgraded auto-cloud mining platform unlocks genuine passive earnings

China Blocks Nvidia’s RTX Pro 6000D as Local Chips Rise