500,000,000 XRP Locked Until 2028 – Why It Matters

- 500 million XRP has been escrowed until November 2028, removing that supply from circulation and reinforcing long-term supply transparency.

- The lock-up improves predictability for institutions, a key factor for ETFs, regulated products, and large-scale capital allocation.

- Multi-signature escrow signals long-term intent, strengthening confidence in XRP’s supply discipline.

A new on-chain transaction showing the escrow of 500 million XRP until late 2028 has reignited discussion around XRP’s supply dynamics and institutional appeal. According to analyst X Finance Bull, the move carries broader implications than it may appear at first glance, particularly as XRP positions itself for deeper participation in regulated financial markets.

On-Chain Data Confirms 500 Million XRP Escrow

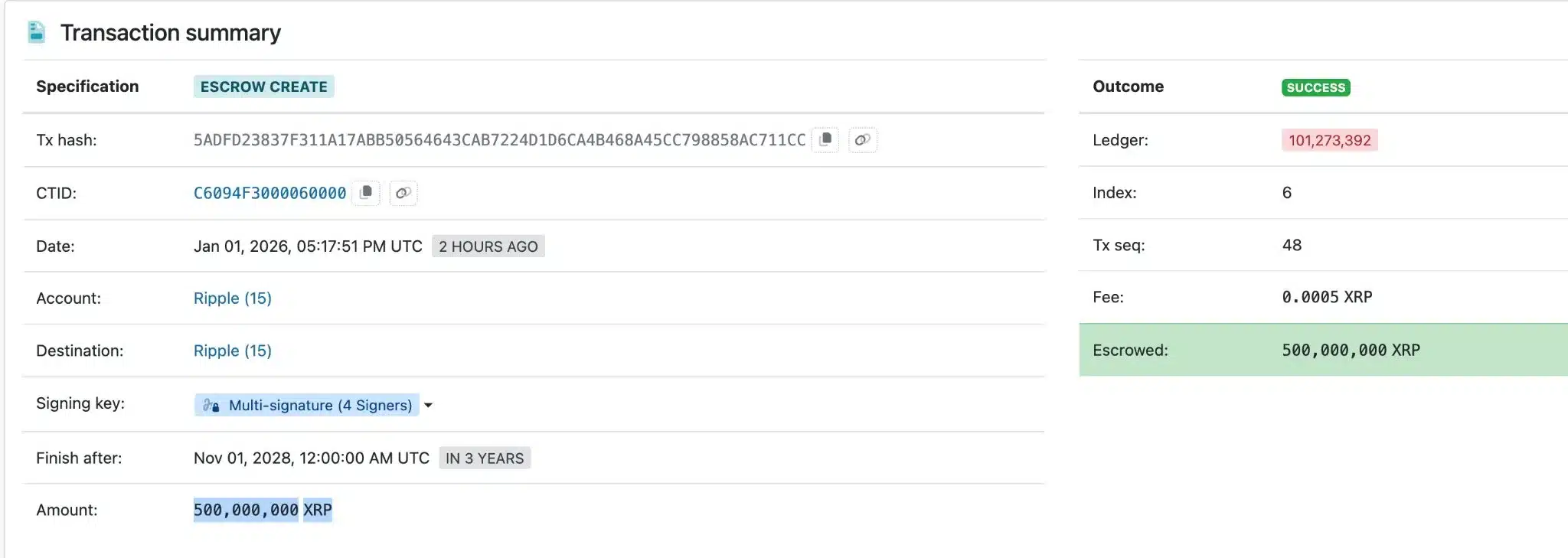

Blockchain records show a successful “Escrow Create” transaction executed by a Ripple-linked account, locking 500,000,000 XRP until November 1, 2028. The transaction was signed using a multi-signature setup involving four signers and recorded at ledger index 101,273,392, confirming both the authenticity and enforceability of the lock-up.

The escrowed funds cannot be accessed or moved until the specified release date, providing a three-year window during which this supply is effectively removed from circulation. The structure and transparency of the transaction have drawn attention from analysts tracking XRP’s circulating supply and long-term issuance schedule.

Also Read: Real Progress That Quietly Changed How XRP Is Viewed

Why Supply Predictability Matters to Institutions

X Finance Bull argues that the significance of the escrow lies less in the raw number and more in what it represents for institutional confidence. Large asset managers and financial institutions tend to prioritize predictability, particularly when assessing assets for long-term exposure or product structuring.

By locking a sizable tranche of XRP under clear, verifiable conditions, Ripple reduces uncertainty around potential sudden supply increases. This predictability can be especially relevant as spot XRP exchange-traded fund (ETF) activity expands and as regulated financial products require clearer assumptions about available liquidity.

Source: XRP Scan

Context: ETFs, Stablecoins, and Infrastructure Maturity

The timing of the escrow has also caught attention. It comes amid growing ETF-related inflows, expanding stablecoin usage across payment rails, and the broader maturation of crypto infrastructure.

Analysts note that, in this environment, clarity around supply mechanics becomes increasingly important. With fewer unanswered questions around when large amounts of XRP might enter the market, institutions can model liquidity and risk with greater confidence.

According to proponents, this supports the view of XRP as a more “ownable” asset at scale rather than a speculative instrument subject to unpredictable dilution.

The use of a multi-signature authorization adds another layer of assurance. Multi-sig escrows are commonly interpreted as signals of deliberate, long-term planning rather than short-term treasury management. Combined with the extended unlock date, the setup reinforces the idea that the locked XRP is not intended for near-term market activity.

A Step Toward Greater Market Confidence

While the escrow does not directly affect XRP’s price in the short term, analysts suggest it strengthens the broader narrative around supply discipline and transparency. For institutional participants weighing large allocations, such measures can reduce perceived risk and improve confidence in long-term exposure.

As X Finance Bull summarized, predictability is a key ingredient for Wall Street conviction, and with 500 million XRP locked until 2028, that predictability has become clearer.

Also Read: $3,600,000,000 XRP Shifted By Mega Whale Amid Ripple Escrow Relock – What’s Happening?

The post 500,000,000 XRP Locked Until 2028 – Why It Matters appeared first on 36Crypto.

You May Also Like

Coinbase To List Singaporean Dollar Stablecoin For Trading

Why Is Shiba Inu (SHIB) Price Pumping Today?