XRP Bucks Crypto Fund Outflows, Adds $70M as Standard Chartered Flags 330% Upside

- Crypto exchange-traded products recorded US$446 million in outflows for a second consecutive week, with Bitcoin and Ethereum products experiencing the heaviest investor selling.

- XRP-linked funds bucked the trend by attracting US$70 million in inflows, primarily driven by newly launched exchange-traded funds including Franklin Templeton’s recent product.

- US Bitcoin ETFs have endured seven straight days of net outflows totalling US$1.1 billion since mid-December, though they collectively hold 6.1% of total Bitcoin supply.

- Standard Chartered’s Geoffrey Kendrick predicts XRP could reach US$8 in 2026, more than double its previous all-time high, supported by the resolution of the SEC lawsuit against Ripple.

While crypto exchange-traded products (ETPs) as a group posted US$446 million (AU$665 million) in outflows for a second straight week, XRP-linked funds stood out with US$70 million (AU$104 million) in inflows, according to CoinShares.

Demand was led by new XRP exchange-traded funds (ETFs), including Franklin Templeton’s recently launched product, even as Bitcoin and Ethereum products bore the brunt of investor selling.

US Bitcoin ETFs have now seen seven consecutive days of net outflows, totalling US$1.1 billion (AU$1.64 billion) since 18 December. Combined, US BTC ETFs still hold 6.1% (or 1.29 million BTC) of the total Bitcoin supply, worth US$112.9 billion (AU$168.4 billion). The biggest holder remains BlackRock’s iShares Bitcoin Trust (IBIT), with US$67 billion (AU$99.9 billion), or 3.6% of all BTC.

At the time of writing, data for IBIT, Invesco’s BTCO and VanEck’s HODL was not yet available and was excluded from the reporting.

While Ethereum ETFs didn’t fare much better, with hundreds of millions in net outflows over recent days, Solana ETFs avoided net negative flows, though accumulation slowed somewhat. Recent flows on Monday showed US$2.5 million (AU$3.7 million) in net inflows.

Related: Bitcoin’s Next Decade: Fewer Fireworks, More Fundamentals

XRP ETFs See Strongest Month-on-Month Flows

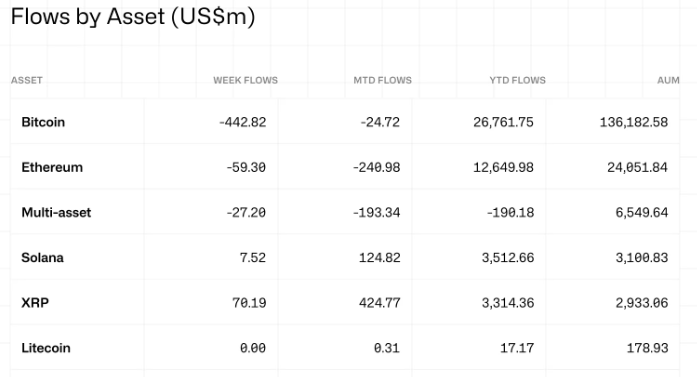

The recent surge in investor interest is reflected in monthly data, with CoinShares reporting that XRP ETFs recorded the strongest monthly inflows at US$424.77 million (AU$633.5 million). Most other ETFs recorded hefty monthly outflows, with Solana, Litecoin, Sui and Chainlink standing out as the only products to post modest net inflows.

Crypto ETF flows, source: CoinShares

Crypto ETF flows, source: CoinShares

Analysts at CoinShares said in a recent report that these flows suggest “investor sentiment has yet to fully recover,” but noted that “year-to-date (YTD) flows remain broadly in line with last year”.

Total assets under management (AUM) have risen by just 10% YTD, indicating that the average investor has not seen a positive outcome this year once flows are taken into account.

CoinShares

CoinShares

Bullish XRP Target for 2026

The strong performance of XRP ETFs, combined with the conclusion of the SEC vs Ripple lawsuit earlier this year, has led some analysts to make bullish predictions for the token in 2026. Geoffrey Kendrick, global head of digital assets research at Standard Chartered, believes XRP will reach US$8 (AU$11.93) next year.

That would be more than double its all-time high of US$3.65 (AU$5.44), reached in July this year, and over 4x its current price of around US$1.84 (AU$2.74). XRP is down 2.5% over the past 24 hours, broadly in line with the wider market slump.

Related: Uniswap Burns $596M in UNI After Near-Unanimous Governance Vote

The post XRP Bucks Crypto Fund Outflows, Adds $70M as Standard Chartered Flags 330% Upside appeared first on Crypto News Australia.

You May Also Like

CEO Sandeep Nailwal Shared Highlights About RWA on Polygon

Uniswap & Monero Chase Gains: While Zero Knowledge Proof’s Presale Auctions Target Record $1.7B