Here’s Why Large Allocators Are Taking Note of XRP – Analyst Cites WisdomTree

- Regulatory clarity is now driving real capital flows, with institutions allocating to blockchains that can be used within U.S. compliance frameworks.

- WisdomTree highlights XRP as a regulatory winner, citing its post-lawsuit clarity and role as compliant cross-border settlement infrastructure.

- XRP is shifting from speculation to institutional utility, increasingly viewed as tradable financial infrastructure.

Crypto pundit Stern Drew argues that regulatory clarity is no longer a theoretical discussion but a decisive trigger for capital flows. Drawing on his background in risk trading, Drew noted that markets typically reallocate capital well before narratives catch up.

As regulatory regimes solidify across the United States and Europe, institutions are increasingly directing funds toward blockchains that can be held, hedged, and deployed within compliance frameworks. According to Drew, this shift explains why certain networks are beginning to stand out to large allocators, even as broader market attention remains fragmented.

WisdomTree Analysis Highlights Regulatory Winners

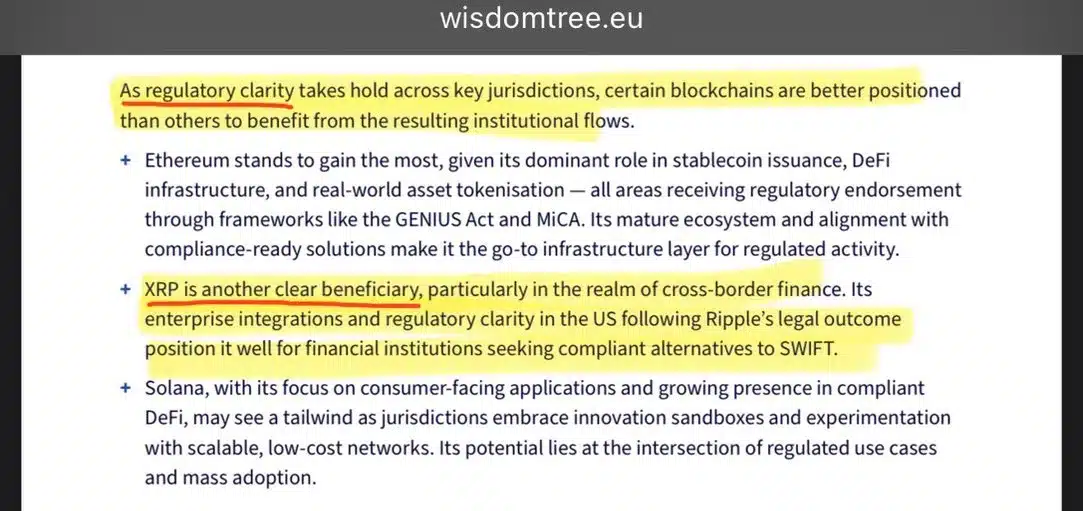

Drew’s comments reference a recent analysis from asset manager WisdomTree, which outlines how regulatory clarity is reshaping institutional blockchain exposure. The document emphasizes that as clearer rules take hold across key jurisdictions, some networks are better positioned than others to benefit from resulting institutional inflows.

The analysis highlights Ethereum as a primary beneficiary due to its dominant role in stablecoin issuance, decentralized finance infrastructure, and real-world asset tokenization, areas increasingly supported by regulatory frameworks such as the GENIUS Act and Europe’s MiCA regime. However, WisdomTree also points to XRP as another clear beneficiary of this regulatory shift.

Also Read: Schiff Dismisses Bitcoin Energy Claims, Calls BTC Mining Power a Total Waste

XRP Positioned as Compliant Cross-Border Infrastructure

According to the WisdomTree excerpt, XRP stands out particularly in cross-border finance. The document notes that XRP’s enterprise integrations and regulatory clarity in the United States, following Ripple’s legal outcome, position it well for financial institutions seeking compliant alternatives to the SWIFT messaging system.

Stern Drew echoed this view, stating that XRP has moved beyond speculative narratives and into the category of “tradable infrastructure.” With legal uncertainty largely resolved, he argues that XRP can now be treated as a functional settlement rail rather than a high-beta crypto asset.

From Narrative Asset to Institutional Utility

Drew emphasized that post-legal clarity, XRP’s role becomes more defined. Its use in regulated cross-border payments allows institutions to deploy capital with greater confidence, transforming XRP into an asset that fits within existing risk and compliance frameworks.

“Bitcoin remains the macro hedge,” Drew said, noting its continued role as a hedge against broader economic uncertainty. However, he stressed that the next phase of institutional allocation is shifting toward utility-driven exposure, including tokenization, regulated payments, and settlement infrastructure.

Why Allocators Are Taking Notice of XRP

The WisdomTree screenshot further underscores this theme by grouping XRP alongside Ethereum as a beneficiary of regulatory endorsement, while also mentioning Solana as a potential tailwind beneficiary in compliant DeFi and consumer-facing applications.

Source: Stern Drew/X

For Drew, XRP’s appearance in such institutional analyses is significant. He argues that large allocators prioritize assets that can absorb real size without regulatory friction. In that context, XRP’s compliance-ready profile and defined role in global payments make it increasingly relevant to institutional portfolios.

A Broader Shift Toward Regulated Blockchain Use Cases

In the broader picture, Drew believes institutional capital is now gravitating toward blockchains that support real-world financial activity rather than purely speculative use cases. As regulatory clarity hardens, assets tied to settlement rails, tokenized assets, and compliant payment systems are gaining attention.

That shift, he argues, explains why XRP is now showing up in allocator books. With regulation acting as a green light rather than a constraint, XRP’s positioning within cross-border settlement infrastructure places it at the center of where institutional capital is beginning to move.

Also Read: Bitcoin Nears $90,000 as Solana Surges While Small Caps Explode Across Crypto Markets

The post Here’s Why Large Allocators Are Taking Note of XRP – Analyst Cites WisdomTree appeared first on 36Crypto.

You May Also Like

Ripple CTO Finally Reacts to Midnight as ‘New Cardano’ Enters XRP Conversation

XRP set for major reshuffle in 2026; Whales control the market, short-term gains could reach 41%