Chainlink’s Top Whales Reverse Course, Quietly Scoop Up $263M In LINK

On-chain data shows the top 100 whales on the Chainlink network have again started accumulating the asset recently, retracing their earlier distribution.

Top Chainlink Addresses Have Been Adding Since The Start Of November

In a new post on X, on-chain analytics firm Santiment has discussed about the latest trend in the holdings of the top Chainlink addresses. Santiment defines “top addresses” as the 100 largest wallets on the network.

This category would naturally include the largest of whales on the blockchain, who carry some degree of influence due to the sheer size of their holdings. As such, the behavior of these investors may be worth monitoring.

Now, here is the chart shared by Santiment that shows how the Chainlink supply held by the top addresses has changed over the last few months:

As displayed in the above graph, the combined supply of the 100 largest Chainlink wallets witnessed a decline in October, implying that these massive entities were participating in distribution.

The selling from the top addresses first began as LINK’s price went through a sharp crash. The selloff continued until the start of November, when the indicator finally arrived at a bottom.

Shortly after, the supply of the 100 largest LINK investors saw a reversal, signaling the return of accumulation. According to Santiment, these whales have collectively added 20.46 million tokens (about $263 million) to their holdings. This has not only retraced the October drawdown in their supply, but also in fact taken it to an even higher level.

While the top Chainlink addresses have shown net accumulation since the start of November, the pace of buying hasn’t been constant. From the chart, it’s apparent that most of the accumulation occurred in November, with not much coming in December so far.

It now remains to be seen what trend the 100 largest LINK investors will show next, and whether it will have any influence on where the cryptocurrency heads next.

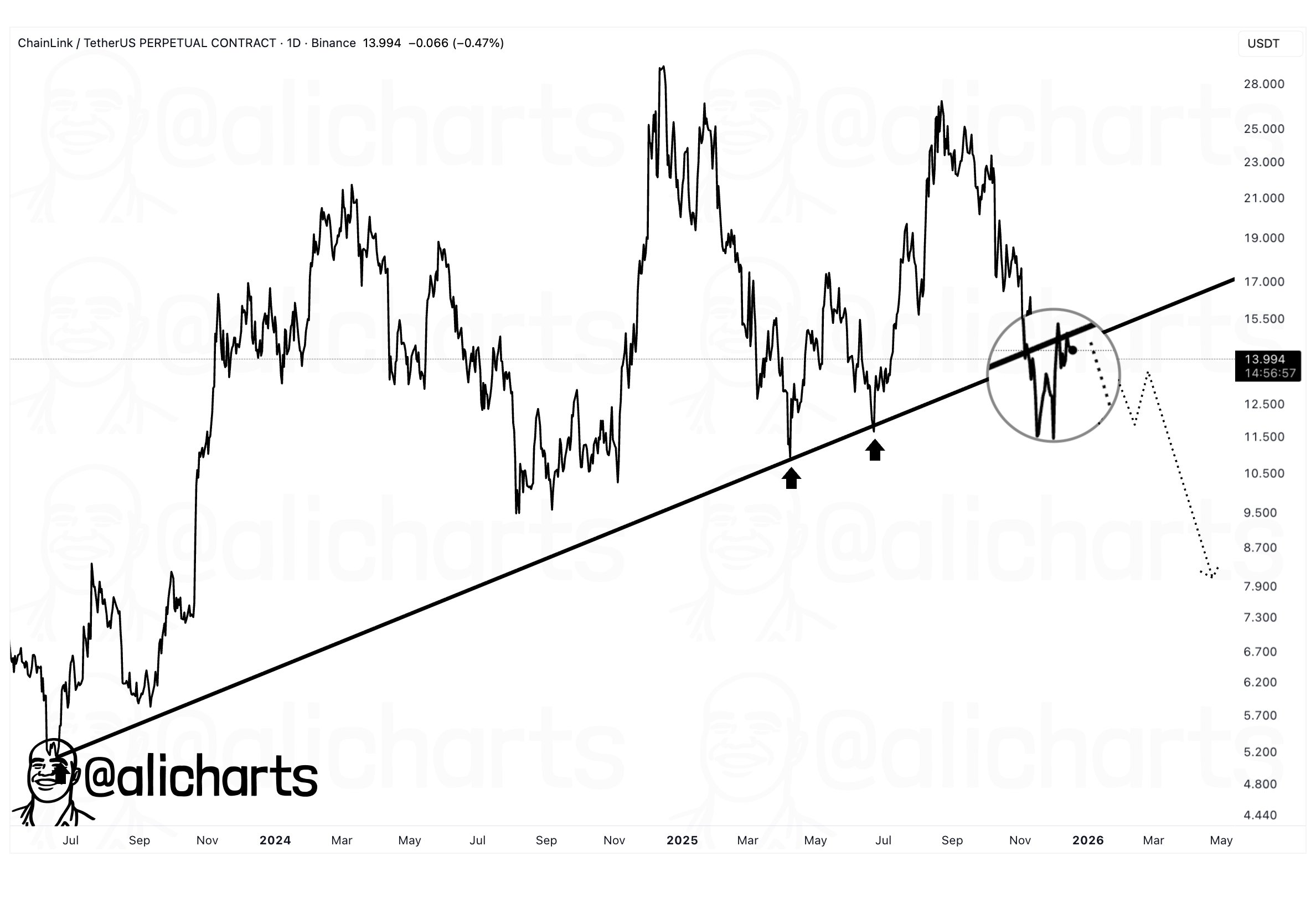

In some other news, Chainlink recently lost a multi-year technical support line, as analyst Ali Martinez has highlighted in an X post.

As is visible in the above chart, Chainlink made two retests of this line during the first half of 2025 and each time, it found support. The retest that occurred after the latest price downtrend, however, ended up in failure, with the asset dropping below this line for the first time since 2023.

After the breakdown, LINK attempted to retrace it, but the retest from below also ended in rejection, a potential sign that the support may have flipped into resistance.

LINK Price

Following its most recent drop, Chainlink is trading around $12.96.

You May Also Like

XRP Confirms Downtrend After $1.50 Breakdown, with $1.15 in Focus

Will Bitcoin Crash Again After Trump Insider Whale Dumps 6,599 BTC?