Franklin Templeton has made XRP the 4th largest position in its multi-coin ETF, signaling major institutional confidence. Fund weightings reflect conviction, risk analysis, and long-term expectations—and XRP now ranks ahead of dozens of other blockchains in their internal models. The firm sees strong upside, lower structural risk, and real utility in future digital finance. This move shows institutions are shifting from hype to real-world use cases, with XRP emerging as a core allocation in professional portfolios.

XRP News [LIVE] Update , 5th DEC – XRP ETF News , Ripple RLUSD , XRP Price.

![XRP News [LIVE] Update](https://image.coinpedia.org/wp-content/uploads/2025/12/01124853/How-High-or-Low-Can-XRP-Price-Go-After-Fifth-ETF-Launch-Today-1024x536.webp)

The post XRP News [LIVE] Update , 5th DEC – XRP ETF News , Ripple RLUSD , XRP Price. appeared first on Coinpedia Fintech News

December 5, 2025 06:21:34 UTC

XRP Becomes Core Holding in Franklin Templeton’s Multi-Coin ETF

December 5, 2025 06:14:47 UTC

Ripple Builds a One-Stop Global Finance Powerhouse with Major 2025 Acquisitions

Ripple has poured nearly $4B into expanding its crypto and payments ecosystem, making 2025 its boldest year yet. With major acquisitions—GTreasury, Rail, Palisade, and Ripple Prime—the company is building a unified, end-to-end infrastructure for real-time global value movement. From treasury intelligence and stablecoin payments to high-speed custody and institutional liquidity, Ripple is creating a complete payments stack that lets businesses move, manage and settle money instantly across traditional and digital assets.

December 5, 2025 06:14:47 UTC

XRP Ledger Velocity Hits Highest Level of the Year as On-Chain Activity Jumps

XRP Ledger’s Velocity metric surged to 0.0324 on December 2, marking its highest level of the year, according to CryptoQuant. This sharp rise shows XRP is moving rapidly across the network rather than sitting in cold wallets. Analyst CryptoOnchain says the spike reflects high liquidity, active trading, and increased whale movements. The surge in circulation signals strong on-chain activity and growing market participation around XRP.

December 5, 2025 06:10:42 UTC

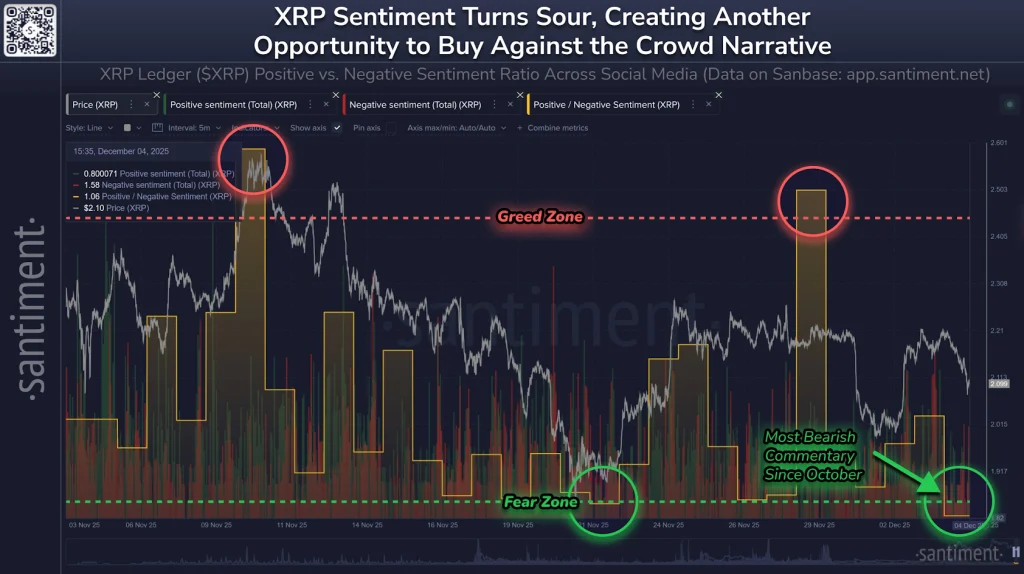

XRP Price Fear Spikes to Highest Level Since October

XRP’s fear levels have surged to their highest point since October, according to Santiment. The last time sentiment was this bearish, XRP bounced back with a strong 22% rally in November. Analysts say the current spike in fear could signal another potential buying opportunity if history repeats. With traders turning cautious and sentiment hitting extremes, XRP may be setting up for its next move.

December 5, 2025 06:01:24 UTC

XRP Scores Historic Win with First CFTC-Regulated U.S. Spot Listing

XRP just secured its biggest regulatory breakthrough yet. Bitnomial has launched the first CFTC-regulated spot crypto exchange in the U.S., and XRP is listed from day one. This allows XRP to trade spot, futures, perps, and options under federal oversight. Even more, XRP is now approved as trading collateral, meaning traders can post it as margin like Treasuries or stablecoins. A massive legitimacy upgrade for XRP.

You May Also Like

Peter Schiff challenges President Trump to debate, moves on Binance’s CZ

Solana Treasury Firm Holdings Could Double as Forward Industries Unveils $4 Billion Raise