Almost $1,000,000,000 XRP in Vaults – Here’s the Latest

- XRP’s assets under management near $1 billion, showing strong market growth.

- Ethereum’s ETF inflows surge, while Bitcoin sees slight decline.

- XRP steadily gains traction as investor confidence rises.

XRP’s presence in the cryptocurrency ETF market continues to grow, with total assets under management (AUM) across all XRP issuers now approaching a staggering $1 billion. This sharp increase highlights the confidence investors have in XRP, despite the regulatory hurdles it has faced in recent years.

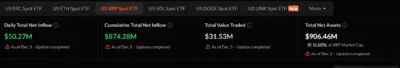

As of December 3, XRP Spot ETFs saw substantial daily inflows of $50.27 million according to Soso Value data. Cumulative net inflows for XRP now total $874.28 million, showcasing consistent investor interest. Additionally, XRP’s total AUM has reached $906.46 million, bringing it closer to the $1 billion mark, representing approximately 0.68% of XRP’s overall market capitalization.

Source: Sosovalue

Also Read: Ripple CEO Just Said the Quiet Part Out Loud, and it’s Huge for XRP

XRP’s Growing Influence in the Crypto ETF Market

While Bitcoin and Ethereum continue to dominate the cryptocurrency ETF landscape, XRP’s steady rise is a significant development. Within the same timeframe, Bitcoin’s Spot ETF saw a minor decline in daily inflows, with a net outflow of $14.90 million, whereas Ethereum’s Spot ETF recorded an impressive $140.16 million in daily net inflows. Ethereum’s total AUM has surged to $19.70 billion, a clear sign of growing interest from both institutional and retail investors.

However, despite the strong performance of Bitcoin and Ethereum, XRP is steadily increasing its market share. This trend indicates that investors are diversifying their portfolios and seeking exposure to XRP. Notably, XRP’s rapid accumulation of assets underscores its growing significance in the crypto space, especially as it nears the $1 billion threshold in vaults.

XRP’s Rise Amidst Market Competition

XRP’s performance continues to shine, with net inflows showing steady growth. The nearly $1 billion in institutional vaults reflects the increasing importance of XRP in the cryptocurrency ETF market. With cumulative net inflows now at $874.28 million, XRP’s consistent rise in AUM highlights its appeal to investors looking to diversify their portfolios with alternative crypto assets beyond Bitcoin and Ethereum.

Although Bitcoin’s dominance and Ethereum’s strong inflows are still notable, XRP’s sustained growth is attracting more investor attention. The latest data confirms that XRP is rapidly strengthening its foothold in the market, signaling a bright future for the cryptocurrency as it approaches the $1 billion mark in assets.

Also Read: Bitcoin and Ethereum Lead the Market with Positive 24-Hour Gains

The post Almost $1,000,000,000 XRP in Vaults – Here’s the Latest appeared first on 36Crypto.

You May Also Like

Trust Wallet issues security alert: It will never ask users for their mnemonic phrase or private key.

Crypto Market Cap Edges Up 2% as Bitcoin Approaches $118K After Fed Rate Trim