XRP News: XRPL Velocity Hits Record 2025 High, Will XRP Price Explode

The post XRP News: XRPL Velocity Hits Record 2025 High, Will XRP Price Explode appeared first on Coinpedia Fintech News

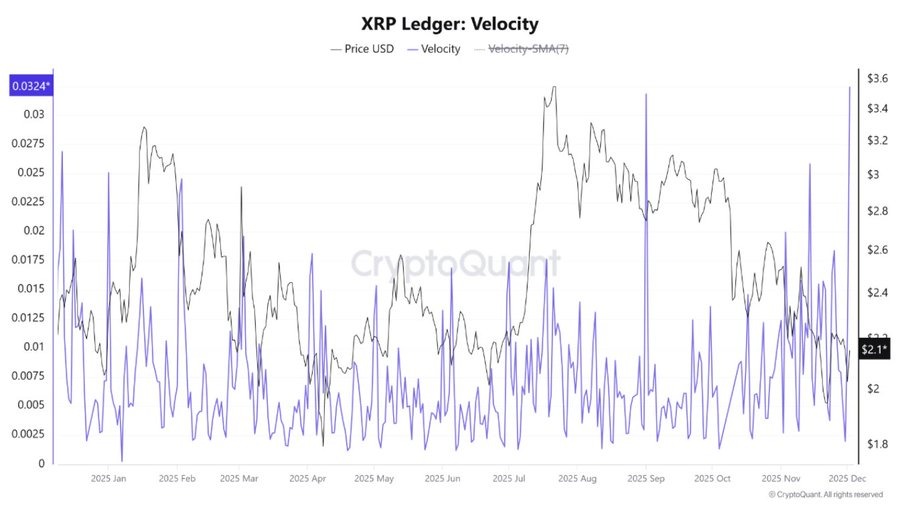

XRP is showing strong signs of rising activity as CryptoQuant, an on-chain analytics data provider, shows that the XRP Ledger recorded a massive spike in Velocity, hitting 0.0324, the highest level in 2025

At the same time, a lot of XRP is being taken off exchanges because institutional ETFs are buying large amounts.

With rising activity, traders are now wondering what this could mean for XRP?

XRP Velocity Hits New 2025 Peak as Ledger Activity Rises

According to CryptoQuant, XRP Ledger data showed a sharp rise in transaction Velocity, marking the highest level recorded this year. Meanwhile, the XRP ledger handled more than 2.23 billion XRP in payments in a single day.

This rise in movement hints that more traders, users, and even large investors are becoming active.

When velocity increases, it normally means coins are not sitting still. Instead, they are shifting rapidly between wallets, which often points to stronger network demand.

RealFi Brings Fresh Hype as $650T Real Estate Market Eyes XRP

A big part of the growing excitement comes from RealFi. December 5 is the key date, as the Real Token will list on a centralized exchange, opening access for many new users. RealFi, a project that plans to move real-world real estate onto the XRP Ledger.

This listing is seen as an important step for XRPL because it shows how real-world assets can be connected to blockchain systems in a simple and scalable way.

This sector is worth nearly $650 trillion, and even a 1% of this liquidity entering the XRPL ecosystem could increase demand for XRP.

XRP ETF Pulls Tokens From Exchanges

The launch of the XRP ETF is putting more pressure on XRP’s available supply. So far, these ETFs have pulled in over $874.3 million in net inflows, which reduces the number of tokens left for regular traders.

With fewer tokens available on exchanges, any rise in demand can create a supply shock, something traders are closely watching.

XRP Price Outlook

Looking at the XRP price chart, the token is forming a new long-term range after several months of slow movement.

Traders are keeping a close eye on the 0.618–0.786 Fibonacci zone, a region often used to identify strong reversal points. If XRP holds this zone well, the next potential target is in the $3.50–$4.00 range.

As of now, XRP is trading around $2.16, down 1% over the last 24 hours, with a market cap of $130.5 billion.

You May Also Like

XRP Whales Accumulation Signals an Explosive Price Rally Above $9-$10 Range

Polygon Tops RWA Rankings With $1.1B in Tokenized Assets