XRP News: XRP Tests $2 as Bulls Fight Bears

XRP falls below 2 with 103 percent volume. Vanguard is reporting XRP ETFs, but technical signals indicate a mixed direction in the future.

XRP fell below the psychological level of 2 on Monday. The pressure on selling was intense and pushed the prices down. A prompt retaliation was made by the bulls.

The token traded between $1.99 and $2.07. Action on prices is unstable. Neither party has taken the upper hand.

Institutions Enter as Price Wobbles

Volume rose to 149.1M in the selloff. This number doubled the average per day. The move was evidently instigated by institutional participants.

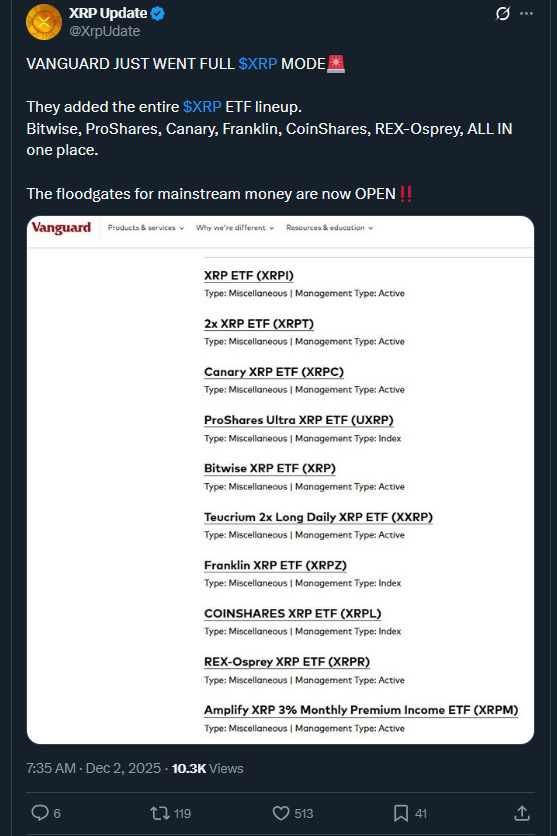

Vanguard has recently also introduced XRP ETFs to its brokerage customers, a significant change in policy. The asset manager manages more than 11 trillion. It has already prohibited any crypto products.

XrpUpdate on X reported that Vanguard included the whole XRP ETF lineup. The report indicated that the investment giant had offerings by Bitwise, ProShares, Canary, Franklin, CoinShares, and REX-Osprey. XrpUpdate said the development opened the floodgates of mainstream capital.

Source –XrpUpdate on X

Technical Signals Flash Warning

All the bounces were rejected by the zone of 2.05 to 2.07. XRP stays within a narrow band. Compression at around $2.02 is an indication of a bigger move.

At 15:00 UTC, XRP was driven by bears between $2.04 and $1.99. Volume increased 103 percent above average. Buyers intervened at once.

The token rebounded to $2.023. The recurrent surges above 2 indicate that the demand is high. Greater dismemberments have not been achieved.

You might also like: XRP News: XRP Crashes 7%: Will $2.05 Support Hold?

What Traders Watch Next

The focal point is still the $2 level. Defenses repeatedly indicate that there are buyers. The other failure will provoke more losses.

Breaking above 2.05 would reverse momentum to the bullish. Such a move would nullify the downward trend. To maintain gains, recovery efforts should be equal in volume.

Since its launch, XRP ETFs have received net inflows of $756.26 million. The total assets amounted to $723 million within 11 trading days. The accumulation rate is sound.

Consolidation of 2.02 implies that directional confirmation will be realized in the next 24 to 48 hours. Downside targets are at $1.95, and there is a break of support. Up to resistance reclaim opens at $2.12-2.15.

Markets in derivatives exhibit deteriorating open interest. The leverage exposure decreased in the pullback. There are mixed signals in whale activity with a minor net distribution.

The arrangement forms a binary situation. Bulls require reclaim of $2.05. Bears are seeking $2 breakdown on further falls.

The post XRP News: XRP Tests $2 as Bulls Fight Bears appeared first on Live Bitcoin News.

You May Also Like

LMAX Group Deepens Ripple Partnership With RLUSD Collateral Rollout

Pastor Involved in High-Stakes Crypto Fraud